On the heels of strong Manufacturing survey data this week, US Services data expectations were more mixed for June (PMI exp down, ISM exp up) amid a sudden plunge in ‘hard’ data.

-

S&P Global US Services PMI fell from 53.7 to 52.9 in June (below the 53.1 expectations) – still above 50 (expansion).

-

ISM Services rose from 49.9 to 50.8 in June (above the 50.6 expectations) – back above 50 (expansion)

Baffle ’em with bullshit…

Source: Bloomberg

Under the hood, the picture was more mixed with new orders rising back into expansion territory but employment falling further and prices paid dipping modestly (from two year highs)…

Source: Bloomberg

Positive responses:

-

“After several slow months, business is starting to increase. New requests are going out to suppliers.” [Other Services]

-

“Business seems to be picking up. Many of the macroeconomic factors that were concerning look to be playing out in our favor. High interest rates are still a problem. Supplies are ample for current business levels.” [Wholesale Trade]

-

“Restaurant sales and traffic remain flat to prior year. Staffing is adequate for our current needs, and no supply chain concerns this month.” [Accommodation & Food Services]

-

“Prices have gone up from tariff recovery fees — separate line items — but the supply chain, deliveries and inventories have remained mostly stable after the initial disruption. Costs continue to increase across the board, so our goal is to mitigate that.” [Health Care & Social Assistance]

Negative responses:

-

“Confidence in a predictable economic environment has eroded to a point where capital investments are being severely curtailed.” [Professional, Scientific & Technical Services]

-

“Increased cost from tariffs and the potential for tariffs is impacting cost increases. Higher cost of high-dollar items like 150-horsepower farm tractors are forcing farmers to delay purchasing or purchase used equipment. Tension in the Middle East is creating great concern and uncertainty.” [Agriculture, Forestry, Fishing & Hunting]

-

“Sales remain stubbornly slow due to affordability issues with higher mortgage rates and high property values. Residential construction has embarked on cost-cutting measures through value engineering, supplier margin reductions and layoffs.” [Construction]

-

“General uncertainty around the economy continues to drive increases in prices. Also, lots of SaaS (software-as-a-service) vendors are using the AI (artificial intelligence) boom to restructure pricing and products, resulting in massive increases.” [Information]

-

“Business growth is slow. Global economic conditions impacted by U.S. tariffs are creating significant uncertainty, which is holding businesses back from making short- to medium-term business decisions.” [Real Estate, Rental & Leasing]

-

“General uncertainty around the economy continues to drive increases in prices. Also, lots of SaaS (software-as-a-service) vendors are using the AI (artificial intelligence) boom to restructure pricing and products, resulting in massive increases.” [Information]

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

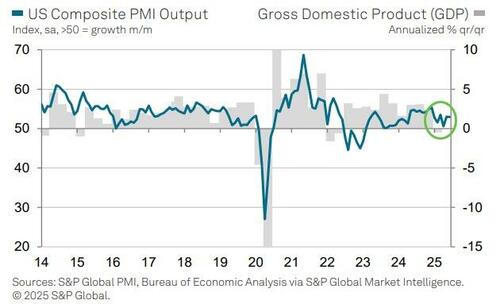

“The US service sector reported a welcome combination of sustained growth and increased hiring in June, but also reported elevated price pressures, all of which could add to pressure on policymakers to remain cautious with regard to any further loosening of monetary policy.

“Viewed alongside an improvement in manufacturing growth reported in June, the services PMI indicates that the economy grew at a reasonable annualized rate approaching 1.5% in the second quarter, with momentum having improved since the lull seen in April. Rising demand for services has meanwhile encouraged firms to take on additional staff at a rate not seen since January.

However, Williamson notes that “we are seeing some worrying signs of weakness below the headline numbers.”

“…notably in respect to exports and falling activity among consumer-facing service providers, which has curbed the overall pace of economic expansion. Concerns over government policies have meanwhile created uncertainty and dampened spending on services more broadly, while also ensuring confidence in the outlook remains subdued compared to the optimism seen at the start of the year.

The continued expansion of business activity in the coming months along the lines seen in June is therefore by no means assured.

“Price pressures have remained elevated in June. Although weak demand and intense competition were reported to have helped moderate the overall rate of increase compared to May, the overall rate of prices charged inflation for services remains the second-highest for over two years, thanks to widelyreported tariff-related cost increases, and will likely contribute to higher consumer price inflation in the near-term.”

So take your pick… did the Services sector improve in June (ISM) or deteriorate (PMI)?

Loading…