Last month, Santa Clara University School of Law made a welcome announcement that today’s students find all too rare: the school is cutting tuition.

Starting next fall, Santa Clara Law will provide a guaranteed $16,000 tuition scholarship to all incoming full-time J.D. students. The scholarship is renewable for up to three years—the duration of the law program. Because it is guaranteed to all students, the scholarship amounts to an effective $16,000 cut in the net tuition students pay annually.

The school’s rationale for its new scholarship is notable: Santa Clara says that the initiative is “designed to offset the impact of the recent repeal of the Graduate Plus federal-loan program, which is effective July 1, 2026.” It is “designed to ensure that next year’s incoming class has access to the funds they need… despite new federal loan limits.”

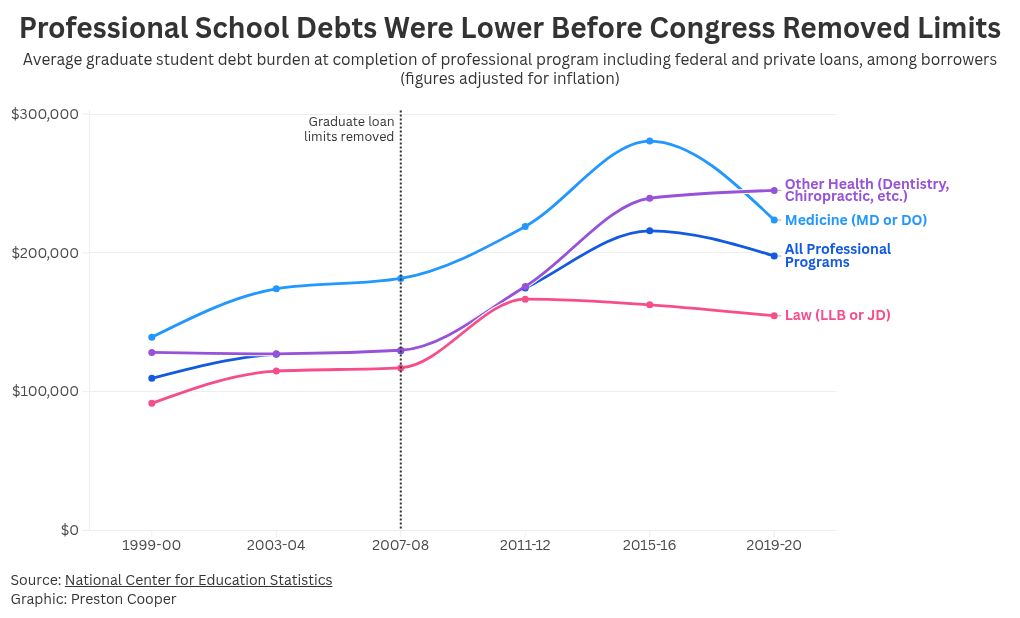

Prior to the One Big Beautiful Bill Act (OBBB), which Congress passed this summer, graduate students could borrow effectively unlimited amounts from the federal government, a policy which encouraged tuition hikes and overborrowing. Starting with new students next fall, OBBB will cap federal borrowing for law school at $50,000 per year and $200,000 in aggregate.

Universities have fretted about the new loan limits in OBBB, claiming they will reduce access to graduate school and force students to turn to the private student loan market. But Santa Clara Law’s action demonstrates that at least one school—and likely many more—has the capacity to reduce tuition in line with the new loan limits.

Indeed, law schools were able to make federal student loan limits work in the not-so-distant past. In 2020, the average new law school graduate accumulated $155,000 in student debt. But in 2004, just before Congress enacted the Grad PLUS loan program that eliminated caps on borrowing, average law school debt stood at just $115,000 (adjusted for inflation and including both federal and private loans).

Law schools have a proven ability to function without unlimited federal loans. While uncapped borrowing allowed tuition and underlying costs to get out of control at many graduate schools, the new loan limits in OBBB can move the needle back towards more reasonable tuition costs and debt burdens. It won’t be surprising if we soon see more graduate schools announce tuition reductions similar to Santa Clara Law’s.

The post The “Big, Beautiful Bill” Is Already Bringing Down Tuition appeared first on American Enterprise Institute – AEI.