Decades ago during my years in college and grad school, I had a strong side-interest in Soviet history, and read quite a number of weighty books in that subject. Most of these heavily focused upon the Stalin era, describing the almost unprecedented loss of life that occurred during that period from the combination of executions, Gulag deaths, and terrible famines.

But these horrifying stories were sometimes leavened by episodes so strange and ironic that I was never entirely sure whether they were real or merely invented.

For example, during the first half of the 1930s, the Great Famine caused by forced collectivization and dekulakization was widely described as having caused many, many millions of deaths. Stalin pushed ahead with this project despite the considerable misgivings of some of the other Soviet leaders, most of whom would themselves soon be purged and often shot just a few years later.

Given such horrifying famine conditions in the Ukraine and other Soviet regions, social order collapsed to the point that many of these deaths went unreported at the time. Thus, they only became apparent several years later when the Soviet Census of 1937 found that there were considerably fewer Soviet citizens alive than had been expected.

According to my history textbooks, Stalin was greatly dismayed by these Census results. But rather than admitting that his policies may have had such adverse consequences, the Communist dictator decided that the expert statisticians of the Census bureau were responsible for the problem, and had them all purged and shot as dastardly anti-Soviet saboteurs and wreckers.

Naturally, I always snickered a little at those forced to live under such a bizarre and irrational autocrat who reacted to a less than favorable message by shooting the messenger. And at least according to Wikipedia, the basic story of such Stalinist irrationality was apparently true, with the 1937 Soviet Census showing that the population was perhaps 10 million lower than had been expected and the Census bureau was indeed purged as a consequence.

But today, in the wake of the apparent economic and political consequences of President Donald Trump’s bizarre and autocratic tariff policies, I am reminded of the famous opening lines of one of Marx’s books, in which the author claimed that historical events appear twice, “first as tragedy, then as farce.” Thus, during the last week or so, we have seen our own government react in ways quite similar to those of Stalin, though so far at least lacking the sanguinary component.

Earlier this year on April 2nd, Trump had declared “Liberation Day,” unveiling a sweeping new set of tariffs against the trade goods of every other country in the world. His new tariff rates were so extremely high and seemingly arbitrary that I doubt I was the only one who wondered whether his presentation had accidentally been delayed twenty-four hours and he had originally scheduled his announcement for April Fools’ Day.

Certainly nothing like this had ever previously happened in American history. Indeed, I could not recall any foreign dictator let alone a democratically-elected leader who had ever unilaterally done anything so strange with regard to foreign trade. As I wrote soon afterward:

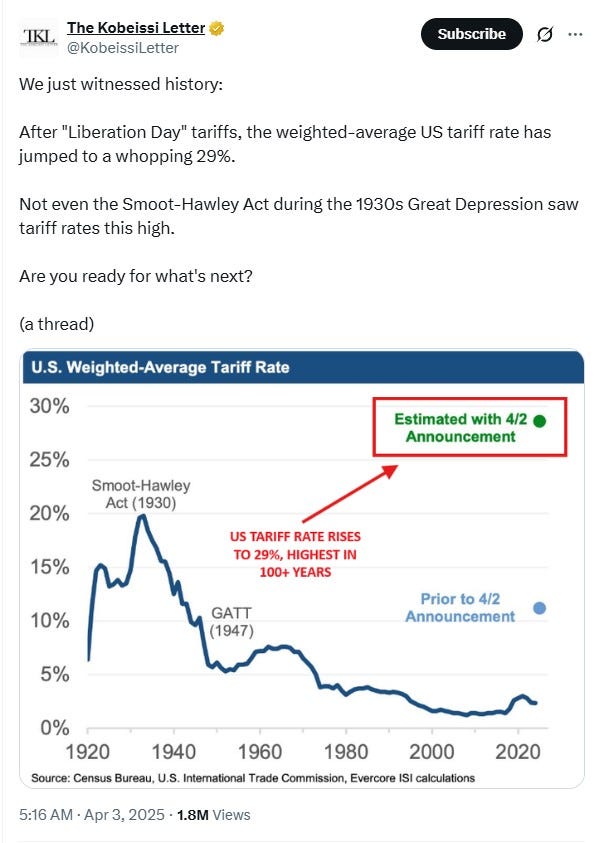

Tariffs are just a type of tax levied on imports, and America annually imports well over $3 trillion worth of foreign goods, so tariff taxes obviously have a huge economic impact. But Trump suddenly raised those taxes by more than a factor of ten, taking them from around 2.5% to 29%, rates far, far beyond those of the notorious 1930 Smoot-Hawley Tariff and reaching the levels of more than 100 years ago. This certainly amounted to one of the largest tax increases in all of human history.

Trump’s policies were so strange and destructive that the broader historical analogy that immediately came to my mind was the disastrous Great Leap Forward implemented in China under Chairman Mao. A few days after Trump’s declaration I published a piece making this suggestion.

As might naturally be expected, our financial markets completely panicked at these huge new import taxes. The terrible blows to stock prices, bond rates, and the value of the dollar all seemed to reflect the belief of investors that our country was facing total economic disaster.

As I soon emphasized, one reason for such widespread financial fear was Trump’s bizarre claim that unlike all previous American presidents, he possessed the power to set tariff tax rates by emergency decree:

According to our Constitution, tariffs and other tax changes must be enacted by Congressional legislation. But Trump ignored those requirements, instead claiming that he had the power to unilaterally set tariff tax rates under the emergency provisions of a 1977 law that no one had ever previously believed could be used for that purpose.

Across our 235 year national history, all our past changes in tariff, trade, or tax policy—including Smoot-Hawley, NAFTA, the WTO, and Trump 45’s own USMCA—had always been the result of months or years of political negotiations, and then ultimately approved or rejected by Congress. But now these multi-trillion-dollar decisions were being made at the personal whim of someone who had seemingly proclaimed himself a reigning, empowered American autocrat.

As might be expected, Trump’s huge tax increase on $3 trillion of imports quickly led to a very sharp drop in stock prices, but Trump declared that he was unbending and would never waver. China had prepared for exactly such an economic attack, and when it soon retaliated with similar tariffs on American products, Trump counter-retaliated, with several days of those tit-for-tat exchanges eventually raising tariff rates against China to an astonishing 145%, essentially banning almost all Chinese goods. Many other countries and the EU also threatened similar retaliatory tariffs, but since their tax rates were governed by law rather than autocratic whim, their responses were necessarily much slower.

Although Trump initially promised to stay the course, the quick collapse in the financial markets soon forced him to back down, drastically reducing his new tariff rates for three months while he negotiated bilateral trade deals with other countries.

However, just a week after he announced those gigantic tariffs against the entire world and repeatedly promised to maintain or even further raise them, Trump suddenly changed his mind. Although he kept the Chinese rates at those ridiculous levels, he declared that tariffs on all other countries would suddenly be reduced to a very high but rational 10% rate for the next 90 days while he decided what to do.

Thus, during the course of a single week, Trump had raised American tariffs by more than a factor of ten, then dropped them by a factor of two, representing exactly the sort of tax policy we might expect to see in a Bugs Bunny cartoon.

Trump’s totally unexpected reversal naturally produced a huge recovery in stock prices, which regained much of the ground that they had previously lost, and Trump boasted about all the money that his friends had made from that unprecedented market rebound. This led to some dark suspicions that our unfortunate country had just witnessed one of the most outrageously blatant examples of insider trading in all of human history.

Across thousands of years, the world has seen many important countries ruled by absolute monarchs or all-powerful dictators, with some of these leaders even considered deranged. But I can’t recall any past example in which a major nation’s tax, tariff, or tribute policies have undergone such rapid and sudden changes, moving up and down by huge amounts apparently based upon personal whim. Certainly Caligula never did anything so peculiar, nor Louis XIV nor Genghis Khan nor anyone else who comes to mind. Lopping off the heads of a few random government officials was one thing, but drastic changes in national financial policies were generally taken much more seriously. I don’t think that Tamerlane ever suddenly raised the tribute he demanded from his terrified subjects by a factor of ten, then a few days later lowered it back down by a factor of two.

What will our tariff rates on $3 trillion of imports be like in a few months? I doubt that anyone can say, even including the current occupant of the Oval Office. For example, late Friday night the Trump Administration apparently exempted smartphones, computer equipment, and other electronics from his Chinese tariffs, hoping that the timing would help hide that further abject surrender from the American population.

Consider America’s major business corporations or even its small mom-and-pop operations. Nearly all of these have some substantial connection to international trade, even if they merely rely upon ordinary products that they buy at Costco or Walmart. On April 2nd, Trump announced his huge new tariffs that would greatly raise the price of those products or possibly lead to their disappearance, then on April 9th he changed his mind and suspended those tariffs for 90 days, but still proposed to afterward enact them, while essentially banning nearly all Chinese imported goods with a 145% tariff that may or may not continue.

Under those circumstances, how could any rational corporate planner—or even sensible small-businessman—formulate any long-term investment plans? For at least the next 90 days, virtually all business investment will surely remain frozen, except perhaps for a little panic-buying. It’s hardly surprising that consumer sentiment quickly reached the worst levels since record-keeping began.

Trump’s dramatic U-turn a week after his initial tariff announcement did allow the financial markets to stabilize and regain the ground they had lost, though his many critics began to ridicule him with the acronym TACO—“Trump Always Chickens Out”—using it to describe our president’s regular response to strong challenges. Even so, most observers predicted that the higher tariff rates that remained together with the tremendous uncertainty and the sharp decline in consumer sentiment would probably result in serious economic problems whether or not Trump ever made good on his threat to revisit the tariff issue after ninety days.

But contrary to those plausible concerns, the employment numbers released by the Bureau of Labor Statistics (BLS) over the next several months remained surprisingly strong, puzzling those who had warned that economic uncertainty would sharply reduce the willingness of businesses to expand and create jobs.