Financial centers are a core pillar of the modern economy, channeling capital, facilitating trade, and driving innovation across the world.

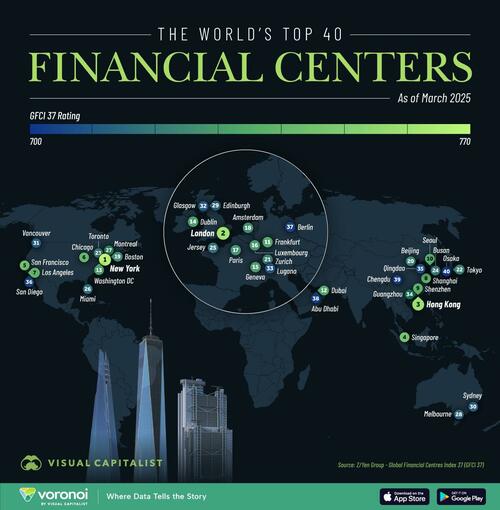

In this graphic, Visual Capitalist’s Marcus Lu visualized the world’s top 40 most competitive financial centers, using data from the 37th edition of the Global Financial Centres Index (GFCI 37).

Data & Methodology

The GFCI 37 was compiled using 140 quantitative measures from sources like the World Bank, OECD, and UN.

These measures are combined with assessments collected by respondents to the GFCI online questionnaire. In total, the GFCI 37 used 31,314 assessments from 4,946 respondents.

The data we used to create this graphic is listed below.

| City | GFCI 37 Rank | GFCI 37 Rating |

|---|---|---|

| 🇺🇸 New York | 1 | 769 |

| 🇬🇧 London | 2 | 762 |

| 🇭🇰 Hong Kong | 3 | 760 |

| 🇸🇬 Singapore | 4 | 750 |

| 🇺🇸 San Francisco | 5 | 749 |

| 🇺🇸 Chicago | 6 | 746 |

| 🇺🇸 Los Angeles | 7 | 745 |

| 🇨🇳 Shanghai | 8 | 744 |

| 🇨🇳 Shenzhen | 9 | 743 |

| 🇰🇷 Seoul | 10 | 742 |

| 🇩🇪 Frankfurt | 11 | 741 |

| 🇦🇪 Dubai | 12 | 740 |

| 🇺🇸 Washington DC | 13 | 739 |

| 🇮🇪 Dublin | 14 | 738 |

| 🇨🇭 Geneva | 15 | 737 |

| 🇱🇺 Luxembourg | 16 | 736 |

| 🇫🇷 Paris | 17 | 735 |

| 🇳🇱 Amsterdam | 18 | 734 |

| 🇺🇸 Boston | 19 | 733 |

| 🇨🇳 Beijing | 20 | 732 |

| 🇨🇭 Zurich | 21 | 731 |

| 🇯🇵 Tokyo | 22 | 730 |

| 🇨🇦 Toronto | 23 | 729 |

| 🇰🇷 Busan | 24 | 728 |

| 🇯🇪 Jersey | 25 | 727 |

| 🇺🇸 Miami | 26 | 726 |

| 🇨🇦 Montreal | 27 | 725 |

| 🇦🇺 Melbourne | 28 | 724 |

| 🇬🇧 Edinburgh | 29 | 723 |

| 🇦🇺 Sydney | 30 | 722 |

| 🇨🇦 Vancouver | 31 | 721 |

| 🇬🇧 Glasgow | 32 | 720 |

| 🇨🇭 Lugano | 33 | 719 |

| 🇨🇳 Guangzhou | 34 | 718 |

| 🇨🇳 Qingdao | 35 | 717 |

| 🇺🇸 San Diego | 36 | 716 |

| 🇩🇪 Berlin | 37 | 715 |

| 🇦🇪 Abu Dhabi | 38 | 714 |

| 🇨🇳 Chengdu | 39 | 713 |

| 🇯🇵 Osaka | 40 | 712 |

Areas of Competitiveness

The quantitative factors used in the GFCI model are grouped into five areas of competitiveness:

-

Business environment: Transparency and stability of systems, regulatory complexity

-

Human capital: Access to skill professionals, investment in education

-

Infrastructure: Quality of physical and digital infrastructure

-

Financial sector development: Accessibility to clients, development of digital solutions

-

Reputation: Trustworthiness of legal and regulatory systems

Regional Insights

We’ve summarized the main highlights from each GFCI region below.

North America

North America has four centers in the top 10: New York, San Francisco, Chicago, and Los Angeles. The most improved within North America are Miami and Vancouver, which both climbed over 10 places in the ranking.

Western Europe

London is the region’s dominant center, with seven other cities featuring in the top 20. The average rating across Western Europe increased by 2.14%.

Asia Pacific

Asia Pacific has six centers in the top 20, with four belonging to China (Hong Kong SAR, Shanghai, Shenzhen, Beijing). Looking elsewhere, Hangzhou, New Delhi, Kuala Lumpur, Ho Chi Minh City, and Manila all rose six or more places.

Middle East & Africa

The region’s leading centers are Dubai and Abu Dhabi, with Dubai climbing four places to 12th in GFCI 37. Meanwhile, Tel Aviv, Kuwait City, and Johannesburg each fell more than 10 places.

Latin America & The Caribbean

São Paulo rose seven places this year, making it the leading financial center in the region.

If you enjoyed today’s post, check out Billion Dollar Companies by Country in 2025 on Voronoi, the new app from Visual Capitalist.

Loading…