One day before Halloween (perhaps he would have been better served to wait a few hours for give it a spookier, Oct 31 post date), the “Big Short” Michael Burry emerged from his periodic X/Twitter hibernation, where he tends to nuke his account every so often, only to reemerge several months later, with a cryptic post in which he references both the classic movie WarGames, and the movie Big Short (in which Christian Bale plays him). It said “Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play.“

Sometimes, we see bubbles.

Sometimes, there is something to do about it.

Sometimes, the only winning move is not to play. pic.twitter.com/xNBSvjGgvs— Cassandra Unchained (@michaeljburry) October 31, 2025

He followed it up with another post earlier today, which hinted that – as Goldman first did last summer – the return on AI was just too little, and like the early days of the dot com bubble when there was a massive overspending on fiber capex, so too many of the leading companies of the current AI bubble would crash and burn.

Move along pic.twitter.com/ysPWozmnbt

— Cassandra Unchained (@michaeljburry) November 3, 2025

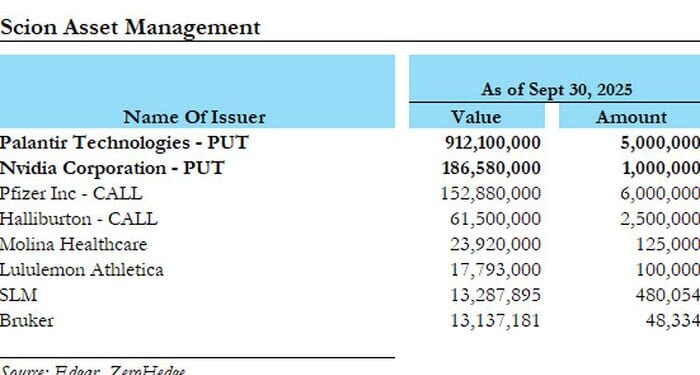

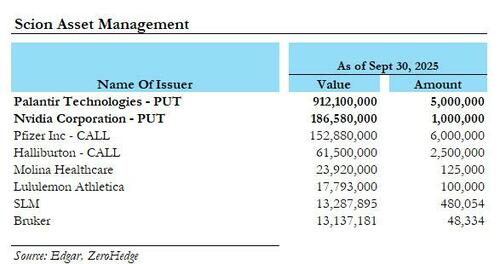

And then something interesting happened: Burry’s Scion Asset Management published its 13F some two weeks early, and revealed that Burry not only sees a bubble, but is doing something about it.

Half of the 13F was boring: mostly small legacy positions including Bruker, Lululemon (which has suffered a spectacular collapse this year), as well as SLM and Molina Healthcare.

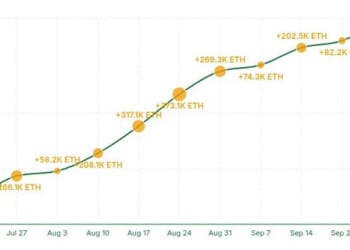

However, the other half was interesting, first – because it was entirely in the form of puts and calls, and second – because the puts were for Palantir and Nvidia, the two companies that define the AI bubble. And not any puts, but very large puts (for Burry’s AUM) – the notional equivalent value for the Palantir puts was a whopping $912 million (equivalent to 5mm shares), while his Nvidia Put was worth a notional equivalent $186 million.

Unfortunately, we don’t know either how much premium Burry actually paid or the actual terms of the puts including strike price and maturity.

All we know is that Burry appears to once again be swinging for the bubble fences, similar to what he did during the housing bubble, and is shorting the two names that are most synonymous with the current market mania, similar to what he did in 2008 when he was shorting housing using CDS.

We also know that since both names are sharply higher than where they were on Sept 30 (the date of the 13F), Burry has already suffered substantial losses on his positions, assuming he hasn’t already liquidated them (at a loss).

And while some will declare that Burry putting his money where his bubble-bursting mouth is, is a sign of the top, we have two words of caution: back in 2005, Burry was early by about 2 years, and even though he ultimately got the trade right, the carry on the CDS crushed him.

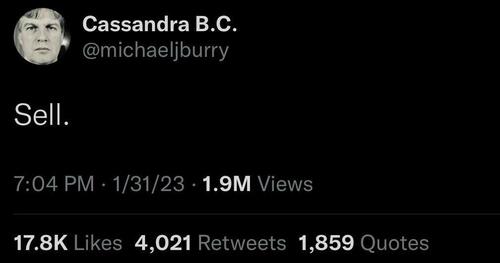

Second, the last time Burry tried to top tick the market was January 2023 when he blasted the one-word “Sell.”

The market is up 69% since then.

Loading recommendations…