Authored by Simon White, Bloomberg macro strategist,

Near-term US recession risk is low, but there are pockets of weakness that could mutate into a downturn later this year. The weaker dollar, though, will be key to whether the US avoids that fate and stocks a significant decline.

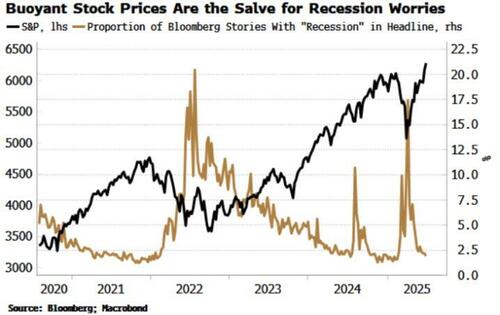

For now, it’s gone quiet on the recession front.

Not long ago, there was febrile speculation that a downturn was imminent, despite a lack of support from leading data.

Since then, the clamour has died down, and that can make one a little uneasy. Not necessarily because we should be worried about an imminent recession, but it does imply the market is now less prepared for bad news, which increases the likelihood of a disproportionate impact on asset prices.

My Recession Gauge – an amalgamation of 14 separate recession indicators – has fallen and is well under the activation threshold. But there are areas of weakness in the economy that could trigger anxiety and cause stock markets to drop, at least temporarily.

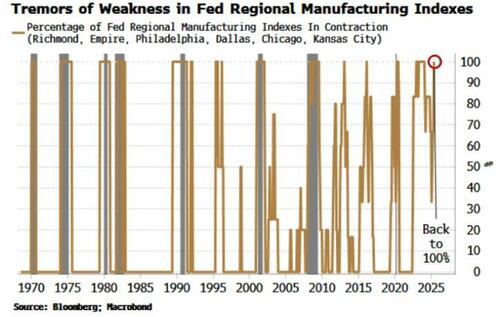

One notable point can be found in the Federal Reserve’s regional manufacturing indexes. Individually they are very volatile. But when they act in concert, they give a more reliable indication. The combined signal has recently jumped back to 100%, with all the indexes now in the contraction zone.

As we can see from the chart above, this particular data point has given a few false positives in the past, so it is not perfect. But equally it’s not something that should be ignored, as manufacturing is one of the most leading sectors in the economy. Moreover, recessions are pervasive. So a nationwide decline in manufacturing is best monitored.

We might also see other signs of economic weakness in the coming months. One point to focus on might be whether the rise in WARN (advance layoff) notices presages weakness in unemployment claims and the wider labour market. Another area to watch is the housing market, and whether that starts to become a wider problem.

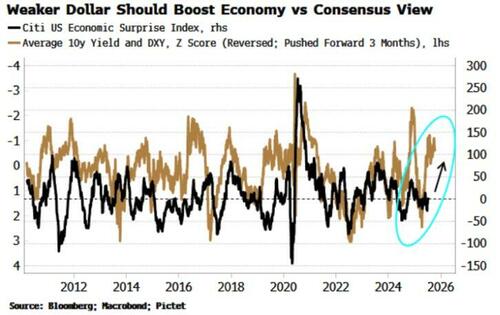

None of these guarantee a recession however, especially if the weaker dollar eases financial conditions to keep a downturn at bay. The drop in the US currency should also translate into a boost for stock earnings.

More broadly, though, dollar weakness and (at least for now) relatively stable yields are typically consistent with economic data improving relative to the consensus.

There are more malign effects from the weaker dollar also in the pipeline such as higher inflation, but at least through the rest of this year, it might be enough to forestall a return of recession angst.

Loading…