Allowing VA hospitals to treat privately insured patients could expand access and reduce costs

NEW YORK, NY – The federal Veterans Affairs (VA) hospital system was designed to serve a large, concentrated population of veterans injured in the world wars. In the years since, that population has dramatically declined, but the VA retains many of the costly institutional commitments it incurred then. In a new report, Manhattan Institute senior fellow Chris Pope lays out a policy solution to make fuller use of its expansive facilities.

The report traces the development of the VA health-care system from an organization dedicated to treating the wounds of war, into a general provider of care, which nonetheless delivers only 30% of the medical services that veterans receive. The VA’s institutions have not adjusted to the system’s new role, which has left it with substantial overhead costs.

Key findings include:

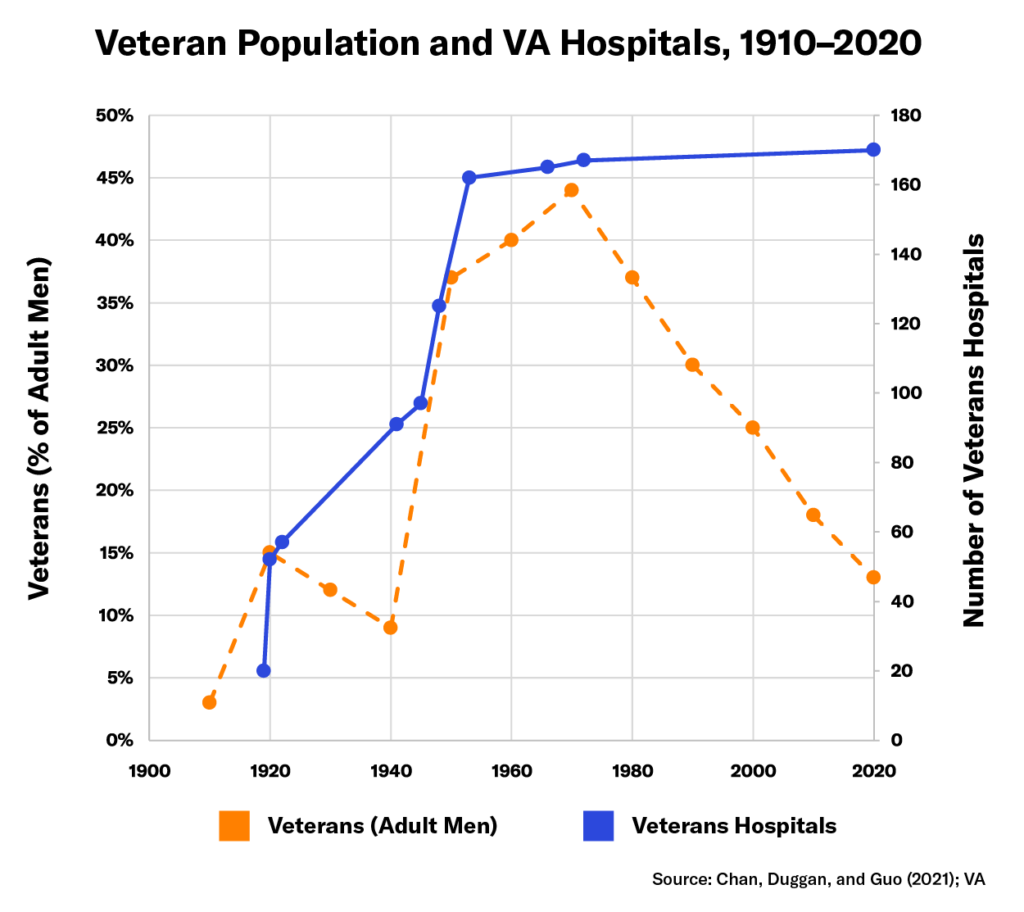

- Overcapacity: Despite a veteran population that has greatly declined since the end of conscription, the VA still operates the same 170 facilities as in the 1970s. The majority of VA-funded inpatient care is now delivered by community hospitals.

- Rising costs: From 2000 to 2023, per-veteran spending by the VA increased more than ninefold, as expenditures on VA facilities have not been reduced when the delivery of care has shifted to private providers.

- Inefficiency: In Florida, for example, VA hospitals treat just one-third of the patients that comparably-sized private hospitals do.

Pope argues that to preserve the VA system and make better use of public resources, Congress should allow VA hospitals to treat and bill privately insured patients not currently eligible for VA benefits. This would allow VA hospitals to spread their fixed costs across a broader patient base, slowing the growth of per-patient expenditures and improving access to care.

Click here to read the full report.

Are you interested in supporting the Manhattan Institute’s public-interest research and journalism? As a 501(c)(3) nonprofit, donations in support of MI and its scholars’ work are fully tax-deductible as provided by law (EIN #13-2912529).