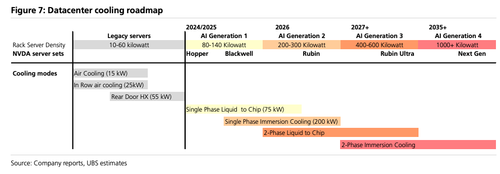

As artificial intelligence chips become more powerful and energy-intensive, legacy air-based cooling systems are fast approaching obsolescence. Chemours is addressing this gap with its next-generation 2-phase liquid cooling technologies, which UBS describes as “purpose-built for more demanding applications in data centers.” With thermal loads projected to exceed 200 to 1,000 kW per rack by the end of the decade, advanced cooling is no longer optional. UBS, calling it a “chilling opportunity,” sees Chemours well-positioned to lead this transition.

A team of analysts led by Joshua Spector stated that Chemours is commercializing two proprietary 2-phase coolant solutions — Opteon SF33 for direct-to-chip cooling and Opteon 2P50 for immersion cooling — aimed at cooling next-generation AI data centers operating at high kW per rack.

What is Chemours doing with data centers?

Spector noted:

Chemours has developed two products specifically targeted at datacenter cooling. Both are two-phase products, which offer unique advantages over current technology.

As AI server energy intensity increases, there are more efficient cooling methods needed. For advanced chips/servers rolling out now, hyperscalers are starting to install direct to chip cooling and single phase immersion cooling equipment. Both of these are much more efficient than legacy air cooled datacenters, but there are limits on server energy density (ideal up to 200kW/rack).

As server energy density goes above 200 kW, cooling will need to get more efficient in order to achieve max processing performance and not require much more cooling space. 2-phase coolants can help solve this problem, and Chemours has purpose built these products for the more demanding application in datacenters.

The analysts provided clients with a roadmap for datacenter cooling, showing that Chemours is well-positioned to support cooling needs across the U.S. through this year and into the mid-2030s.

This is where Chemours comes in. Chemours is a leader in refrigerants, mainly used in stationary cooling, automotive cooling, and cold storage. Chemours and Honeywell jointly developed the latest generation of refrigerants…

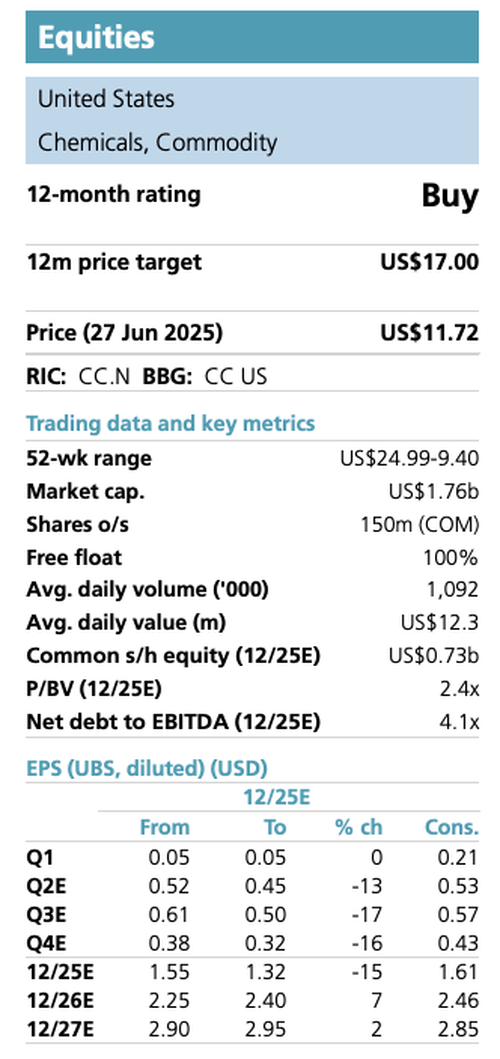

Spector expects Chemours’ data center cooling opportunity to be a longer-term growth driver, with no EBITDA contribution currently modeled, but with the potential to reach $10–20M by 2027, $70M by 2030, and $160M by 2035—representing up to 10% of total EBITDA by then. The total addressable market for 2-phase cooling could reach $1.5B by 2035, with Chemours targeting ~1/3 share and 30% margins. While this would add 1–2 percentage points to EBITDA growth later this decade, it would require further capital or partnerships. He maintained a “Buy” rating and $17 price target….

Bottom?

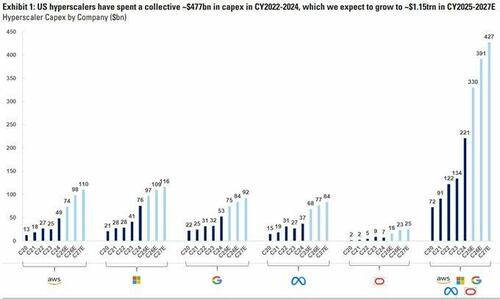

As U.S. hyperscalers unleash a wave of capex…

…Chemours appears well-positioned to capitalize on the rising demand for advanced data center cooling solutions.

. . .

Loading…