Authored by Charles Hugh Smith via OfTwoMinds blog,

What’s required is not just a revised spreadsheet but an entirely new culture and value system.

I’ve been referencing The Ratchet Effect since 2010 as it explains why shrinking bloat is so much harder than expanding bloat.

A common example is household income and spending. When the couple were just starting out, they lived like students with barebones expenses. Then as their income rises, so do their expenses, and so by the time they’re making $300,000 a year, every dollar is already spent yet they’re still deep in debt. LA couple who earn $300K/year told Dave Ramsey they’re drowning in $119K of debt.

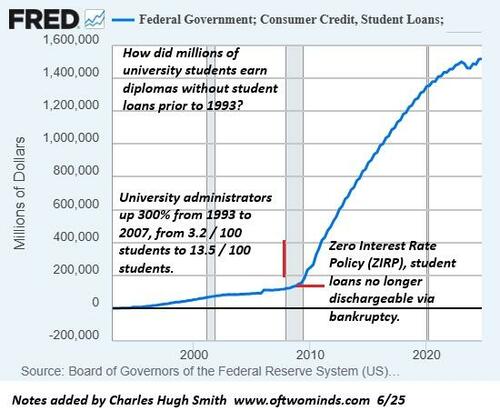

Institutional bloat is even more difficult to reverse. Way back in 2010, I posted a link documenting how a major public university’s administrative staff bloated up from 3.2 full-time administrators per 100 students in 1993 (before student loan debt skyrocketed) to 13.5 administrators per 100 students in 2007. The Ratchet Effect: Fiefdom Bloat and Resistance to Declining Incomes (August 23, 2010).

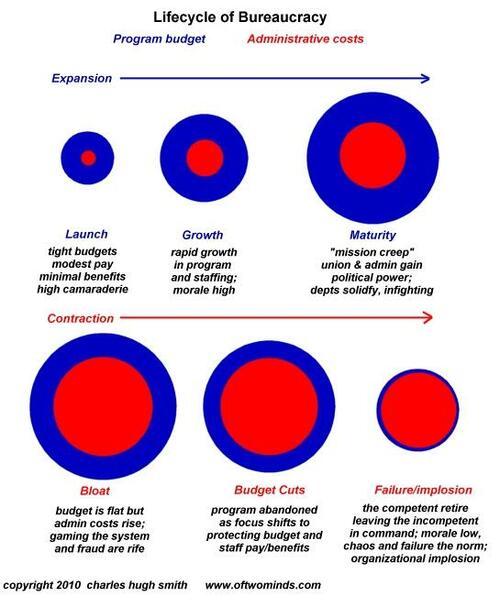

As staffing increases, a powerful self-interest in maintaining the status quo becomes the norm. This drive to maintain the status quo at all costs becomes the implicit mission of the organization. As budgets expand, there’s no end to the ways it can be spent–all in service of “improving” something or other.

Human ego manifests The Ratchet Effect as well. We like to live large and show off our shiny new campus offices, and resist downsizing and sacrifices with every fiber of our being.

In households, we want to maintain the look and feel of our elevated status: our numerous travel extravagances, our new SUV, etc. But the financial The Ratchet Effect is key, for it’s easy to add debt and painful to make sacrifices to pay debt off.

Another core dynamic of The Ratchet Effect is the normalization of extremes. As expenses and debt soar, we soon view what would have been seen as extreme in a previous era as not just normal but sustainable.

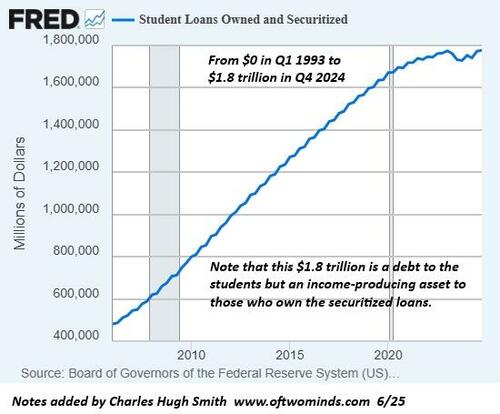

So student loans go from $0 in early 1993 to $1.8 trillion in Q4 2024, and nobody thinks anything is extreme because it’s been going on so long we accept it as normal.

The dynamic that leads to collapse is as invisible as the extremes. Once the organization–household, institution, corporation or nation-state, the dynamic is scale-invariant–has hardened into a brittle state of stasis, it’s impossible to shrink the budget without collapsing the entire structure.

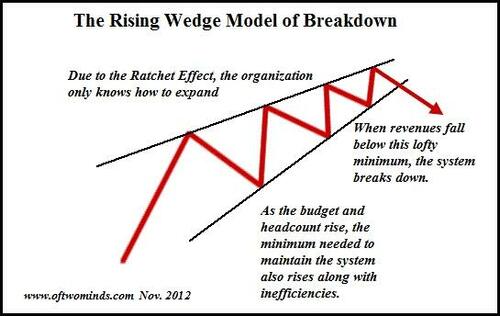

I call this the Rising Wedge Model of Breakdown: as expenses, self-interest and debt all expand, it becomes increasingly difficult to slash expenses without triggering the implosion of the organization.

Under the guise of cutting the fat to save the muscle, what actually happens is the muscle is cut to save the fat. This is a complex process, but in summary, the most competent realize the organization is dysfunctional and cannot be salvaged in its current bloated state of denial, and so they immediately jump ship.

The naive who believe they can turn the situation around give it their best effort but the resistance to any meaningful sacrifices is so tenacious that they burn out and quit.

That leaves the delusionally incompetent who reckon they’re finally getting the power they long deserved. This leads to the substitution of PR and artifice for actually reducing the organization to a sustainable level, for what’s required is not just a revised spreadsheet but an entirely new culture and value system.

This chart I prepared in 2010 summarizes the dynamics of breakdown.

As an example of all these Ratchet Effect dynamics, let’s look at student loans. Prior to the start of the student loan machinery in 1993, the U.S. had a mysterious ability to educate millions of university students without burdening the students with trillions of dollars of student loan debt.

Some believe the aliens enabled this fabulous accomplishment, as it’s obviously far beyond the reach of mere humans.

The substitution of debt for competence really took off in the aftermath of the Global Financial Meltdown of 2008-09, when the Federal Reserve instituted ZIRP, Zero Interest Rate Policy, making borrowing “affordable” (heh), and our wisdom-infused political leaders declared student loan debt undischargeable in bankruptcy, virtually the only type of consumer loan that cannot be discharged in bankruptcy.

This serves the interests of the wealthy who own the securitized student loan debt as income-producing assets. It would be a crying shame if a student debt-serf could get out of paying interest, depriving poor millionaires of income desperately needed to live large.

As is easily predictable in the context of the Rising Wedge Model of Breakdown / The Ratchet Effect, higher education is now imploding as revenues decline. That the university operated perfectly well 30 years ago with 3 administrators per 100 students is like marveling at the Great Pyramid: how did mere humans manage to do such monumental work? Now the reduction from 14 administrators per 100 students to 12 administrators per 100 students is shattering the foundations of the institution.

The story of the next decade is the playing out of the Rising Wedge Model of Breakdown / The Ratchet Effect throughout the entire status quo: households, institutions, corporations and nation-states will all hasten to cut muscle to save the fat and then wonder why everything is imploding under the weight of delusion and denial.

As noted previously, what’s required is not just a revised spreadsheet but an entirely new culture and value system. Without that, we get zip, zero, nada in meaningful adaptation to new realities.

* * *

Loading…