Oil pries are tumbling further this morning following reports that OPEC+ leader Saudi Arabia wants the group to consider reviving more oil production ahead of its scheduled return at the end of next year to reclaim market share.

Bloomberg reports that, according to people familiar with the matter, key alliance members will hold a video conference on Sunday that will consider what to do with a 1.66 million barrels a day tranche of halted supplies, having just fast-tracked the return of a previous layer over the past five months.

“Our latest soundings from the group suggest they are very much considering unwinding that final tranche” of halted supply “sooner rather than later,” Livia Gallarati, global crude lead at Energy Aspects Ltd., said in a Bloomberg television interview.

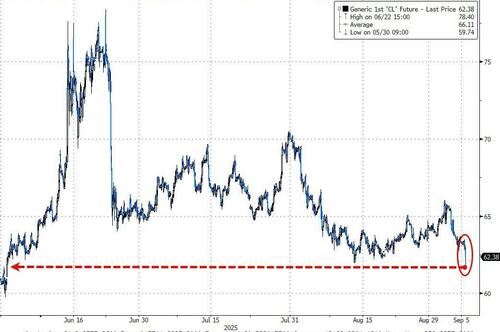

WTI tumbled back to a $61 handle – at three month lows – after the headlines…

While extra supply would be a boon for consumers and a win for Trump, it’s a financial threat for producers from the US shale industry to OPEC+ members themselves.

The move would underscore a clear pivot by OPEC+ toward defending market share and not prices.

Delegates from the Organization of the Petroleum Exporting Countries have said the Saudis are eager to claw back sales volumes ceded to rivals like US shale drillers. Crown Prince Mohammed bin Salman will visit Washington in November to meet President Donald Trump, who has called for lower fuel prices.

Loading recommendations…