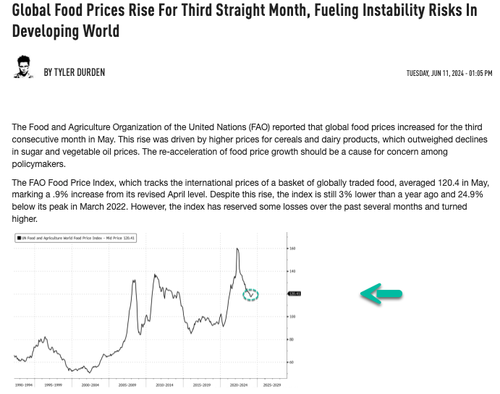

The Food and Agriculture Organization of the United Nations’ Food Price Index, a global benchmark for food commodity prices, registered its highest level since early 2023 in July. This marks a notable inflection point after a multi-year downward trend that followed the Covid and Russia-Ukraine war price spikes.

The FAO Food Price Index averaged 130.1 in July, up 1.6% from June, driven primarily by sharp increases in meat and vegetable oil prices.

“The index tracks monthly changes in the international prices of a set of globally traded food commodities. In July, price increases in the meat and vegetable oil indices more than offset declines in the cereal, dairy and sugar indices,” FAO wrote in its monthly report.

The FAO Food Price Index has undergone a significant reversal since bottoming out in early 2024, following a downturn after the price spikes during Covid and Russia’s invasion of Ukraine. It is now at its highest level since February 2023, up 43% from its early Covid-era lows, and will likely remain elevated into next year.

Here’s a summary of the report:

-

Headline Index: Averaged 130.1 (+1.6% MoM), driven by meat and vegetable oils. Still 18.8% below the March 2022 peak but 7.6% above July 2024.

-

Cereals (106.5, -0.8% MoM): Wheat & sorghum prices fell on new harvests; maize & barley rose. Rice (-1.8%) declined on ample supply and weak demand.

-

Vegetable Oils (166.8, +7.1% MoM): 3-year high. Palm oil up on strong demand; soy oil supported by biofuel sector; sunflower oil higher on Black Sea supply tightness; rapeseed oil down on new EU crop.

-

Meat (127.3, +1.2% MoM): Record high. Bovine & ovine prices surged on China/U.S. demand; poultry edged higher as Brazil regained AI-free status; pig meat fell on oversupply & weak EU demand.

-

Dairy (155.3, -0.1% MoM): First drop since April 2024. Butter & milk powders down on abundant supply; cheese prices up on strong Asia/Near East demand & tighter EU exports.

-

Sugar (103.3, -0.2% MoM): Fifth monthly decline on expectations of 2025/26 production rebound (Brazil, India, Thailand), partly offset by recovering import demand.

Last month’s uptick signals increasing price momentum in global food markets. While the index remains well below its 160 peak in 2022, sustained upward pressure in global food prices could reignite inflationary pressures.

Implications:

- Fragile States: A renewed price surge could spark food insecurity and social unrest in low-income, import-dependent nations.

In the U.S., the Trump administration needs to place a larger emphasis on strengthening local food supply chains to mitigate external supply shocks. That means know your local rancher and farmer, as well as make plans for a backyard garden and chicken coop.

Readers have been well-informed about this inflection point…

Related:

. . .

Loading recommendations…