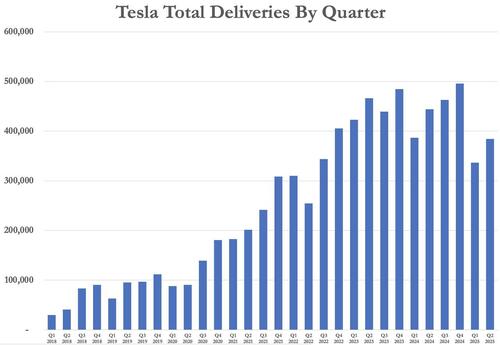

Tesla’s Q2 delivery numbers came in at 384,122 vehicles, just below the estimate of 389,407. While estimates had been lowered multiple times, the number is still better than whisper numbers as low as 350k or 360k that were starting to make their way around the street over the past week. As a result, Tesla stock has popped this morning by almost 7%.

Production beat expectations. Tesla built 410,244 vehicles, compared to the forecast of 400,083.

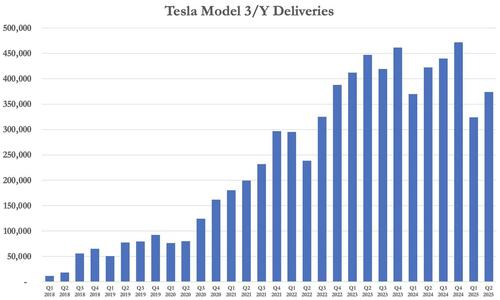

Model 3 and Model Y deliveries totaled 373,728, slightly under the estimate of 377,295.

The “Other Models” category — including the Model S, X, and Cybertruck — showed Tesla delivered 10,394 vehicles, below the expected 14,644.

Production of these models also came in slightly under, at 13,409 compared to the estimate of 13,616.

Model 3 and Y production reached 396,835 units, higher than the expected 383,567, suggesting Tesla had ramped up output of its most popular models.

Ahead of Tesla’s Q2 2025 delivery report, expectations were subdued amid signs of continued demand weakness and investor concerns over the company’s growth trajectory. Analysts widely anticipated another disappointing quarter, despite hopes pinned on the rollout of a refreshed Model Y and the company’s long-term robotaxi ambitions.

The Bloomberg consensus projected Tesla would report global deliveries of 395,328, representing an 11% year-over-year decline, though still higher than the 336,700 vehicles delivered in Q1. Production was expected to hit 443,321 units, up from 410,800 in the same period last year.

However, some firms were significantly more bearish. Wells Fargo predicted a 21% drop in deliveries from a year ago, estimating just 343,000 units — far below consensus. JPMorgan cut its estimate to 360,000, calling it a “sizable” 8% miss versus consensus. UBS was only slightly more optimistic, forecasting 366,000 units.

Expectations were tempered by hard data from Tesla’s largest markets. In Europe, Tesla registrations fell 27.9% in May, despite overall EV registrations in the region growing 25%, according to the European Automobile Manufacturers Association (ACEA). Year to date, Tesla’s European sales were down 37.1%.

In the U.S., April registrations dropped 16% to 39,913 units. Meanwhile, Chevrolet’s EV registrations surged 215%, overtaking Tesla in growth, while Ford saw a 33% drop.

At the start of Q2, analysts were still optimistic, projecting 444,000 deliveries — in line with the same period in 2024. That forecast steadily declined as market data revealed Tesla wasn’t production-constrained, but rather grappling with a demand problem, despite aggressive discounts and 0% financing offers on the Model 3 and Model Y.

Loading…