Executive Summary

Since the collapse of Bretton Woods in 1971, the U.S. Dollar has functioned as a fiat currency. The petrodollar agreement in 1974 tied the Dollar indirectly to oil, reinforcing global demand for the Dollar. Today, with increasing skepticism toward fiat currencies and a rising interest in decentralized assets like Bitcoin, the U.S. could consider a new monetary system backed by Bitcoin as a digital, scarce, and decentralized asset. Bitcoin effectively delivers a more modern, automated and software-based approach to central banking.

This piece explores the viability of a Bitcoin-backed monetary system in the context of key historical financial developments, as well as the strategic path for its implementation.

The report concludes with an actionable strategy relevant to policymakers, financial institutions and investors.

-

July 1944 – The Bretton Woods Agreement: The Bretton Woods Conference established the U.S. Dollar as the world’s primary reserve currency, backed by gold. Under this system, the U.S. Dollar was pegged to gold at a fixed rate of $35 per ounce, while other major currencies were pegged to the U.S. Dollar. This agreement created a stable global monetary framework anchored by the U.S. Dollar’s convertibility into gold, and it laid the foundation for post-World War II economic growth.

-

August 1971 – Nixon Closes the Gold Window (“Nixon Shock”): President Nixon suspended the Dollar’s convertibility into gold. This marked the transition of the U.S. dollar from a gold-backed currency to a fiat currency whose value was determined by government decree rather than any fixed and independent asset.

-

October 1973 – The Oil Crisis and Price Shock: In response to U.S. and Western support for Israel, OPEC (led by Saudi Arabia) imposed an oil embargo on the U.S. and several Western nations. The embargo led to a severe shortage of oil, causing prices to quadruple from around $3 per barrel to $12 per barrel by early 1974. This sudden spike in energy costs triggered widespread inflation, economic disruption, and a global crisis that drove stagflation (simultaneously high inflation and high unemployment) in the Western economies.

-

June 1974 – The U.S.-Saudi Petrodollar Agreement: The U.S. and Saudi Arabia reached a pivotal agreement that laid the foundation for the petrodollar system, which later expanded to include other OPEC nations. The establishment of the petrodollar solidified the U.S. Dollar’s status as the world’s primary reserve currency, as the global demand for Dollars increased in conjunction with oil transactions. This arrangement also supported the growth of oil production worldwide and reduced OPEC’s strategic leverage, while providing the U.S. with a reliable source of foreign investment and demand for US government debt.

-

October 2008 – Release of the Bitcoin Whitepaper: In the wake of the global financial crisis and major bank failures, an anonymous inventor known as Satoshi Nakamoto published Bitcoin: A Peer-to-Peer Electronic Cash System. The paper described a transaction network requiring no third-party financial institutions or government intermediaries whatsoever.

-

March 2009 – The Federal Reserve Launches Quantitative Easing (QE): In response to the 2008 financial crisis, the Federal Reserve implemented its first round of Quantitative Easing (QE), purchasing U.S. Treasury bonds and mortgage-backed securities to inject liquidity into the financial system. This unprecedented monetary policy expanded the Fed’s balance sheet and marked the beginning of a prolonged period of U.S. Dollar debasement, fueling sustained asset price inflation.

-

December 2012 – The U.S. Debt-to-GDP Ratio Surpasses 100%: For the first time since World War II, the U.S. debt-to-GDP ratio exceeded 100%, signaling a shift to a highly leveraged fiscal position. This milestone underscored the growing reliance on debt-financed government spending and raised concerns about long-term fiscal sustainability.

-

April 2020 – The Fed Launches Aggressive Quantitative Easing Amid COVID-19 Pandemic: To counter the economic fallout from the COVID-19 pandemic, the Federal Reserve initiated a new round of aggressive QE, again expanding its balance sheet by purchasing Treasury bonds and mortgage-backed securities at an even greater scale. This increase in the money supply significantly debased the U.S. Dollar and drove a surge in asset prices, further exacerbating wealth inequality.

-

February 2022 – The U.S. Freezes Russia’s Foreign Currency Reserves and Weaponizes the U.S. Dollar: In response to Russia’s invasion of Ukraine, the U.S. and its allies imposed severe financial sanctions, freezing Russia’s foreign currency reserves held across Western banks. This action marked a turning point in global financial diplomacy, as it weaponized the U.S. Dollar and raised concerns among other nations about the risks of holding dollar-denominated reserves.

-

March 2022 – Shift Away from the U.S. Dollar in Global Oil Trade: Amid escalating geopolitical tensions, several oilproducing nations began entering bilateral agreements with their trading partners to settle oil transactions in currencies other than the U.S. Dollar. This signaled a potential erosion of the petrodollar system, as countries sought alternatives to reduce reliance on the U.S. Dollar in global trade.

-

June 2023 – Suspension of the U.S. Debt Ceiling: Congress eliminated the debt ceiling, removing the statutory limit on federal government borrowing. This decision effectively allowed unlimited borrowing, raising concerns about unchecked fiscal policy and the potential acceleration of U.S. debt growth, putting further pressure on the Dollar’s stability.

-

January 2024 – Bitcoin ETF Approved: The SEC approved the first spot Bitcoin ETF, paving the way for broader retail and institutional investment. This milestone legitimized Bitcoin, and the ETF wrapper provided easier access for investors, driving increased demand and significant capital inflows.

-

July 2024 – Trump Privately Refers to Bitcoin as “The New Oil”: In a private conversation leaked to the media (but not covered by the mainstream media), former President Donald Trump described Bitcoin as “the New Oil,” signaling a potential shift in U.S. policy toward digital assets. The statement suggests a recognition of Bitcoin’s growing role as a strategic asset in the global financial system.

-

November 5, 2024 – Donald Trump Wins U.S. Presidential Election: In a decisive and landslide electoral victory, Donald Trump is re-elected as President of the United States, with Republicans taking control of both the House and Senate. The election outcome marks a turning point for U.S. policy on digital assets and an end to unfettered regulatory hostility. The Trump administration commits to regulatory clarity, favorable tax policies, the establishment of a Strategic Bitcoin Reserve, and a framework that supports widespread digital asset adoption by individuals, institutions, corporations, pensions and governments.

-

November 8, 2024 – First Middle Eastern Crude Oil Transaction Using Tether Trade Finance: The world’s largest stablecoin firm, Tether, used its trade finance platform to complete its first funding of a crude oil transaction in the Middle East, settling in USDT. This groundbreaking deal appears to herald a major shift in global trade finance, showcasing the adoption of stablecoins as an alternative settlement mechanism for major commodity transactions outside of the traditional banking system.

The Future, and the Case for a Bitcoin-Backed U.S. Monetary System:

Under the petrodollar system, the U.S. effectively allowed the price of oil to rise (in Dollar terms), which increased global oil production and mitigated the strategic threat posed by OPEC. By creating a large, Dollar-denominated asset class (oil), the U.S. also established a mechanism to support the Dollar’s dominance abroad and finance its growing deficits at home. Surplus oil revenues from OPEC nations were recycled into U.S. Treasuries, reinforcing demand for the Dollar and giving the U.S. tremendous economic power globally.

Domestically, this system enabled politicians to engage in extensive borrowing and spending, driving U.S. debt from 36% of GDP in 1971 to ~125% today, a trajectory that now poses a serious challenge to the U.S. as a financial superpower, as well as its energy and national security.

Even at a ~$2 trillion market value, and with over ~$20 billion in average daily trading volume, Bitcoin is not yet large enough to replace the petrodollar as the backbone of the U.S. monetary system. However, a significant increase in Bitcoin’s price could catalyze a new paradigm.

Higher Bitcoin prices would likely drive substantial growth in U.S. Dollar-backed stablecoin issuance (due to the greater total market value of the asset class, and as the network effects of Bitcoin and digital asset transactions take hold);.

In turn, stablecoin issuance would directly boost demand for U.S. Treasury bills, effectively shifting the backstop of U.S. deficits from oil to Bitcoin.

This would allow the U.S. to maintain its monetary dominance while undermining the strategic power of the BRICS nations, who have turned to gold in an attempt to challenge and circumvent the Dollar system.

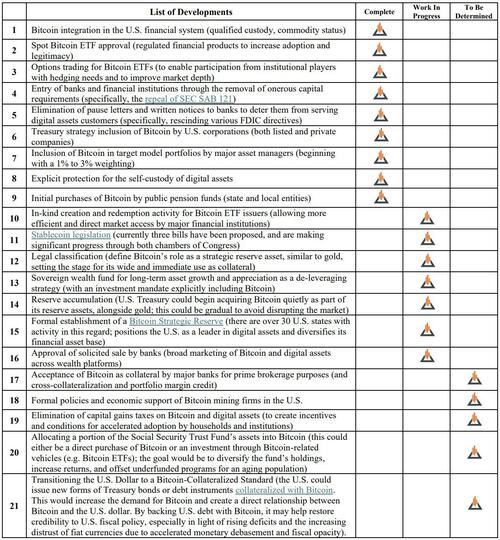

There are several recent developments that indicate the groundwork for this transition may already be underway.

The framework that follows is a preliminary outline of the potential steps towards a Bitcoin-Backed Monetary System.

The 21-Step Integration of Bitcoin into the U.S. Financial System:

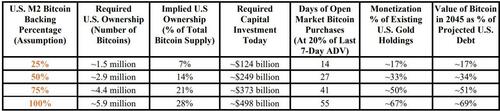

Calculating the Required U.S. Ownership of Bitcoin:

When considering the transition to a Bitcoin-backed monetary system, M2 money supply provides the most comprehensive measure of U.S. Dollar liquidity in the economy. M2 includes not only cash and checking deposits (collectively defined as M1), but also savings accounts, money market funds, and other near-money assets.

This broader measure captures the full extent of Dollar-denominated assets that circulate and store value within the U.S. economy.

Key Assumptions:

-

Current U.S. M2 Money Supply: $22 trillion

-

Projected U.S. M2 Money Supply in 2045: $79 trillion (applying the 6.7% CAGR from 2000-2024)

-

Projected Bitcoin Price Target in 2045: $13 million (per Michael Saylor’s Bitcoin24 Model)

-

Capital Investment Today: Funded through partial monetization of official existing U.S. gold holdings (8,133 tonnes with a current market value of $764 billion); for simplification, assumes constant price of gold

-

Fully Diluted Bitcoin Supply: 21 million Bitcoin

-

Adjustment for Theoretical versus Actual Supply: It is estimated that 3 to 4 million Bitcoin may be lost or irretrievable, making the effective supply closer to 17 to 18 million Bitcoin. However, for simplicity and to maintain a conservative estimate, the maximum supply of 21 million Bitcoin is used

-

Below is a table showing the required U.S. ownership of Bitcoin for different levels of backing by 2045:

Bitcoin Backing Scenario Analysis

Note: Analysis is for illustrative purposes only; market data is as of 2/26/2025 and from publicly available sources.

Scenario Overviews:

1) 25% Backing

- This level of backing by the U.S. could serve as a hedge or partial reserve, similar to the role gold used to play in the early 20th century.

2) 50% Backing

- A 50% backing level implies a much more substantial reliance on Bitcoin within the U.S. monetary system. Increasing Bitcoin’s allocation not only accelerates its global adoption and reinforces its credibility as a reserve asset, but it also provides a meaningful hedge against escalating U.S. debt. With projections suggesting that the national debt could balloon to approximately $115 trillion by 2045 (based on extrapolation), a 50% backing could potentially offset up to 34% of that burden.

3) 100% Backing

Full backing would represent a Bitcoin standard, where the entire U.S. M2 money supply is backed by Bitcoin.

A full Bitcoin backing serves as a complete hedge against fiat debasement and central bank policy errors, positions the U.S Dollar as a purely hard-money asset, and reduces Net Debt to GDP to under 100% by reducing nearly 70% of the nation’s debt burden.

A Bitcoin-backed system would leverage Bitcoin’s superior characteristics as a harder and scarcer asset than gold, positioning the U.S. as a first mover in adopting a supranational, independent and digital reserve asset. The concept of transitioning to a new U.S. monetary system backed by Bitcoin as collateral is both ambitious and transformative. It represents a profound shift from the current fiat-based, debt-financed model towards a digital, decentralized, and scarce foundational asset.

Loading…