The Southern Poverty Law Center (SPLC) is among the most-controversial major left-of-center activist nonprofits in the country, and rightly so. To the extent Americans are familiar with the group, it is probably for its “hate map,” which notoriously lumps Klansmen, neo-Nazis, and other genuine extremists alongside mainstream conservative and religious organizations. It also conspicuously neglects to track extremist groups on the left, perhaps most glaringly under its suspiciously sparse antisemitism category.

Despite its bias, SPLC’s hate-group designation—which it claims illustrates “the pervasive infrastructure of white supremacy in the U.S.”—is regularly cited as authoritative by media outlets. Though it is organized as an Internal Revenue Code § 501(c)(3) charity, SPLC makes little attempt to conceal its ideological—indeed, political—motivations. In this respect, it is far from unique. Much of the contemporary charitable sector is, regrettably, quite politicized.

What truly sets SPLC apart, even among its activist-charity peers, is how phenomenally wealthy it is. On the group’s Form 990 covering its fiscal year 2023, SPLC reports $169.8 million in total revenue, with $109.7 million of that coming from grants and contributions and $57.2 million coming from investments. It spent over $122 million that year, including more than $56 million on employee compensation and benefits. Its fundraising expenses were over $17.4 million. In 2024, SPLC’s total revenue dropped to $129 million, with $106.4 million of that coming from grants and contributions. Nevertheless, its net assets that year increased to an astonishing $786.7 million, more than doubling since 2016. “The S.P.L.C.—making hate pay” reportedly was a running joke among staffers at the so-called “Poverty Palace.”

Charitable Comparisons

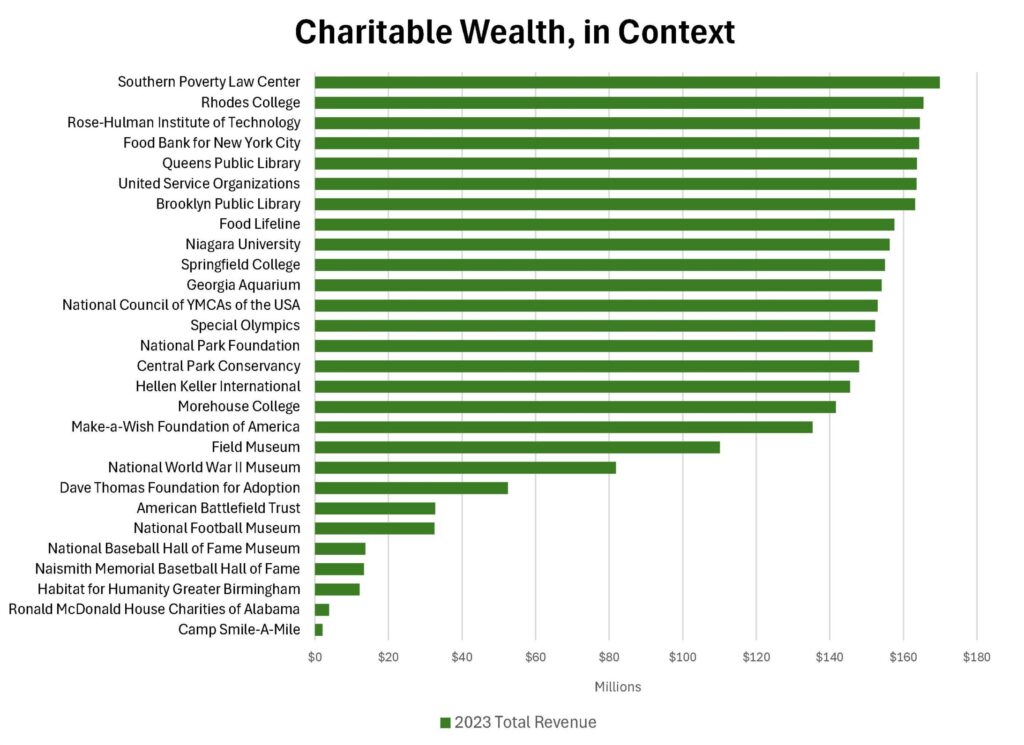

It is worth putting SPLC’s vast “charitable” wealth in context, with 2023 being the most-recent year for which nonprofit financials are widely available. That year, it reports higher total revenues than the Special Olympics, which boasts millions of participants worldwide. The same is true of the United Service Organizations (USO), whose 250+ centers were visited more than 6.5 million times by members of the military community. The National Park Foundation, the Congressionally chartered nonprofit tasked with supporting America’s national park system, reports less revenue than SPLC. So does the YMCA of the USA. The Make-A-Wish Foundation of America’s 2023 revenues are some $34 million lower than SPLC’s, while Helen Keller International’s are $24 million lower.

Chicago’s famous Field Museum—which had more than 1.1 million visitors in 2023—reports lower revenues and net assets than SPLC. The same is true for the Central Park Conservancy, which is responsible for New York City’s eponymous urban green space. The Georgia Aquarium—the largest in the country—keeps a representative sampling of the planet’s aquatic life happy in 11 million gallons of water with less revenue than SPLC. The National World War II Museum’s 2023 revenues are less than half those of SPLC.

SPLC’s 2023 revenues are more than twice (and closer to three times) the revenues of the professional football, baseball, and basketball halls of fame combined. Speaking of basketball, Springfield College, where the sport was famously invented in 1891 and which is currently attended by nearly 3,000 students, reports less total revenue on its 2023 Form 990 than SPLC. So does Rhodes College, Morehouse College, the Rose-Hulman Institute of Technology, Niagara University, and many other institutes of higher education. Both the Brooklyn and Queens public libraries in New York City, which are funded almost entirely by government grants, report less revenue than SPLC.

On its Form 990 covering July 2022 through June 2023, the Food Bank for New York City reports $164.2 million in total revenue. It distributed 80.7 million pounds of food during that time period, which it said was equivalent to 66 million meals provided to those in need. Seattle-based Food Lifeline reports $157.4 million in total revenue that year and distributed over 73 million pounds of food, the equivalent of 233,457 meals per day. Both managed this with less revenue than SPLC. The Dave Thomas Foundation for Adoption’s 2023 revenues are less than one-third of SPLC’s, yet it helped to finalize more than 1,000 adoptions that year. The American Battlefield Trust, which protected over 1,200 new acres of battlefield land in 2023, did so with revenues less than one-fifth of SPLC’s.

In SPLC’s home state of Alabama, Habitat for Humanity Greater Birmingham built 26 homes and performed “critical repairs” on an additional 296 in 2023, all with revenues less than one-tenth of SPLC’s. SPLC’s revenues are almost 45 times greater than the Ronald McDonald House Charities of Alabama, which provided over 19,000 room nights and over 13,000 individual meals to the families of children requiring hospital care in ’23. SPLC’s ’23 revenues are over 85 times greater than Birmingham-based Smile-A-Mile, which provided recreational programming and support to over 2,500 pediatric cancer patients and family members.

Opportunity Costs

How else does SPLC compare to—or, contrast with—these groups and countless others? Like them, it is a (c)(3) charity the activities of which are incentivized by the American public through tax-exemption and tax-deductible contributions. Is there a qualitative difference in the “charity” in which they engage?

SPLC has amassed a veritable fortune painting its ideological/political opponents as malevolent extremists, and there is a major opportunity cost to the hundreds of millions of charitable dollars warehoused in its investment accounts. How is that money helping anyone? How many nonprofits across the country could use those funds to perform real, on-the-ground charity in their communities?

This article first appeared in the Giving Review on July 10, 2025.