With ‘soft’ data turning back up to hard data’s reality, all eyes are on this morning’s Manufacturing PMI surveys for signs of continued reality-checks on the economy.

-

S&P Global’s US Manufacturing PMI rose from 50.2 to 52.0 in end May (but that was down from the flash print of 52.3) – Highest since February.

-

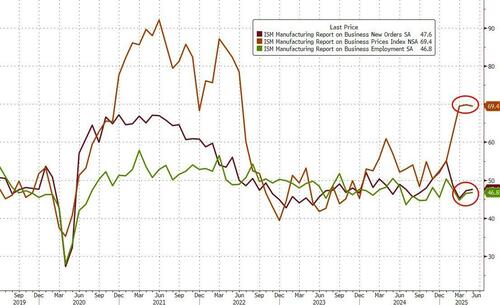

ISM’s US Manufacturing PMI fell from 48.7 to 48.5 (below expectations of 49.5) – Lowest since November

Source: Bloomberg

But, “the rise in the PMI during May masks worrying developments under the hood of the US manufacturing economy,” according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

“While growth of new orders picked up and suppliers were reportedly busier as companies built up their inventory levels at an unprecedented rate, the common theme was a temporary surge in demand as manufacturers and their customers worry about supply issues and rising prices.

“These concerns were not without basis: supplier delays have risen to the highest since October 2022, and incidences of price hikes are at their highest since November 2022, blamed in most cases on tariffs. Smaller firms, and those in consumer facing markets, appear worst hit so far by the impact of tariffs on supply and prices.

Prices remain at or near 3 year highs while new orders and employment continue to contract…

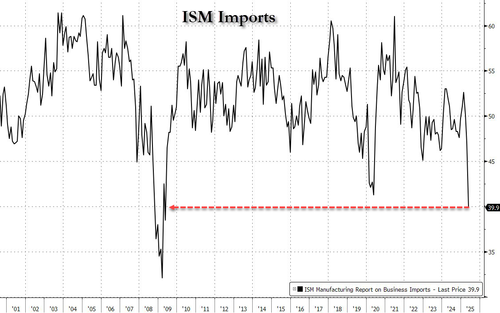

Imports plunged in April (to the lowest since 2009)…

But, uncertainty remains:

“Encouragingly, manufacturers regained some optimism in May after sentiment had been hit hard by tariff announcements in April, partly reflecting the pauses on new levies.

However, uncertainty clearly remains elevated amid the fluid tariff environment, and factories have so far shown a reluctance to expand headcounts in the face of such volatility.”

Baffle ’em with bullshit surveys continue…

Loading…