Authored by Peter Tchir via Academy Securities,

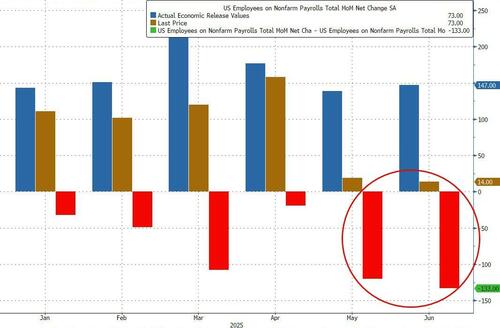

The headline establishment survey was 73k, which looks not so great at first blush, but unfortunately, is one of the better numbers in the entire report.

Only 1 economist surveyed by Bloomberg had a number lower than the actual.

As bearish on jobs as some of the rest of this analysis may sound, I suspect that we overstated job growth the prior months and are entering the time of year where we underestimate it, but we are all stuck living with the official data.

Not that I’m bitter, but last month’s headline number was revised down from 147k to 14k. Only bitter as we were expecting weak data last month and then didn’t get it, only to find a month later, we were probably right. How can businesses make decisions with such bizarrely inaccurate data? In this day and age of AI, electronic data, there has to be a way to get “better” as in “more accurate” data, rather than coping with “garbage in, garbage out”.

Total two month revisions were -258k.

The birth/death model, which we see as fraught with issues, miscalculations based on a legacy economy that doesn’t exist any longer, added 257k jobs (I think that is unadjusted and maybe the full amount doesn’t get passed into the final number but it disturbs me that a total of only 73k incorporates a significant boost from this calculation).

Manufacturing lost jobs in each of the last two months, though if tariffs are going to work to bring manufacturing back, it will take time (I remain skeptical of how much of a resurgence in manufacturing employment of humans we will get via tariff policy).

Government shrank a bit, after some weird seasonals pushed them higher initially last month (who knows where they are after revisions). That should get worse as we move into September and we see the impact of DOGE (most doge’d employees are still counted as employed since they are still receiving their salary).

The unemployment rate only inched higher to 4.2% – a bright spot on the surface. But that was with the labor rate declining to 62.2% (the lowest participation rate since 2022). The underemployment rate (potentially a precursor to further labor issues) moved up 0.2% to 7.9%. Not a horrible number in its own right, but the trend is not good (and fits our view that the low QUITS rate as reported by JOLTs tells us labor is concerned about their ability to get a job).

The Household Data, used for the unemployment rate had -260k jobs lost. Without the lower participation rate, unemployment rate would be higher. That brings the 3 month total for this measure to -863K total.

The Fed should take notice and cut – they should have gone this month and I’m still in the 3-4 cut for the year camp (which looks less ridiculous today than it did a few weeks ago).

Treasuries are rallying across the curve, which makes sense, though I’d be fading the long end with 10’s back to 4.27%.

One reason for that bearishness on longer term yields at these levels is the Fed might be forced to cut even as inflation pressure from tariffs trickle in.

Also, and somewhat contradictory, there is the potential that the court system will invalidate the existing tariffs. That money may have to be refunded (there is supposedly a market to trade potential tariff refunds – Wall Street will trade anything ). If we see lower tariffs and refunds on tariffs already paid, we could see pressure on bond yields, because while we don’t think the market has been giving enough benefit to tariff revenue, it has given some benefit. With appeals, injunctions, etc., we are some ways a way from the final decision, but we could see some noise around existing tariffs.

It is far from clear where the trade deals announced (often with great fanfare and little detail) will stand in the wake of any court decisions forcing the administration to use new or different avenues to impose tariffs. Companies that benefitted the most or were hurt the most by trade deals could see some reversals in their price action as well.

Bottom Line

Fade the rally in the long end of bond yields.

Be cautious on equities, and look for some reversals of recent trends between the outperformers and the laggards (the Russell 2000 is down year to date, and I’m not sure it is time to commit overweight here, but it is getting tempting).

Tariffs will be interesting as we see reaction (and potentially more deals) based on the tariff rates being set. At the same time, the court rulings could play a major role.

Finally, we continue to look to National Production for National Security and DEREGULATION to help some sectors do very well in the coming weeks and months!

Good luck and I do wish we had accurate data last month, imagine what the Fed might have done at the meeting if they knew jobs were punk last month and not some illusory surprise to the upside

Loading recommendations…