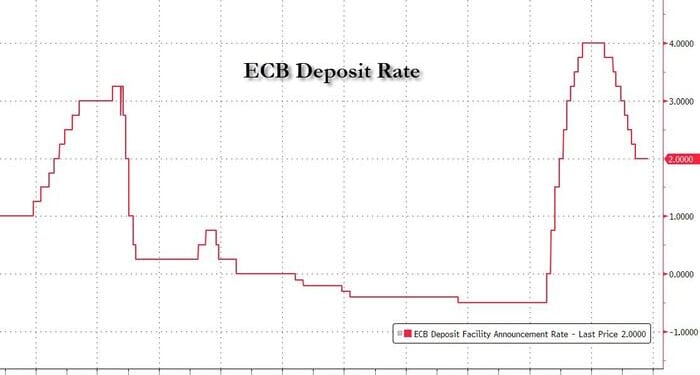

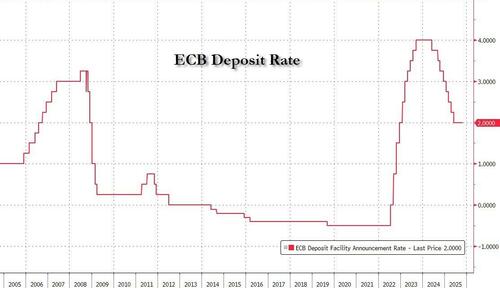

As widely expected (and previewed), the ECB held rates unchanged (they key deposit rate remained at 2%, the refinancing rate was unch at 2.15%, and the marginal lending facility stayed at 2.4%) and also kept its guidance, unchanged as well. In what was a carbon copy of its previous statement, the ECB said it was not pre-committing to a particular policy path; said inflation remained close to its target; and said future decision would be based on risks to inflation outlook.

Here are the highlights from the statement on the Economy…

- Economy has continued to grow despite challenging global environment.

- Robust labor market, solid private sector balance sheets and ECBs past interest rate cuts remain important source of resilience.

- Outlook still uncertain due to global trade and geopolitics.

And on Policy

- ECB not pre-committing to a particular rate path.

- Will follow data dependent and meeting-by-meeting approach to determine appropriate monetary policy stance

The statement was rather optimistic on growth, although it highlights persistent uncertainty:

The economy has continued to grow despite the challenging global environment. The robust labor market, solid private sector balance sheets and the Governing Council’s past interest rate cuts remain important sources of resilience. However, the outlook is still uncertain, owing particularly to ongoing global trade disputes and geopolitical tensions.”

Ahead of the ECB announcement, the latest data showed that Q3 GDP for the euroarea had come in at 0.2%, just fractionally above expectations.

While the meeting was down the center, some like Oliver Rakau at Oxford Economics sense the doves starting to make a push ahead of the December meeting.

Don’t know about you, but I am not very comforted, when a CB needs to point to solid private sector balance sheets, when justifying its inaction despite projections showing 2yrs of sub-2% inflation. But also, 1st para sounds a bit like doves started to make a push heading to Dec pic.twitter.com/FmohCoLmp2

— Oliver Rakau (@OliverRakau) October 30, 2025

And here’s the reaction from Mark Wall, chief European economist at Deutsche Bank:

“Where’s the smoking gun for a rate cut? Despite the US tariffs, despite all the various sources of uncertainty, the European economy continues to eke out some growth. Economic ‘resilience’ is keeping the ECB doves in check, and the policy pause on the rails.”

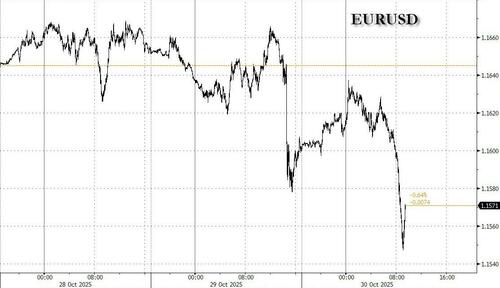

In kneejerk reaction, the EURUSD – which had been sliding all day – staged a modest rebound from session lows.

Loading recommendations…