Shares of Fair Isaac Corp. (FICO), the company behind the widely used FICO credit score, dropped earlier this week after a federal agency approved the use of its biggest competitor, VantageScore, for mortgage underwriting, according to the Wall Street Journal.

The Federal Housing Finance Agency (FHFA) will now allow lenders to choose between FICO 10T and VantageScore 4.0 when issuing loans sold to Fannie Mae and Freddie Mac, which together back nearly half of all new U.S. mortgages.

Previously, only FICO scores were accepted. A prior proposal to require both FICO and VantageScore for each loan faced resistance from lenders over costs and complexity. The FHFA ultimately reversed course, with Director Bill Pulte saying in social media posts that the change is aimed at improving credit access, especially for renters and rural borrowers.

VantageScore CEO Silvio Tavares called the update “long overdue.” Unlike older FICO models, VantageScore 4.0 factors in alternative data like rent, utility, and telecom payments. FICO responded by saying it “welcomes competition on a level playing field,” noting that its newer models also use such data when available.

Despite the policy shift, analysts say FICO’s dominance in the mortgage market—where its models are used in over 90% of lending decisions—isn’t likely to vanish quickly. “This is a win for VantageScore, but we don’t see it as an immediate risk to FICO,” said TD Cowen analyst Jaret Seiberg.

He noted that lenders may still prefer FICO, even at higher cost, due to limited experience with VantageScore and concerns over potential buybacks from Fannie or Freddie.

The Journal writes that Seiberg also suggested that the FHFA’s move may have inadvertently helped FICO by avoiding a mandatory dual-score requirement, which might have increased lender familiarity with its competitor. “[FHFA Director] Pulte may end up safeguarding FICO’s dominant position,” he wrote.

Still, increased competition could chip away at FICO’s pricing power. The company charges credit bureaus $4.95 per score pull today, up from just 60 cents in 2018. “The implicit assumption now is that FICO’s pricing power isn’t the same because there is actual competition,” said Autonomous Research analyst Kelsey Zhu.

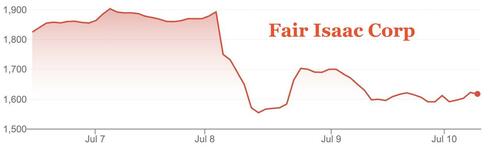

FICO shares plunged as much as 19% during the day on Tuesday before recovering late in the session to close down nearly 9%.

Heading into Thursday’s cash session shares were down about 11% over the last 5 days.

Loading…