As he had hinted on several previous occasions, FHFA Chair Bill Pulte said he had ordered Fannie Mae and Freddie Mac to prepare a proposal to include cryptocurrencies as assets in the risk assessment of single-family mortgage loans.

The order directs Fannie and Freddie to “only consider cryptocurrency assets that can be evidenced and stored on a US-regulated centralized exchange.”

After significant studying, and in keeping with President Trump’s vision to make the United States the crypto capital of the world, today I ordered the Great Fannie Mae and Freddie Mac to prepare their businesses to count cryptocurrency as an asset for a mortgage.

SO ORDERED pic.twitter.com/Tg9ReJQXC3

— Pulte (@pulte) June 25, 2025

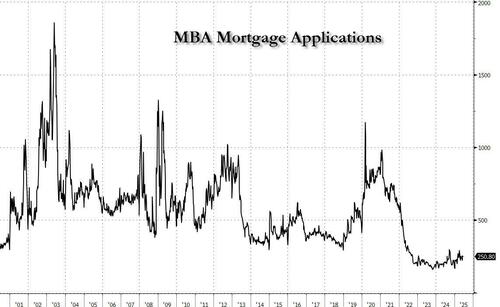

The move is intended to help mortgage seekers who have crypto assets qualify for loans, and comes amid a collapse in the number of mortgage applications in recent years as the US experiences a housing crisis.

Pulte hinted at today’s notice in a statement on X from June 23, when the FHFA head said his agency will “study the usage of [sic] cryptocurrency holdings as it relates to qualifying for mortgages.”

While homeownership has remained relatively stable over the last 50 years in the US, with around 62% of the population owning homes, the number of new applicants has seen a sharp decline in recent years forcing a record number of young Americans to live with their parents or to be stuck in rental purgatory for decades.

The number of mortgage originations dropped to near record lows in the middle of 2024 and has improved little in the first quarter of 2025, with rates still viewed as sky high by most consumers. The drop in originations, and particularly in refinancing, has been attributed to several factors.

Firstly, the supply of housing is not growing sufficiently to address demand. Construction is lagging, more housing is being purchased by investors,rather than by would-be homeowners, and elderly homeowners are still living at home rather than moving to senior living accommodations.

Borrowing is also getting more expensive, and many have attributed the slump in originations to the Federal Reserve’s higher interest rates to combat inflation. Pulte has frequently criticized the Fed’s rate policies, going so far as to call for the resignation of Chair Jerome Powell, who will be testifying before Congress on June 26.

Amid these headwinds, Pulte is looking for ways to make borrowing more feasible for homeowners, and crypto has emerged as possible wildcard.

While some boutique lenders already allow borrowers to use their crypto as collateral, study and acknowledgement from the FHFA would represent a major step forward for crypto adoption, particularly amid flagging mortgage application numbers.

According to CoinTelegraph, acknowledging crypto officially at the FHFA could open up sizeable federal lending programs for more borrowers. In 2024, the FHA alone issued over 760,000 single-family mortgages worth $230 billion.

Until Jan. 23, 2025, most banks couldn’t offer crypto-backed loans or mortgages due to Staff Accounting Bulletin No. 121, a banking rule from the Securities and Exchange Commission that required financial institutions to count cryptocurrencies as a liability rather than an asset on their balance sheet. The rule was repealed quickly after President Donald Trump took office.

Still, loans secured through federal programs like FHA, VA and USDA currently do not let borrowers use their crypto as collateral. Indeed, some federal loans may not even allow dollar liquidations from crypto sales to be used for down payments, according to 99Bitcoins editor Sam Cooling.

Personal finance expert Andrew Lokenauth said that would-be homeowners looking to buy with their Bitcoin proceeds need to “be careful to document everything and save the paperwork.”

Bitcoin advocates lauded Pulte’s openness to Bitcoin (BTC), with some stating that there are already features that lenders prefer — e.g., a transparent paper trail — built into the digital asset.

Mitchell Askew, an analyst at Bitcoin mining-as-a-service Blockware, said that the asset’s liquidity and transparent custody, namely its public blockchain, make it a “perfect collateral” for home loans.

CJ Konstantinos, founder of Bitcoin mortgage and bond company People’s Reserve, said that Bitcoin could further help derisk the mortgage-backed securities market the FHFA oversees by regulating Fannie Mae and Freddie Mac. “This is a no brainer.”

There are already a small number of lenders that let borrowers offer up their crypto as collateral, but they are few and far between. These cater more toward the investor class of home buyers and carry risks some may not be ready to stomach.

Milo (formerly MiloCredit) approves loans for borrowers instantly, but they first need to show that they have enough crypto to cover the entire value of the loan. Milo CEO Josip Rupena said that many clients were buying their second homes, vacation properties or investment properties.

“Many have strong incomes, but traditional banks wouldn’t have qualified them for the full value of these homes,” he said.

Strike, another company offering Bitcoin-collateralized loans, states that there are some risks to crypto loans in their current form. Volatility is a major factor. If BTC’s price decreases dramatically, the loan-to-value rate increases, “which can trigger margin calls or liquidations — forced sales at inopportune times.”

Lenders are open to risk as well. One commenter stated, “The risk models for this will be insane. Traditional mortgages assume relatively stable income and assets. Now you’re dealing with borrowers whose net worth can swing 50% in a week. How do you stress-test a portfolio when your collateral includes everything from Bitcoin to random DeFi tokens?”

But crypto ownership in the US is growing increasingly common, with lawmakers and regulators in Washington moving apace to implement rules and legal frameworks that are friendly to the industry.

Recent studies show that crypto is no longer just the remit of uber-rich crypto bros but is increasingly seen as a legitimate retail asset among normal investors. Some 20% of Americans, around 65 million people, are estimated to now own crypto, according to the National Cryptocurrency Association’s “2025 State of Crypto” report.

Their investments aren’t astronomical either; some 74% of crypto portfolios in the US are worth less than $50,000.

Allowing crypto for downpayments or as collateral could unlock homeownership for the growing number of investors if Bitcoin joins the list of other securities they can use to get a mortgage.

Loading…