Authored by Chris Macintosh via InternationalMan.com,

So much to talk about and so little time…

I will make this statement because it is relevant to the situation we all find ourselves in today:

“Lord Anton says that ‘power corrupts and absolute power corrupts absolutely’. But reflecting, it is key to understand that power does not transform, it amplifies.

He who leads, shows what he really is… with more impact. Power doesn’t change people, it just takes away the need to pretend. The righteous protects, the ambitious abuses, the insecure becomes a tyrant. It is not power that corrupts, it is the true face of each that emerges when there is no longer fear of consequences.”

I believe that the reason we are seeing outright abuses is that the abusers used to operate in the shadows (covert). But now, as the cloak is forcibly removed, these actors move out of the shadows, becoming overt.

The problem with being overt is that the strategies that are used under covert (Epstein blackmail operations) are very different from overt ones. Once the actions become overt, the cloak is removed and trust evaporates. The ability to control the peasants when trust is no longer there also evaporates.

This is why we’re about to enter a time where authoritarian overt actions come to the table — where the pointy shoes drop the pretenses and show the peasants who they really are.

B.S. Fatigue

“President Trump’s Justice Department and FBI have concluded they have no evidence that convicted sex offender and disgraced financier Jeffrey Epstein blackmailed powerful figures, kept a ‘client list’ or was murdered, according to a memo detailing the findings obtained by Axios.”

Of course, this brings up the problematic question of Ghislaine, who was jailed for trafficking kids… to nobody. If there’s no list, then you can be darn sure her lawyers will be looking to spring her because… well, you can’t be convicted of a victimless crime, can you?

It’s all a bit absurd. Anyone asking obvious questions is called crazy. Shut up, you peasants, with your conspiracy theories. Wear your mask. It’s for your protection. Trust the news, they’re there for you.

This reminds me of how the documents relating to the moon landing held by NASA went missing. The most important and groundbreaking event in the history of NASA, and whoops, lost it. Weird!

Some humorous quips on the topic…

They expect you to believe this shit. Meanwhile…

And it all kicked off around 2021. It’s all so puzzling. I wish someone could figure it out.

Why point this all out?

Easy. It is what happens at the end of empires. The peasants lose faith in their masters. I mean, who but the retarded believes the guvmint, media, big pharma, big banking, big AG or any of the pointy shoes at this point?

And you know where trust in the pointy shoes is expressed in financial markets? Yup, the sovereign bond markets.

Which brings us to…

Exponential Interest Costs

Let’s revisit the numbers…

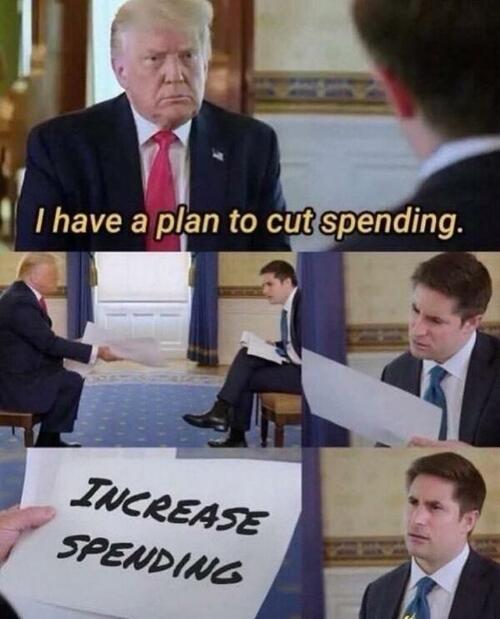

Just before the plandemic, federal debt was $20 trillion and GDP was $21 trillion. Ever since then, the path of travel has been accelerating in one direction. Consider that now we’ve $37 trillion of federal debt, while GDP is $29.1 trillion, putting US government debt to GDP at 127%.

So the parasitic guvmint sector has climbed by 85% while GDP grew only about 20%. Why am I not surprised?

To keep it going, the pointy shoes are now running a 7% annual deficit. Keep in mind the average for the last few decades was around 3.8%. This all matters because debt always matters, even if only eventually.

Recall in some issues back we listed out the four elements which exist for a massive change in the geopolitical order of the world and consequent repricing of assets which takes place. To refresh your memory, they are:

-

The monetary and credit cycle where nations get into a sovereign debt problem, which needs to be dealt with.

-

Domestic conflict, typically beginning as political disagreement, but where disagreement isn’t resolved by discourse.

-

A rising power challenging the existing power and causing international conflict.

-

Technological changes that assist in disrupting the status quo.

This brings up the question of, “Oh well, how can they deal with the debt problem?” History provides a solid list of actions. There are four options:

-

Taxation.

-

Confiscation or seizure of assets.

-

Austerity (the pointy shoes looking around and saying, “By golly, we’re a bunch of parasitic muppets, destroying things, best we rein ourselves in.” This, of course, rarely, if ever happens.

-

Debt restructuring, which is what Orange Man was attempting to do with tariffs, which amounted to a negotiation with creditors and which has, for the most part, failed.

As of right now, the federal debt is skyrocketing, and traditional policy levers are no longer working effectively. Raising interest rates simply inflates debt service costs, causing losses for bond holders while presenting a real risk of not only maturing debts NOT being rolled over but holders of these debt instruments selling them.

My colleague Lyn Alden makes a point regarding the total debt vs base money. She argues that total credit is expanding with base money lagging and that past shocks such as the global financial crisis of 2008 and CONVID didn’t reverse this. Her argument — one I agree with — is that this trend ain’t going backwards… ever.

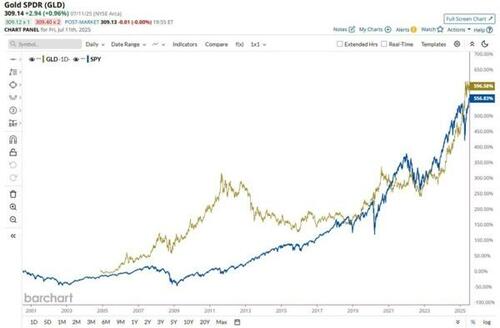

Which brings us to… gold and real rates.

As real rates plunged, gold has surged. If gold thrives in this environment (and it clearly does), so does Bitcoin, challenging old assumptions that scarce assets perform poorly in high-rate regimes.

Consider that gold has now outperformed the US stock market (dividends included) over the last 25 years. And yet, very few institutions and almost no retail investors own it.

* * *

The unraveling isn’t coming — it’s here. From covert corruption to exponential debt and the death of institutional trust, the signs are no longer subtle. If you’re reading this, you’re likely not waiting for permission to question the narrative — you’re already doing it. But understanding what comes next — and how to prepare for it — is another matter entirely. We’ve put together a special report to help you make sense of the chaos and position yourself wisely.

Clash of the Systems: Thoughts on Investing at a Unique Point in Time

In it, you’ll discover:

- The key macro forces driving the collapse of trust and capital flows

- Why traditional playbooks are failing — and what replaces them

- Actionable ideas for preserving wealth and freedom in a high-stakes, low-trust world

Click here to read it now. Because by the time the “pointy shoes” admit what’s really happening… it’ll be far too late to react.

Loading recommendations…