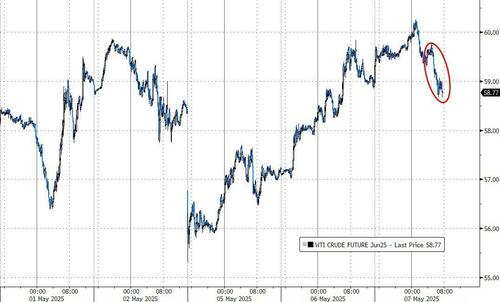

Oil pries pumped and dumped back tro unchanged ahead of this morning’s official inventory and supply data after hopeful (demand) signs of US-China trade talks battled with fearful (supply) signals from OPEC*+.

“There is a fear that the trade negotiations in Switzerland with China could backfire and turn into a demand destruction event,” said Robert Yawger, director of the energy futures division at Mizuho Securities USA. Building market sentiment that a rate-cut is not in the cards anytime soon is also weighing on prices, he added.

Oil has trended lower since late January due to escalating trade frictions and plans by OPEC+ to keep boosting idled supply, but prices have moved away from their lows in the last couple of days.

DOE

While gasoline stocks built for the first time in 10 weeks, Crude and Distillates inventories drewdown last week…

Despite the ‘drill, baby, drill’ narrative, US crude production slipped significantly over the past couple of weeks…

Source: Bloomberg

WTI is slipping lower this morning, extending losses after the official data…

When will the lower crude prices ripple through to lower pump prices?

And lower inflation (and expectations for all those UMich-responding Democrats).

Loading…