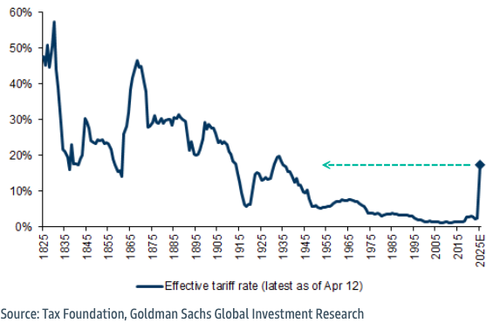

Four months after President Trump stunned the world and rattled global markets by unveiling “Liberation Day” tariff rates, his latest revisions (read here), announced Thursday, and set to go into effect in a week, sparked fresh global equity futures selling early Friday morning. With an average tariff rate of 15%, the world now faces the highest US levies since the Great Depression days of the 1930s, and these rates are roughly six times higher than one year ago and will certaintly lead to further rejiggering of supply chains.

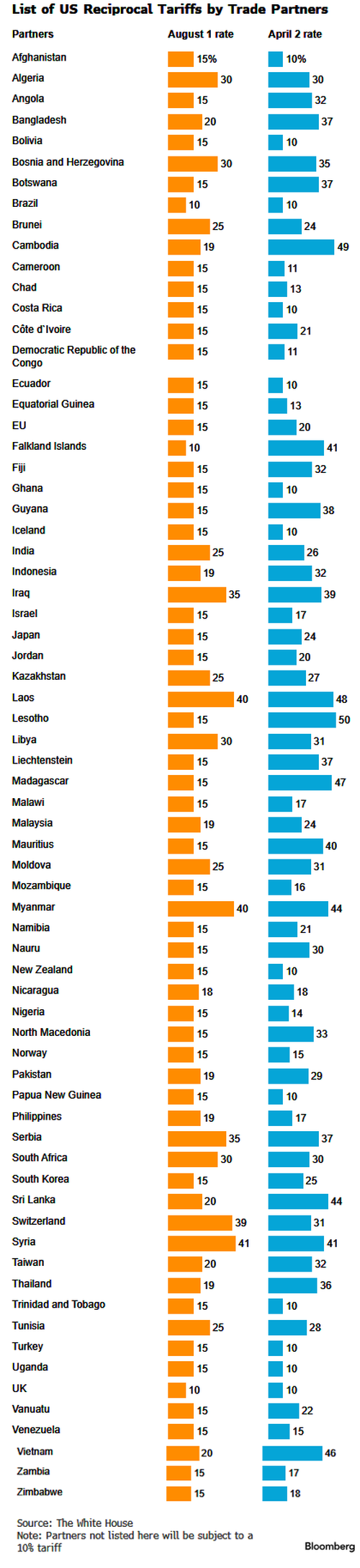

The new tariff rates are set to take effect in just seven days, starting at 12:01 a.m. ET. A baseline 10% tariff will apply to imports from most countries.

Here’s what you need to know:

-

10% Global Minimum Tariff imposed across all imports.

-

Canada: Tariff raised to 35% (from 25%), but goods under USMCA remain exempt.

-

Switzerland: Tariff increased to 39% (from 31%); Swiss officials criticize the change, citing divergence from prior draft terms.

-

40 Countries: Imports face a 15% tariff.

-

12+ Economies: Hit with even higher duties.

-

China & Mexico: Deadline delayed by 90 days.

The list:

The multi-month wave of tariff threats sparked front-loading of exports, supporting many Asian economies and shielding US consumers from price spikes. However, that could all change…

Commenting on this is Raghuram Rajan, former India central bank governor and chief economist of the International Monetary Fund, who is now a professor at the University of Chicago Booth School of Business, told Bloomberg TV earlier today, “For the rest of the world, this is a serious demand shock,” adding, “You will see a lot of central banks contemplating cutting as the rest of the world slows.”

Loading recommendations…