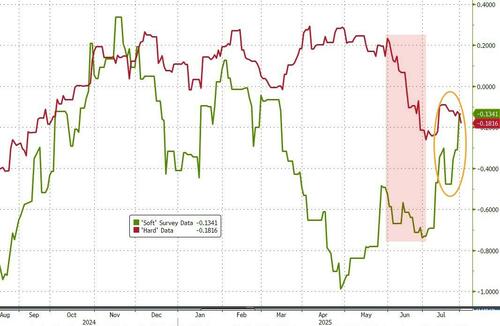

‘Hard’ data has disappointed in recent weeks (most notably today’s payrolls miss) and while soft data overall has been rising, today’s Manufacturing surveys were expected to show deterioration (after a rebound from April lows).

-

S&P Global US Manufacturing PMI fell from 52.9 to 49.8 (final) in July (back below 50 for the first time since December). The final print is slightly higher than the flash print of 49.5.

-

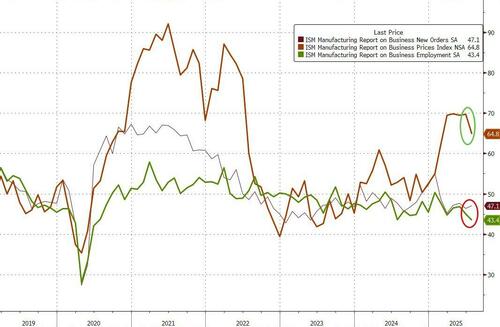

ISM US Manufacturing PMI fell from 49.0 to 48.0 (worse than the increase to 49.5 expected). That is the weakest since Oct 2024.

So both surveys are in contraction/recession…

Source: Bloomberg

The Employment component confirms this morning’s payrolls weakness, New Orders remain in contraction, but the silver lining is that fears of inflation are falling…

“July saw the first deterioration of manufacturing operating conditions since last December as tariff worries continued to dominate the business environment,” said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

“The downturn at the start of the third quarter in part reflects the passing of a busy period of tariff-related inventory accumulation in prior months.

Factories reported little change in inflows of new orders and reduced stock holdings of both raw materials and finished goods in July.

This comes after companies had built up inventories in May and June amid concerns over higher import prices and worsening supply availability resulting from tariff hikes.

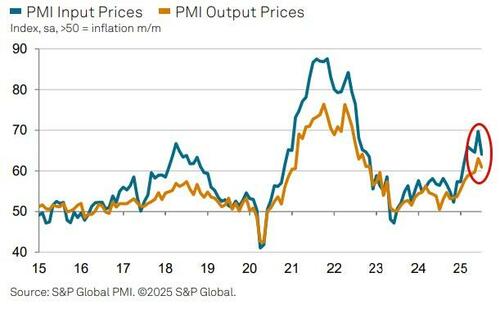

But there is a silver lining in inflation data…

“Input prices continued to rise at a steep rate, with these higher costs often being passed on to customers to drive another month of elevated selling price inflation, but there are signs that these price pressures may have peaked back in June.

Finally, Williamson notes that “optimism about the year ahead has meanwhile taken a knock as factories worry about reduced demand from customers, especially in export markets, and the inflationary impact of tariffs.”

“Employment consequently fell as factories trimmed headcounts amid concerns over rising costs and lower sales.”

Today’s ‘hard’ data decline left ‘soft’ data to lead

Is the hard data weakness (and sub-50 PMI) enough to push Powell to finally cut?

Loading recommendations…