With bond yields sliding thanks to the ongoing stock drawdown, there wasn’t many concerns about demand for today’s 20Y auction. And rightly so, because the sale of $16 billion in 20 year bonds went through without any difficulty amid solid, if hardly stellar, demand.

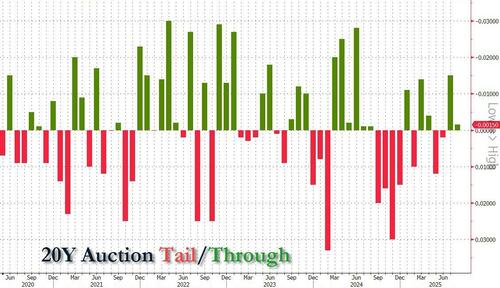

The auction prices at a high yield of 4.876%, down from 4.935% in July and stopped through the When Issued 4.877% by 0.1bps, the second consecutive stop through after 2 tails.

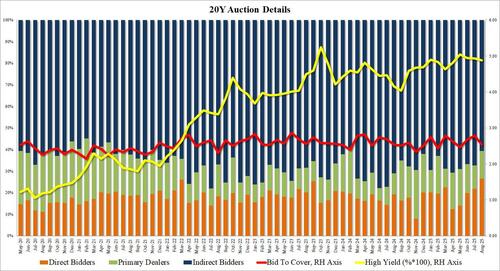

The bid to cover was 2.54, down from 2.79 and the lowest since May; it was also below the six-auction average 2.63.

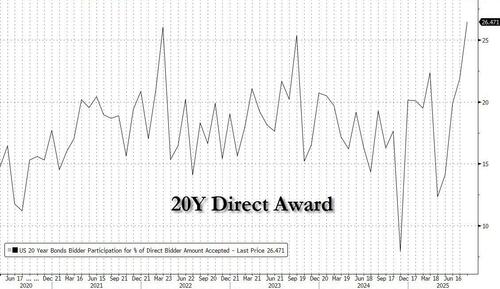

The internals were on the weak side, with foreign buyers stepping back as Indirects took down just 60.6%, down from 67.4% and the lowest since Feb 24. And with Directs stepping up to buy a record 26.5% of the auction…

… Dealers were left with 12.9%, below the recent average of 14.1%.

Overall, this was a solid, if forgettable, auction and the market response confirms as much: the 10Y did pretty much nothing after the break, with yields grinding lower all day and hitting fresh session lows shortly after the auction priced.

Loading recommendations…