Goldman analysts led by Noah Poponak maintain a “Buy” rating on Boeing, citing new Planespotters data that suggests the embattled planemaker may finally be emerging from its manufacturing slump. A series of mid-air incidents and quality control issues had previously forced 737 Max production caps, but June’s stronger delivery figures point to a potential turnaround.

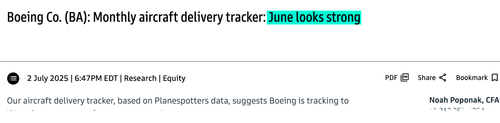

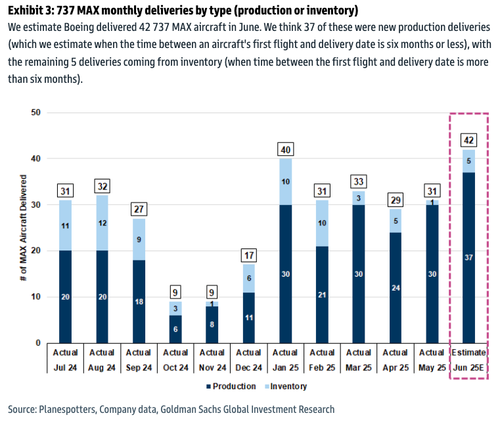

Poponak told clients that Planespotters’ aircraft delivery tracker for Boeing planes is trending around 58 deliveries for June (57 excluding 1 KC-46A delivery), including 42 737 MAX and 9 787.

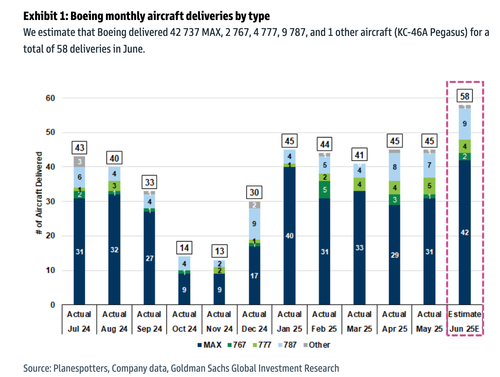

“Of the 42 MAX deliveries, we estimate 37 were new production, with 5 from inventory. 58 deliveries is a step function improvement over the mid-40 delivery rate BA has been holding for the last 5 months,” the analyst said.

Poponak noted the uptick in deliveries, calling June “strong” and “another month of progress,” as well as the highest in quite some time, adding that it “indicates to us that product quality improvements are holding, enabling higher production rates, and therefore allowing for more deliveries.”

“We think BA will stabilize MAX production at ~38/month over the next several months, request a move to 42/month late in 2025, and raise production in increments of 5/month thereafter,” he said.

Here’s a breakdown of Boeing’s June deliveries by aircraft variant.

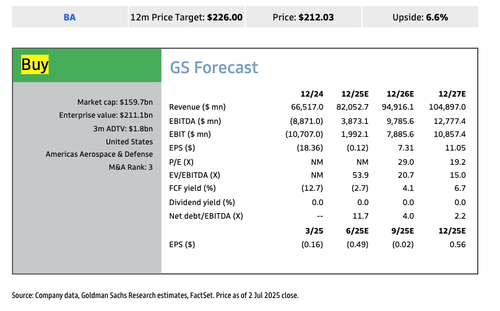

Poponak is Buy rated on the stock with a 12-month price target of $226. He said this is derived from targeting a 3.8% free cash flow yield on 2026E free cash.

Boeing shares are consolidating, a sign that direction could, at some point, be coming.

Related:

Spoiler alert: Boeing is not on the ‘must-own’ defense stocks…

Loading…