I’ve said it before and I’ll say it again: the seeds of this economic crisis were sown the moment we let COVID panic override common sense.

We injected trillions into the system under the guise of “relief,” inflated asset bubbles, distorted labor incentives, and trained both Wall Street and Main Street to expect free money forever. We turned off the economy, paid people not to work, and then acted shocked when inflation spiked, supply chains broke, and productivity cratered.

And when the bill came due? The Fed panicked in the opposite direction—cranking rates higher and faster than any time in modern history, breaking the very consumers it claimed to protect.

Now, the cracks are no longer theoretical—they’re everywhere you look.

The latest economic signals paint a stark and unsettling picture: the American consumer has hit a wall, and the broader economy is teetering on the brink. This isn’t just a seasonal blip; it’s a fundamental shift, with deep implications for the coming months.

The most direct and alarming indicator of consumer health lies in their paychecks. For the first time since August 2020, average weekly paychecks declined on a three-month basis through June 2025. This “highly unusual weakness” has only occurred a handful of times in the last three decades , each instance coinciding with severe economic contractions like the dot-com recession (September and October 2001) or the 2008-2009 financial crisis. Even the solitary occurrence in the 2010s, October 2012, prompted the Federal Reserve to embark on its third round of quantitative easing.

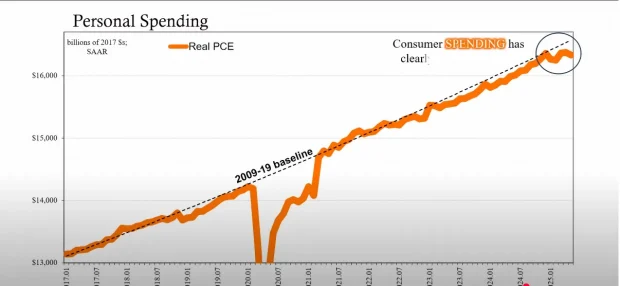

The impact on spending is undeniable. Real personal consumption expenditures have been negative on a five-month basis for the entire first five months of 2025 – a situation not seen since 2020. Retail sales fell in January 2025, and overall Personal Consumption Expenditures (PCE), which includes spending on services, have followed suit through the first half of the year, up to May, the latest available data. The only exception was a small pickup in March, which was largely attributed to consumers rushing to beat anticipated tariff price changes that, for the most part, haven’t materialized since.

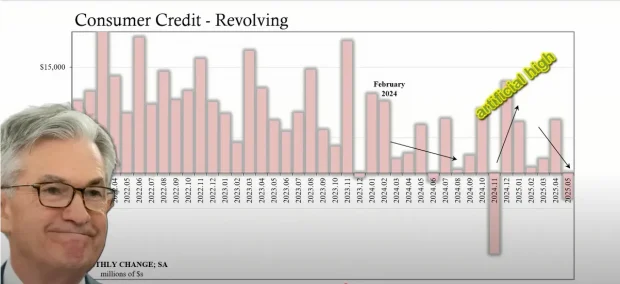

Adding to these worries, consumers are actively pulling back on credit. Revolving consumer credit, primarily credit card debt, declined by a significant $3.5 billion in May 2025, following a $7.5 billion increase in April.

This sharp reduction puts greater emphasis on hard data over mere sentiment surveys. This behavior follows a clear change in credit card usage observed around March 2024 , with growth in aggregate revolving credit balances slowing to practically zero by August 2024. Consumers are consciously refraining from adding to credit lines, applying for fewer cards, and in more extreme circumstances, even paying down existing debt. These are prudent, defensive tactics reserved for when a large proportion of workers are unsure about their job prospects and worried about their incomes.

The labor market, often presented as a picture of strength by official narratives, is also revealing its cracks. While headline payroll numbers might appear deceptively positive, the underlying data tells a starkly different story. The hours index, a critical measure of labor input, slid by 0.3% in June, marking the worst monthly decline in a year.

This directly contradicts the notion of a substantial increase in employees, suggesting any gains were likely part-time or similar. Furthermore, employment itself utterly collapsed in May and June, down by a combined 600,000 in those two months. Perhaps most alarming, the labor force itself shrunk by three-quarters of a million , not due to vacation or retirement, but because “there is no work”. This explains why the adjusted unemployment rate, which attempts to capture these dropouts, is nearing 5% and continues to rise.

The struggles of businesses further reinforce this grim outlook. Many online merchants, who are integral to the broader retail landscape, are increasingly unable to offer discounts. Their margins are already being pressed down too far, and with sales weak and costs rising, employers are broadly cutting back on expenses, including employees. This creates a self-reinforcing loop: consumers, seeing their incomes in jeopardy, pull back on spending, which puts even more pressure on employers to cut labor, and so the cycle continues.

Even central bankers are quietly acknowledging the dire circumstances. The Federal Reserve’s New York branch recently published a post titled “The zero lower bound remains a medium-term risk,” effectively admitting the “distinct nonzero possibility” of a return to Zero Interest Rate Policy (ZIRP). This marks a significant concession, especially given that New York Fed President John C. Williams is an author on the piece. This represents a profound shift from the days when officials like Bill Dudley dismissed market signals from Eurodollar futures as “just a bunch of hedging”. The markets, particularly the interest rate swap market, have consistently signaled lower rates for longer , a reality the Fed is now beginning to grapple with.

The “uncertainty” that the Fed now points to when explaining why the probability of hitting zero rates is the same now as in 2018, despite current rates being substantially higher, is no mystery to those paying attention to market fundamentals. As economists themselves have begun to grudgingly admit, their models often failed to incorporate the financial system. This means that despite starting from a higher interest rate point, the economic circumstances are such that the chances of reaching zero remain uncomfortably high.

The truth is becoming increasingly evident: the American consumer, once the engine of growth, has remembered how to hit the wall. It’s not just a passing “sentiment” issue; it’s deeply rooted in tangible and established weakness across the labor market and consumer spending. And the data is screaming it from every angle.

This article was originally published on Rational Ground.