For an illustration of just how robust an appetite for Opendoor Technologies shares was on Monday, Bloomberg’s Yiqin Shen asks readers to consider the stock’s volume as a proportion of total trading activity in the US.

Here are the stunning facts: about 1.9 billion shares of the online platform for buying and selling US real estate changed hands on Monday, equivalent to almost 10% of the total stock-market activity on US exchanges that day!

Putting this in context, more money changed hands in Opendoor today, than did in Meta, which has a market cap that is almost a 1000x larger.

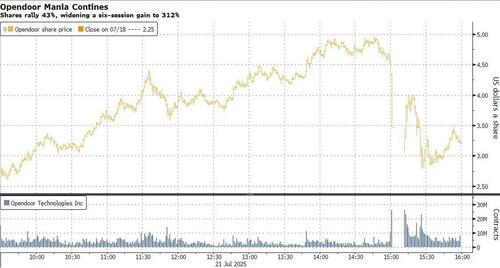

Shares of the Tempe, Arizona-based company, which traded for far less than $1 as recently as a week ago, gained 43% on Monday, widening its advance in July to 502% and bringing back the memories of a GameStop Corp. frenzy in 2021.

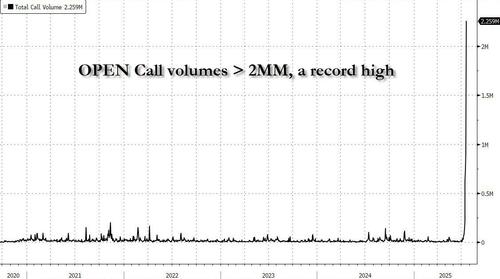

However, the real action wasn’t in the shares, but rather in the options, which exploded higher in what can only be called a historic gamma squeeze. As shown below, over 2 million call options traded in the name, much greater than any day in the company’s history, and the 3rd highest daily total of 2025 for any US stock, behind only Nvidia and Tesla.

Today was so remarkable, however, that the number of OPEN call options traded today surpassed the number of calls traded than NVDA and TSLA combined.

So euphoric was the meme stock trading, that Goldman wrote in its mid-day recap that driving much of today’s activity (again) was “the Retail footprint which has continued to grow since 930am – OPEN has traded 1B shares, making up ~9% of tape volumes so far (last Monday we wrote: “Retail feels much less involved this so far – one easy way to tell: NVDA is the 3rd most active stock on the session (on “heavy” Retail days, there are generally a dozen or so penny stocks that are more active)”… today there are 19 more active stocks than NVDA (half of which trade

Furthermore, as we explained in our afternoon wrap, this morning featured a lower quality bid to stocks with Goldman’s short basket (GSCBMSAL) surging +2.5% out of the gates, but has since given it all back while our Meme basket (GSXUMEME) is off 180bps from its intraday high. Meanwhile, Goldman’s Momentum pair (GSPRHIMO) continues to chop lower (with YTD winners under pressure) after closing out Friday with its 2nd best weekly performance of the year.

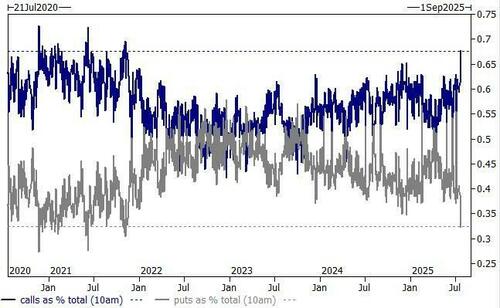

One final point of caution (and we will discuss this more in a subsequent post): as Goldman derivatives guru, he is starting to get “2021 vibes” as it feel very “chasey” out there: “calls are almost 70% of the total market volume (10am observation) … hasn’t been this high since 2021 meme days.”

And we all know how those days ended.

Loading…