The U.S. restaurant industry is entering the second half of the year with renewed momentum, supported by improving sales trends, easing headwinds, and a rebound in confidence among lower- and middle-income consumers, according to a new note from UBS. This comes after lower-income consumers saw their wallets squeezed and sentiment plunged in the wake of the inflation storm sparked by the previous administration.

A team of UBS analysts led by Dennis Geiger wrote that casual dining chains continue to outperform, thanks in part to growing price gaps with quick-service and fast-casual competitors, making the full-service experience relatively more attractive for budget-conscious consumers. They see further near-term upside for the segment, with easier year-over-year comparisons in July and positive traffic trends in May.

Overall industry visits are -.5% year-to-date through May, the breakdown by segment tells a more nuanced story. Fine dining and coffee chains have driven traffic growth, up 1.3% and 2.6%, respectively, although per-location visits remain in decline. Casual dining visits slipped 1.5% overall, but stabilized on a per-store basis amid a wave of restaurant closures.

Quick-service restaurant (QSR) performance remains mixed. Some brands are expected to benefit from product rollouts and promotional activities, but others are under pressure due to slumping foot traffic and heightened value consciousness among lower-income customers. Fast-casual traffic trends were also mixed, with negative trends.

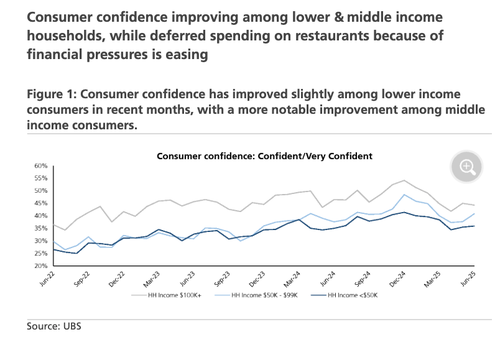

Geiger cited new consumer survey data that showed a surprising improvement in confidence among lower-income consumers, a potentially bullish signal for the class of consumers battered by inflation under the Biden-Harris regime.

Improving lower income confidence, w/ dining out spending deferrals easing

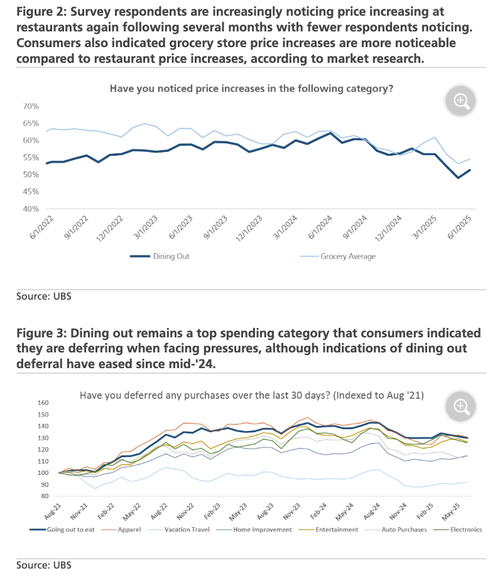

According to recent consumer survey data, consumer confidence has encouragingly improved slightly among lower income households, while the improvement is more noticeable among middle income consumers. Additionally, although dining out remains a top spending category that consumers indicated they are deferring when under financial pressure, indications of dining out deferral continued to eased in the June survey (see Charts of the Week inside). That said, consumers are concerned about the impact of tariffs, with 90% of respondents noting concern in a recent Numerator survey (in line w/ earlier results), and 81% expecting to adjust their finances or shopping habits in response. But consumers are less worried about the impact tariffs could have on the overall economy, w/ 33% worried about the impact (from 41% in late April).

Interesting to note that fewer consumers now cite dining out as a top spending category to cut back on, although 90% remain concerned about the impact of tariffs, the analysts noted.

Charts of the Week

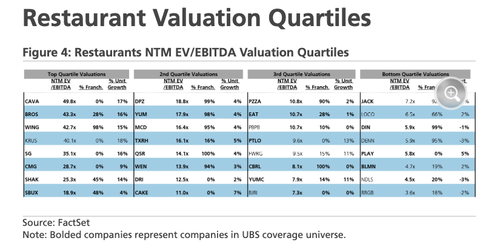

Valuation metrics for restaurant stocks, with companies in the UBS coverage universe highlighted in bold.

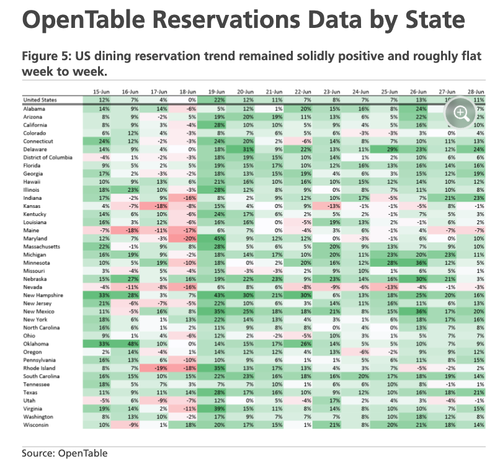

Restaurant reservation platform OpenTable shows postive trends across the industry on a state-by-state basis. This is a proxy for real-time restaurant traffic trends.

The takeaway: Sentiment improving for lower- and middle-income consumers this summer.

Loading…