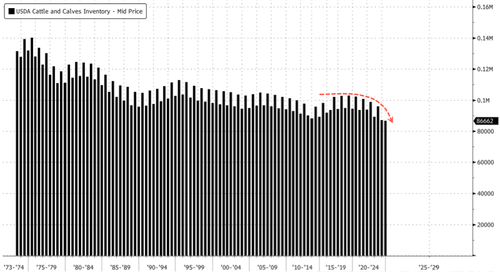

During Tyson Foods’ earnings call on Monday, Brady Stewart—head of the company’s beef and pork supply chains—offered fresh insight into what may be the emerging bottom in U.S. cattle supplies, which have fallen to their lowest levels in over 70 years. His comments came in response to a question from one Wall Street analyst.

Barclays analyst Benjamin Theurer asked Stewart about the overall environment in the beef industry:

So it feels like you only had a small volume drop-in the quarter that could almost be explained by just the leap year and some of the calendar effects. So just wanted to understand a little bit better what you’re seeing in terms of supply of cattle and the cost of that into your operations and how you think about the earlier signs maybe as to some of the heifer retention? Is that building or not? So how should we think about just these throughout the cycle? Are we at the bottom or is it just still too early to tell? That would be my first question.

Stewart explained that while cattle supply remains down year-over-year, record-high animal weights are helping to offset the decline in volume. He added that the U.S. cattle industry is likely at or near the bottom of its inventory cycle, with herd levels now at a 73-year low.

Here’s the executive’s response to the Barclays analyst that provides valuable insight for consumers, ranchers, and everyone in between tracking the nation’s cattle supplies:

Ben, I think it’s important to note that cattle on feed from a weight perspective are extremely heavy. We’re at record weights throughout the business as well. So we’re seeing some weight that is offsetting from a volume perspective, some of the lower headcounts we’re seeing as the supply has been obviously lower than year ago.

Relative to heifer retention and I would just say this and Curt has mentioned this before, if we’re not at the bottom relative to cow inventories, we can definitely see it from here as well. And I think a couple of reference points behind that certainly would be we’ ve seen an extreme drop almost 18% in beef cow harvest numbers.

And then secondary to that is we have seen a drop relative to heifer on feed, which means if the heifer are not on feed, they’re being retained by farmers and ranchers as well. And we’re seeing a 4% drop in heifers year-over-year as well. So I think the signs are really aligning to a rebuild to start to occur. And from a liquidation standpoint, really seeing the bottom at this point as well.

At the start of the year, the U.S. Department of Agriculture’s annual Cattle Inventory report revealed that the nation’s cattle supply had fallen to a 73-year low, totaling about 86.6 million head.

At the supermarket, USDA data from the end of March showed the average price for a pound of ground beef reached yet another record high of $5.79.

Commenting on Stewart’s remarks is The Beef Initiative founder, Texas Slim, who said:

“Rebuilding the herd takes more than forecasts—it takes proof of work. Ranchers holding back heifers aren’t chasing trends; they’re investing in land, genetics, and legacy. That 18% drop in beef cow harvest isn’t a collapse—it’s a recalibration. If this is the bottom, it’s the kind only real producers can build from.”

Slim said:

“Rebuilding America’s cattle herd will take years—and critically, it must include the participation of mom-and-pop ranchers across the country. The current model, dominated by four multinational meatpackers, is unsustainable—on national security grounds.”

And continued:

“The most effective way to support this rebuilding effort is one order at a time through the ZeroHedge Rancher Direct Store. Last week’s launch, in partnership with ZeroHedge, was a major success. Now, with the ‘Make America Healthy Again’ (MAHA) movement gaining momentum, the connection between independent ranchers and consumers is set to grow stronger than ever.”

Each order puts working capital into America’s mom-and-pop ranchers offering clean MAHA beef.

It’s time for a food revolution.

. . .

Loading…