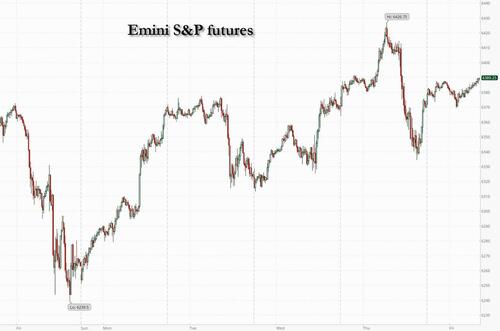

US equity futures rise at the end of a week in which markets were buffeted by tariffs, geopolitical developments and corporate earnings. As of 8:00am ET, S&P 500 futures were up 0.3%, with the underlying index on track for its biggest weekly gain in five. Nasdaq 100 futures gained 0.4% as the AI narrative gets more fuel from TSMC and Softbank. In premarket trading, MegaCap Tech sees NVDA leading gains (+0.7%); sectors like Utilities and Consumer Staples are outperforming. Intel rises after CEO Lip-Bu Tan said he’s got the backing of the company’s board, following Trump’s call for his resignation; Tesla slipped after disbanding its Dojo team, upending its effort to build a supercomputer for driverless-vehicle technology. Headlines were quiet since yesterday’s close with no major macro data reporting today. The next key catalyst will be August 12 CPI release. Trump nominated CEA Chair Stephen Miran to fill Kugler’s expiring term which prompted JPM to now see a 25bp cut in September (vs. his previous December call), following by three 25bps cut in the next three meetings. Yields are flat and USD is lower. Commodities are mixed with oil and precious metals higher, while base metals are flat. Gold is in focus after US Customs and Border Protection clarified that Swiss 1kg and 100oz gold bars are subject to reciprocal tariffs. Otherwise its pretty quiet to close out the week with no major data and Fed’s Musalem speaking at 10:20am.

In premarket trading, Mag 7 names are mostly higher with the exception of TSL, whose shares dropped 0.2% on news it is disbanding its Dojo team and its leader will leave the company, according to people familiar with the matter, upending the automaker’s effort to build an in-house supercomputer for developing driverless-vehicle technology. Shares are down 0.2%. Here are the others (Nvidia +0.7%, Apple +0.6%, Amazon +0.3%, Alphabet +0.2%, Microsoft +0.3%, Meta Platforms +0.2%).

- Block (XYZ) advances 8% after the company raised its full-year profit guidance after second-quarter earnings came in well ahead of Wall Street expectations, fueled by strength in its Cash App lending business and resilient payment volumes.

- Energy Vault (NRGV) falls 15% after the energy storage firm narrowed its revenue forecast for the full year.

- Expedia (EXPE) jumps 16% after the online travel agency reported second-quarter results that beat expectations and raised its full-year forecast.

- Figs (FIGS) rises 7% after the medical-scrubs seller reported second-quarter adjusted Ebitda that beat estimates. The company also boosted its adjusted Ebitda margin forecast for the full year to a range above what analysts expected.

- Flutter Entertainment (FLUT) slips 2.8% after the betting company reported results that surpassed expectations and raised its guidance for the full year. Shares are struggling to find new momentum after rallying around 40% since they bottomed-out in April.

- Gilead (GILD) gains 5% after the drugmaker boosted its adjusted profit guidance for the full year, following better-than-expected results for the second quarter. Analysts note strong sales of the firm’s HIV portfolio in the quarter.

- Goodyear (GT) slumps 6.9% after the tire company reported a second-quarter loss, while analysts expected a profit of 19 cents.

- Instacart (CART) is up 14% after the online grocery delivery company provided a forecast for 3Q adj. Ebitda that beat estimates and reported 2Q order growth that topped forecasts.

- Iovance Biotherapeutics (IOVA) plunges 28% after the biotech firm reported revenue for the second quarter that fell short of Wall Street’s estimates.

- JFrog (FROG) soars 17% after the software company beat expectations for the second quarter and raised its guidance. Several analysts increase their price target on the stock, seeing the improved guidance as still conservative.

- LegalZoom (LZ) surges 22% after the company forecast third-quarter revenue that beat the average analyst estimate as AI partnerships and subscription growth are expected to boost revenue.

- Microchip Technology (MCHP) falls 6% after the semiconductor-device company reported its first-quarter results and gave a forecast. Analysts are broadly positive, but said the results may not have lived up to elevated expectations.

- Ouster (OUST) jumps 20% after the sensor maker reported second-quarter revenue ahead of estimates.

- Soundhound (SOUN) rallies 21% after the US software company reported revenue for the second quarter that beat the average analyst estimate and raised its full year outlook.

- Sweetgreen (SG) sinks 28% after the salad chain slashed its sales guidance and missed second-quarter estimates.

- Trade Desk (TTD) falls 30% after the advertising-technology company reported second-quarter results and gave an outlook some analysts deemed to be underwhelming. It also announced a new chief financial officer.

- Twilio (TWLO) drops 13% after the company’s results included a third-quarter adjusted earnings-per-share view that trailed analysts estimates.

- Under Armour (UAA) slumps 13% after the sportswear company forecast worse-than-expected sales for the current quarter, stalling a turnaround plan that was taking hold.

- Viavi Solutions (VIAV) soars 23% after the communications-equipment company reported first-quarter results that beat expectations and gave an outlook that is above the analyst consensus, prompting an upgrade.

The S&P 500 is once again back to record highs following a 30% surge from its April lows, supported by robust corporate earnings and hopes the Federal Reserve will cut interest rates to support the economy as the labor market shows signs of weakening. Still, some firms have warned clients to prepare for a near-term pullback amid sky-high valuations and continued tariff uncertainty.

“Second-quarter earnings confirm corporate resilience continues. Overall, margins have been steady while firms’ commentary indicates that corporates have been largely adept at managing the impact from tariffs so far,” said Barclays Plc strategists led by Emmanuel Cau. “That doesn’t mean tariff uncertainty has gone away completely given Trump policy making remains erratic.”

In his latest trade moves, Trump escalated tensions by targeting India and imposing a 39% levy on Swiss exports to the US, while saying he’s “getting very close to a deal” with China. The US also confirmed it would end stacking of universal tariffs on Japan and cut car levies as promised. The about-turn on Japan has raised questions about the US trade deal with the European Union, said Jochen Stanzl, chief market analyst at CMC Markets.

“Since the tariff agreement between the U.S. and the European Union, some clarity has emerged, but confusion around its implementation is just beginning to surface,” Stanzl said. “In Japan, there is relief today upon hearing that the various tariffs will not be cumulative. However, it remains unclear whether the same rules apply for Japan and the EU. The complexities surrounding tariffs highlight the unpredictability in implementation, as evidenced by the recent surge in gold prices.”

Gold futures in New York soared after the US put tariffs on bullion bars, threatening to upend trade flows from Switzerland and other key refining hubs. The most-active contract climbed to an all-time intraday high above $3,534 an ounce, widening its premium over the spot price in London.

In geopolitical news, Israeli Prime Minister Benjamin Netanyahu secured cabinet approval on Friday for a military takeover of Gaza City, which he described as part of a final push to topple Hamas after 22 months of fighting and recover its last 50 hostages, dead or alive. Hopes of a truce in the Russia-Ukraine war rose after Trump said he’d be willing to meet with Vladimir Putin, even if the Russian leader hadn’t yet agreed to also sit down with Ukrainian President Volodymyr Zelenskiy.

Meanwhile, Fed Governor Christopher Waller is emerging as a top candidate to serve as the central bank’s chair among President Trump’s advisers as they look for a replacement for Jerome Powell, according to people familiar with the matter. The big news yesterday was that Trump chose Council of Economic Advisers Chairman Stephen Miran to serve as a Fed governor. The US president said that Miran, who will need to be confirmed by the Senate, would only serve the expiring term of Adriana Kugler, which expires in January.

“Having a more dovish Federal Reserve governor on the table is definitely better,” Ivy Ng, a CIO at DWS, said in a Bloomberg TV interview. “But in the end, the Federal Reserve is still more data driven, so we focus a lot on the economic data.”

Europe’s Stoxx 600 is up 0.2% and is on course for its best week since May. Mining, bank and auto shares are leading gains while insurance and technology stocks are the biggest drags. Here are the biggest movers Friday:

- Novo Nordisk advances as much as 4.6% after Intron Health upgraded its rating to hold from sell. The research firm sees the narrative probably being dominated by the potential upside for the Danish drugmaker following peer Eli Lilly’s disappointing data for its new weight-loss pill

- Unipol shares fell as much as 3.8% in Milan after the insurance company reported 1H results. The deterioration of the combined operating ratio in the Property & Casualty business in the second quarter “might raise some questions,” Barclays analyst Alessia Magni wrote in a note to clients

The Mag 7 plus Broadcom, Oracle and Palantir accounted for 80% of the S&P 500’s return since Trump’s ‘Liberation Day’ in April, according to BofA strategist Michael Hartnett. BofA’s flows note also showed that investors poured nearly $107 billion into cash funds in the week through Aug. 6, the biggest inflows since January.

In FX, the Bloomberg Dollar Spot Index rises 0.1%. The Japanese yen and Norwegian krone are the weakest of the G-10 currencies, falling 0.4% each.

In rates, gilts extend their post-BOE fall, pushing UK 10-year yields up another 3 bps to 4.58%. Bunds also drop while Treasuries are little changed after Thursday’s a weak sale of 30-year debt signaled waning appetite for US debt.

In commodities, Gold futures in New York are up 1% having rallied after the Financial Times reported that US imports of one-kilogram bullion bars are now subject to tariffs. The spot price stalls near $3,400/oz. Oil prices rise for the first time in seven sessions, with WTI crude futures climbing 0.3% to near $64 a barrel as traders await US President Donald Trump’s next moves to halt the war in Ukraine after he announced tariffs on India this week for taking Russian oil.

No US economic data is scheduled, and Fed speakers slate includes Musalem on banking and credit (10:20am)

Market Snapshot

- S&P 500 mini +0.3%

- Nasdaq 100 mini +0.3%

- Russell 2000 mini +0.4%

- Stoxx Europe 600 +0.1%

- DAX -0.3%

- CAC 40 +0.2%

- 10-year Treasury yield little changed at 4.25%

- VIX -0.3 points at 16.3

- Bloomberg Dollar Index +0.1% at 1205

- euro -0.3% at $1.1634

- WTI crude +0.1% at $63.97/barrel

Top Overnight News

- The US has imposed tariffs on imports of one-kilo gold bars, in a move that threatens to upend the global bullion market and deal a fresh blow to Switzerland, the world’s largest refining hub. Gold futures surged to an all-time high. FT

- State Street’s SPDR Gold Shares, the biggest precious-metals ETF, boosted its holdings by 202,600 ounces, valued at $688 million, in the last session. That’s the biggest surge since July 22. BBG

- Florida lawmakers are exploring whether to redraw the state’s congressional map, joining a national push in GOP-led states to add seats that may help Trump’s party keep control of Congress in the 2026 midterm elections. BBG

- Food prices on the rise – the UN food price index climbed 1.6% M/M and 7.6% Y/Y in Jul. UN

- Israel’s cabinet approved a military takeover of Gaza City. Israel said the plan’s objective is the “defeat of Hamas” and to recover the last 50 hostages, dead or alive. The IDF already controls around 75% of Gaza. BBG

- TSMC reported a 26% growth spurt in July, adding to evidence of accelerating spending on AI. BBG

- The PBOC will continue to use various monetary policy tools, such as reverse repos, outright reverse repos and the MLF, to maintain liquidity and further implement a moderately loose monetary policy, the Shanghai Securities News reported, citing analysts. BBG

- One BOJ board member hinted policymakers may be moving toward another rate hike by the end of the year, depending on US tariff impacts, according to a summary of the July meeting. BBG

- Japan’s lead trade negotiator has said that the US has promised to fix an “extremely regrettable” oversight to ensure that the country’s biggest companies do not face tariffs in excess of those agreed between the sides last month. FT

- UK CMA has decided not to refer to Boeing (BA) and Spirit Aerosystems (SPR) merger to a Phase 2 investigation.

Trade/Tariffs

- US President Trump suggested there will be no talk on the India tariff until they get things resolved.

- US Treasury Secretary Bessent said China tariffs can be on the table at some point and that President Trump is using tariffs as an instrument of foreign policy, while he stated the TikTok deal is separate from a China trade deal. Furthermore, Bessent said the BRICs countries’ meeting is largely ceremonial and the Fed lacks logic on rates, according to a Fox News interview.

- Japan’s trade negotiator Akazawa said it is regrettable that the US stacked tariffs despite the trade deal but added that they have been able to confirm a non-stacking stance from the US and there is no discrepancy between the US and Japan that there is no tariff stacking. Furthermore, he noted that the US said it will refund any extra tariffs retroactively going back to August 7th and the US side expressed regret over the erroneous citation in the executive order.

- Japan’s government said top tariff negotiator Akazawa held talks with US Commerce Secretary Lutnick for 3 hours and Treasury Secretary Bessent for 30 minutes on Thursday in which both sides reaffirmed the importance of steadily implementing measures that benefit the interests of both Japan and the US under the Japan-US agreement. Furthermore, Akazawa urged the US side to correct the executive order regarding reciprocal tariffs and Japan will continue to maintain close communication with the US side at various levels.

- Brazil’s VP Alckmin said a plan with measures to mitigate the effects of US tariffs is expected to be announced by Tuesday.

- US Customs Border Protection agency said one-kilo and 100-ounce gold bars should be classified under a customs code subject to levies which is a fresh blow to Switzerland, according to FT citing a ruling letter dated July 31st.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following the mostly lacklustre handover from Wall St and amid a deluge of earnings releases. ASX 200 was rangebound with the index contained as gains in the mining, resources and materials sectors were offset by losses in tech, healthcare, telecoms and financials. Nikkei 225 outperformed and briefly reclaimed the 42,000 status, while the TOPIX hit a fresh record high with sentiment underpinned after Japan was able to confirm a non-stacking stance regarding tariffs from the US and with momentum also helped by earnings releases including from SoftBank, whose shares surged by a double-digit percentage after its profit beat. Hang Seng and Shanghai Comp were mixed amid ongoing uncertainty heading into next week’s tariff truce deadline.

Top Asian News

- BoJ Summary of Opinions from the July meeting stated a member said the BoJ is likely to continue raising rates if the economy and prices move in line with its forecasts, while a member said that given high uncertainty on whether the BoJ’s forecast materialises, it must judge the outlook without preconception. It was also noted that there was no change to the view that underlying inflation will stall before re-accelerating despite the Japan-US tariff agreement, and it was stated that US monetary policy and the direction of FX moves may change sharply depending on US consumer inflation and labour data, so policy must be judged after looking at more data. Furthermore, a member said they need at least two to three months to gauge the impact of US tariff policy and it there was also the opinion that the BoJ must proceed with further rate hikes when the chance opens up, as Japan’s policy rate is still below neutral and it must raise rates in a timely fashion to avoid being forced to hike rapidly and cause huge damage to Japan’s economy.

- China Auto Industry CPCA says China sold 1.852mln passenger cars in July, +6.9% Y/Y; Tesla (TSLA) exported 27,269 in July.

- China Q2 Prelim Current Account Balance 135.1bln (prev. 165.3bln).

European bourses (STOXX 600 +0.2%) opened mostly modestly firmer and have traded sideways throughout the session, in very quiet newsflow. European sectors hold a very slight positive bias. Basic Resources top the pile – nothing specific driving the upside, simply just a case of upside across the underlying metals complex. The clear underperformer today is Insurance, which has been hit by post-earning losses in Munich Re (-8%), where the Co. slashed its Insurance rev. forecast. US equity futures (ES & NQ +0.3%, RTY +0.4%) are very modestly firmer across the board, as price action stabilises a touch from the mixed performance on Thursday, with modest outperformance in the RTY.

Top European News

- Novo Nordisk advances as much as 4.6% after Intron Health upgraded its rating to hold from sell. The research firm sees the narrative probably being dominated by the potential upside for the Danish drugmaker following peer Eli Lilly’s disappointing data for its new weight-loss pill

- Unipol shares fell as much as 3.8% in Milan after the insurance company reported 1H results. The deterioration of the combined operating ratio in the Property & Casualty business in the second quarter “might raise some questions,” Barclays analyst Alessia Magni wrote in a note to clients

FX

- DXY is on a firmer footing today. The US macro narrative remains primarily focused on personnel changes at the Fed after reporting that CEA Chair Miran is to fill ex-Governor Kugler’s position on the FOMC, albeit temporarily. Consensus suggests that he will join Waller and Bowman in backing rate cuts during his tenureship. In terms of the top job at the Fed, reporting via Bloomberg has suggested that Waller is now the frontrunner. Waller has been a dovish outlier on the Fed but will be perceived more positively than either of the two Kevins. Today’s docket is light on data, whilst the speaker slate contains 2025 Musalem, albeit the subject matter suggests it may be light on monetary policy guidance. DXY is just about holding above the 98 mark and moved back above its 200DMA at 98.18.

- EUR/USD is lower but contained within Tuesday’s 1.1610-99 range after the pair ran out of steam ahead of the 1.17 mark. It has been an exceptionally quiet week for the Eurozone, with the USD very much in the driving seat for the pair. Some traders are mindful of events surrounding Russia-Ukraine and whether this could have some positive read across for EUR. To the upside, 1.17 remains the key source of focus for the pair. To the downside, support is provided by the 200DMA at 1.1606.

- JPY is softer vs. the USD amidst a relatively indecisive week for the pair. In what has been a confusing few days on the trade front between Japan and the US, Japanese trade negotiator Akazawa has confirmed the non-stacking stance from the US, and there is no discrepancy between the US and Japan that there is no tariff stacking. On the BoJ, the Summary of Opinions from the July meeting showed the Bank debated the chance of resuming rate hikes. USD/JPY is currently tucked within Thursday’s 146.69-147.71.

- GBP has faltered after yesterday’s BoE-induced gains vs. the USD. To recap, the BoE pulled the trigger on another 25bps rate cut. However, the decision to do so was subject to more hawkish dissent than the market was positioned for and subsequently saw traders push back their expectations for policy loosening. Greater clarity could be provided today by comments from Chief Economist Pill, who backed a hold yesterday. The next upside target for Cable comes via the 1.35 mark with the 200DMA just north of this level at 1.3504.

- Antipodeans are both are fractionally softer vs. the USD in what has been a solid showing for AUD/USD and NZD/USD this week.

Fixed Income

- A slightly softer start to the day, but once again, movement at this point is very thin in a sub-five tick range. Note, while action has intensified in the latter part of sessions this week that may not be the case today, as the docket is very light; however, any update on the Fed Chair, tariffs or geopols, among other topics, could see action intensify once again in the latter half of the day. In a narrow 112-00+ to 112-04 band so far. Newsflow since the Fed updates yesterday has been light. In brief, Trump appointed Miran to the Fed taking Kugler’s spot until the term ends in January.

- Softer start to the day for Bunds also, though magnitudes are marginally more eventful than those outlined above. In a 130.01-26 band, getting back towards but still shy of Thursday’s 130.37 best. As above, drivers are light today after a packed week for markets. The European-specific docket is devoid of Tier 1 events, as such impetus may be drawn from any update to the potential catalysts outlined in UST.

- Gilts are directionally in-fitting with the above but magnitudes are slightly more pronounced. Opened lower by just under 20 ticks and then slipped a handful further to a 92.15 trough, but has since reverted back to between today’s 92.22 open and Thursday’s 92.40 close. Remarks from Chief Economist Pill just after midday will be in particular focus. Pill was part of the four who voted to leave rates at 4.25% (decision was, ultimately, a 25bps cut), the four’s main point of justification was “a slower loosening of policy would reduce the risk of inflation not meeting the target sustainably.”.

Commodities

- WTI and Brent price action has been choppy today, but are currently slightly firmer. To recap, nothing really behind the downside this morning, but seemingly a continuation of overnight/this week’s price action as markets continue to price out the cooling geopolitical risk premia in the complex. The reversal also lacked catalysts, but perhaps as traders turn their attention to the developments in Gaza/Israel, whereby Israel’s Security Cabinet approved plans to occupy Gaza City. In terms of the US-Russia meeting, the White House pushed back on comments from Russia’s Kremlin, which suggested a meeting had been agreed to. WTI and Brent currently sit in a USD 63.19-97/bbl and USD 65.80-66.57/bbl range respectively; currently towards highs.

- Gold is contained, holding around the USD 3.4k/oz mark in USD 3381-3409/oz parameters. The main point of newsflow was a report in the FT that the US Customs Border Protection agency is to classify 1 kilo and 100 ounce gold bars as subject to levies, according to the FT citing a July 31st ruling.

- Base metals are broadly contained. Specifics light and the APAC handover was a mixed one caught between earnings and trade uncertainty into next week’s deadlines. At best, 3M LME Copper has breached USD 9.7k but has failed to make any real traction above it with ranges from earlier in the week also fairly lacklustre.

- Russia has increased repair activity at some oil refineries, via Ifx.

Geopolitics: Israel

- Israel’s security cabinet approved PM Netanyahu’s proposal for the occupation of Gaza City to defeat Hamas and the IDF will prepare to take control of Gaza City while providing humanitarian aid to the civilian population outside the combat zones, according to Axios’s Ravid.

- Israeli media said the army intends to impose a siege on Gaza City from all sides and the army will begin a large-scale campaign to call up the reserve forces, according to Sky News Arabia.

Geopolitics: Ukraine

- US President Trump said regarding a Russia-Ukraine ceasefire that it is up to Russian President Putin and that Putin doesn’t have to agree to meet with Ukrainian President Zelensky to meet with him.

- Polish PM Tusk says “I think a pause in the conflict in Ukraine could be close”.

Geopolitics: Other

- US President Trump posted that he looks forward to hosting the President of Azerbaijan and the Prime Minister of Armenia at the White House on Friday for a historic peace summit.

US Event Calendar

- 10:20 am: Fed’s Musalem Speaks on Banking and Credit

DB’s Jim Reid concludes the overnight wrap

Markets have been mixed over the past 24 hours, with the S&P 500 edging -0.08% lower, partly weighed down by disappointing earnings from Eli Lilly (-14.14%), even as the NASDAQ (+0.35%) and the Mag-7 (+0.40%) reached new all-time highs. European equities rallied, with the Stoxx 50 gaining +1.31% as investors responded positively to renewed momentum around potential peace talks between Russia and Ukraine. Elsewhere, US Treasuries and the dollar lost ground after a soft 30yr auction and as Stephen Miran was nominated to temporarily take over the vacant seat on the Federal Reserve Board.

Trump nominated Miran, the Chairman of the Council of Economic Advisers, to serve until January in the seat vacated by Governor Kugler. The President added that “we will continue to search for a permanent replacement”, which could then be used to place a Fed Chair candidate on the Board come January. Last year, Miran had co-authored a plan for reforming the Fed and also popularised the ‘Mar-a-Lago accord’ idea. The dollar index fell by about -0.3% immediately after the news of Miran’s nomination, erasing its daily gain. Earlier, Bloomberg reported that Trump advisers are favouring Fed Governor Christopher Waller as a potential replacement for Chair Powell. Waller was one of two dissenters who favoured a rate cut last week, citing signs that the labour market is “on the edge” ahead of the poor jobs report. As an existing Board member, he might find it easier to build consensus on policy across the FOMC than an external candidate, but he would still require the data to go his way

As an example, Fed pricing was little changed yesterday as Fed Governor Bostic said he still viewed only one rate cut as likely this year given the risks of persistent tariff effects on inflation. However, he did add that the jobs data did make him “think differently about the Fed’s mandate.” So a slight dovish tilt. Meanwhile, 10yr Treasury yields ended the day +2.2bps higher at 4.25%, with most of the increase coming after a weak 30yr auction that saw $25bn of bonds issued +2.1bps above the pre-sale yield. That follows soft 3yr and 10yr auctions earlier this week, with demand for Treasuries waning amid the lower level of yields we’ve seen since the weak payrolls report last Friday.

Back to central banks, the Bank of England added a layer of complexity to the macro backdrop with a rate cut that surprised in tone if not in magnitude. The MPC reduced the Bank Rate by 25 basis points to 4%, in line with expectations, but the messaging was notably hawkish. The initial vote split was an unprecedented 4-4-1, with four members favouring a hold. A second vote was required to reach a 5-4 majority—something never seen before. The Bank also shifted its emphasis from labour market conditions to inflation dynamics, raising its near-term CPI forecast to 4% yoy for September. Governor Andrew Bailey stated that the yield curve would be considered in future decisions regarding quantitative tightening, while reaffirming the Bank’s commitment to the programme.

This more cautious stance has prompted our UK economist Sanjay Raja to revise his forecast. He now expects only one more rate cut this year, keeping a projected terminal rate of 3.25% but for this to be reached in Q2 2026. A full recap of the BoE’s decision is available here.

Following the hawkish meeting, investors dialed back expectations of further BoE cuts. Overnight index swaps are pricing another 19bps of easing by December, with the year-end pricing moving +6.5bps higher on the day. Gilt yields rose, with 2-year yields up +5.8bps and 10-year yields up +2.1bps. With rates moving higher, the FTSE 100 fell -0.69%, underperforming European peers, while sterling strengthened by +0.67% against the dollar. You can see our FX strategists’ post-BoE take on sterling here.

Elsewhere in Europe, sentiment was buoyant. Investors welcomed news that the Kremlin signaled a likely meeting between Trump and Russia’s President Putin as early as next week. The White House has not yet committed to any timing for the meeting, which would be the first between US and Russian Presidents since Russia’s 2022 invasion. While there’s still plenty of uncertainty, the news led to a decline in risk premia for assets impacted by Russia’s war in Ukraine. Oil prices fell for a sixth day running, with Brent crude down -0.69% to its lowest since early June at $66.43/bbl, while the Polish Zloty (+0.39%) had its best day against the euro in over a month.

Improved hopes for a ceasefire also lifted equities across the continent. The DAX rose +1.12%, the CAC 40 gained +0.97%, and the IBEX 35 advanced +1.06%. European sovereign bonds rallied, with yields on 10-year bunds down by -2.0bps, OATs by -1.6bps, and BTPs by -2.4bps. Headlines also noted that Zelensky and European Commission President Ursula von der Leyen were discussing diplomatic options, with Zelensky stating that Europe “must be a participant in the peace talks.”

In details of the US equity moves, the Philadelphia Semiconductor index outperformed (+1.50% ) following the carveouts signaled by Trump for tariffs on chips the previous evening. Nvidia (+0.75%) reached a new all-time high, though Intel fell -3.14% after Trump called on its CEO to resign. Also on the downside, healthcare (-1.16%) was weighed down within the S&P 500 by Eli Lilly, while financials (-1.13%) also struggled.

On the trade front, Trump’s tariffs officially came into effect yesterday, though markets showed little reaction. The EU confirmed that its chip exports to the US will be subject to 15% tariffs rate, despite Trump’s announcement that imported chips could face tariffs of up to 100%. This development also supported European equities. Meanwhile, Commerce Secretary Howard Lutnick indicated that the US may extend its trade truce with China by another 90 days. Switzerland, facing a 39% tariff rate, remains in negotiations with the White House. A government spokesperson said they are committed to reducing tariffs “as swiftly as possible” and are not considering countermeasures. Despite the uncertainty, the Swiss Market Index recovered, rising +0.80%.

In the US, the latest jobless claims data offered some relief after last week’s weak payrolls report. Initial claims for the week beginning August 2 came in only a touch above expectations at +226k versus a +222k forecast. Continuing claims disappointed though, coming in at 1,974k versus a consensus of 1,950k, but this upside was concentrated in California and potentially reflected seasonal effects. Meanwhile, the New York Fed’s consumer survey showed both inflation expectations and labour market perceptions ticking up in July.

Bitcoin climbed +1.87% to $117,239 as Trump issued an executive order directing the Labour Department to re-examine guidance around alternative investments in 401(k)s, which would ease access to private equity, real estate, and digital assets in retirement accounts.

This morning in Asia, the Nikkei (+2.30%) is outperforming, driven by Tokyo’s Ryosei Akazawa’s confirmation that the US will end the stacking of universal tariffs and cut levies on cars, adding that any overpaid levies will be refunded. The index performance was also boosted by stronger-than-expected household spending, which came in at 2.7% (vs. 1.3% expected), despite ongoing inflationary pressures. Elsewhere in Asia, markets are on the weaker side with the Hang Seng (-0.68%), Kospi (-0.81%) and S&P/ASX 200 (-0.13%) lower, while in China, the CSI (+0.06%) and Shanghai Composite (+0.07%) are relatively flat. S&P 500 (+0.29%) and NASDAQ 100 (+0.31%) futures are a decent amount higher. Gold futures increased their premium over spot in late New York trading after the FT reported that gold bullion bars will face US tariffs – a surprising move and another potential blow to Switzerland. The premium has jumped to around $100.

Looking ahead, today’s calendar includes Canada’s July jobs report, while we will hear from the Fed’s Musalem and the BoE’s Pill. The latter will be notable given the fascinating BoE meeting yesterday. Notable earnings releases include Munich Re and Wendy’s.

Loading recommendations…