Takeaways:

* Stocks haven’t kept pace during historical monetary hyperinflation periods despite bull markets. Diversified investment portfolios of say 60% stocks/40% bonds vastly underperform farmland and commodities futures during hyperinflationary periods.

* Pending Congressional legislation will replace the US dollar for a programmable Stable Coin to pay down the national debt.

* Stable Coins must be bought first from an investment house to buy any investments and from retailers of goods and services.

* Stablecoins are programmed money that must backup the coins with commensurate purchases of Treasury Bills. Effectually, the mandated pre-purchase of Stable Coins is a disguised excise tax.

* Stable Coins may be a return to the “Wildcat Banking” era of the 1830’s which resulted in the Panic of 1837 (see Jessica Lepler, The Many Panics of 1837: People, Politics and the Creation of a Transatlantic Financial Crisis, 2013 and Simone Polillo, Conservatives versus Wildcats: A Sociology of Financial Conflict, 2013)

* Deflating the national debt is expected to bring about corresponding deflation in prices for goods and services in which case learning from periods of hyperinflation may be irrelevant and we would have to learn from the Great Depression of the 1930’s.

* Investment-grade bonds, defensive stocks (consumer goods companies), dividend-paying stocks, cash-generating small businesses, and cash are the best performing investments during deflationary periods.

My friend James Anthony offers some wise information to consider before the Great Money Reset expected later this year in his June 28 article “Good Moneys: 100%-Reserve Gold, Stock-Based Money”. But Anthony discusses “potential” gains in value not “actual” historical rates of return or loss during hyperinflationary periods. Some more nuanced information on how differing investments have historically performed during hyperinflationary periods is necessary, with the caveat that we may end up with deflation.

Fortunately, in 2010 the global investment firm Alliance Bernstein conducted research as to how various investments performed during three hyperinflationary periods in the US, Britain and Japan. The research paper is titled Deflating Inflation: Redefining the Inflation-Resistant Portfolio. This study focused on investment performance during differing periods of gold-backed currency and debt-backed currency as we have had since the US dollar was untethered from being backed by gold reserves in 1972.

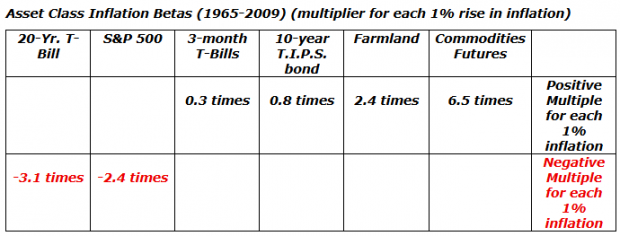

The Alliance study compared investment performance (loss or gain) with money inflation as a baseline. This is called a “Beta” score in investing parlance. The higher the Beta score, the greater the risk. A Beta score is reflexive or correlated in that it indicates how much loss or gain was realized for every 1% of inflation. This is in keeping with the investment principle “the greater the risk, the higher the expected rate of return” on an investment and vice versa. The findings of the Alliance Bernstein report are summed up in words as follows:

“In the US, for example, for a given 1% increase in the inflation rate, 20-year nominal bonds fell 3.1 times as much. Stocks, too, tend to be vulnerable to most rising inflation environments: on average, the S&P 500 historically dropped 2.4 times the rise in inflation, and the broad equity indices of many other countries showed a similar sensitivity. This explains the dismal performance we saw in the traditional 60% stock/40% bond portfolio during the periods of accelerating inflation”. Conversely, productive farmland gained 1.7 times the inflation rate while commodities like gold, soybean or cattle futures gained 6.5 times the inflation rate. This is why mega billionaire oligarchs such as Bill Gates have invested in farmland in preparation for the Great Reset.

The Alliance study can also be summed up in numbers as follows:

Importantly, the report warns that stock values typically rise in bull markets during monetary inflation periods and this can be deceiving because they have historically not kept pace with money inflation.

So, based on history, conventional asset diversification of 60% stocks/40% bonds will likely result in a net loss after adjusting for money inflation despite a bull market in stocks. An asset portfolio weighted toward productive farmland and commodity futures (gold, platinum, agricultural products, crude oil, natural gas, livestock, lumber, etc.) is more likely to outperform inflation by multiples of 1.7 times to 6.5 times a 1% rise in inflation if investment performance mimics past hyperinflations.

However, what we’re ultimately expecting under the substitution of Stable Coins for US Dollars is deflation in goods and service prices because the debt bubble will deflate (see below).

The Emergence of Stable Coin “Wildcat” Marketized Money Market?

What you may not have been informed of yet is that if you buy stocks, bonds or commodity futures contracts you must pay for them in Stable Coins, as cash, checks, and credit cards will be extinguished under the Genius Act passed by the US Senate and the Stable Act pending in the House of Representatives.

We also need to understand that if we are going to be buying stocks that we must first buy a Stable Coin from Fidelity, Vanguard, Blackrock, or some other investment house, which is backed by short term Treasury Bills. The issuers of stable coins cannot be the Federal Reserve Banks but large retail corporations like Walmart, Amazon, Kroger or Chevron gasoline which will use your money to buy T-bills. Stable Coins or tokens can also be issued by the monied class such as the Ivanka Trump Stable Coin. Issuers, however, will be allowed to use the “float” on your money as collateral for seven days (but who will police the zillions of such transactions, so this provision won’t be abused?).

The purpose of Stable Coins is to boost demand for treasury securities to pay off the federal debt. A Stable Coin will be like a prepaid debit card. It is programmed money. You will be constrained from going into personal debt or taking out loans for cars, real estate, small business start-ups. There will be capital contraction. Governments will be inhibited to issue tax exempt bonds to pay for infrastructure and businesses discouraged to borrow to invest in inventions. You can still get a loan from a bank, but you must pay for it in Stable Coin backed by some corporation or investment house buying T-bills. You will be forced to “buy the debt bubble” or “buy the churn” (revenue loss) before it blows up. This, however, does not necessarily constrain government to continue to rack up even more debt. Experts say this will lead to deflation (a decrease in the prices of goods and services).

Stable Coin will mean the US economy will be returning to the “wildcat” banking era before the Civil War where unregulated banks (not corporations of issuers of coins) supplied a medium of exchange in the form of bearer notes based on their own credit. Wildcat banking led to the Panic of 1837.

The institutionalization of Stable Coins will mean having to do homework to investigate the soundness of each issuer before you buy a so-called Stable Coin. For example, in 2023 the “Circle” Stablecoin substantially dipped under its stabilized one dollar unit value when it was discovered that $3.3 billion of its $40 billion reserves were invested in Silicon Valley Bank which was pending collapse due to its investment in failed high tech enterprises.

In the proposed Stable Coin environment, bank loans are expected to charge from 10.9% to 18.9% interest to constrain households from taking on new debt. Residential real estate values would likely drop to the equivalent of an “all cash” price due to higher mortgage interest rates (typically 5% to 10% cash adjustment).

What will happen to small businesses which would have to issue their own Stable Coin is uncertain. As mentioned by James Anthony, several states are authorizing the issuance of Gold Back Paper Dollars containing trace amounts of gold dust. This may allow some greater flexibility for small businesses and sustain a resemblance of a cash economy. Gold-backed paper dollars would likely be more valuable than T-bill backed Stable Coins. But it is unclear whether buying Stable Coins to buy Gold Backed Paper Dollars would equate to double taxation of sorts. Rather, would each state have a clearinghouse for Gold Backed paper coins or tokens?

From the Austrian School of economics, inflation is legalized theft that is blamed on impersonal economic forces rather than political manipulation. Government works by blaming economic downturns and wiping out of the value of money depicted as acts of God, stock market boom and bust cycles, plagues, or wars.

We will likely have some sort of major crisis to justify the compulsory transition to a planned Stable Coin money economy by bank closures, lockdowns, and martial law to cover up the machinations of wiping out the currency value of the dollar. Government often uses mass media predictive programming to mentally prepare us for such shocks (see my article on how the California Energy Crisis of 2001 was “predicted” by Hollywood movies “Recent Science Hoaxes Reruns of California Energy Crisis of 2001”).

The above discussion of Stable Coins is drawn from an online interview with economics expert Paul Gallagher (“Why Stable Coin Isn’t”, June 27, 2025, Youtube). Any errors or omissions are my own.