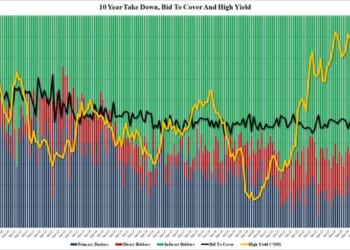

Building on the “Chilling Opportunity” theme around data-center cooling and the rapid rise of liquid-cooling systems in AI server racks, Goldman analysts have raised their 2025-26 global server-cooling market estimates and introduced a new 2027 forecast, reflecting surging demand tied to the accelerating AI data center buildout.

Goldman analysts, led by Allen Chang, penned a note to clients on Thursday, highlighting that liquid-cooling adoption is rapidly accelerating across data centers amid growing demand for higher compute and the accompanying rise in power consumption.

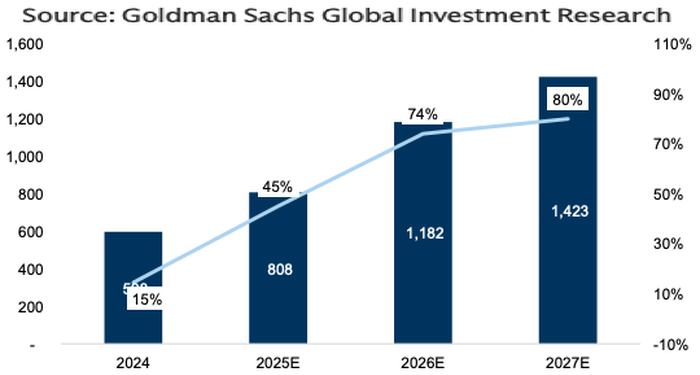

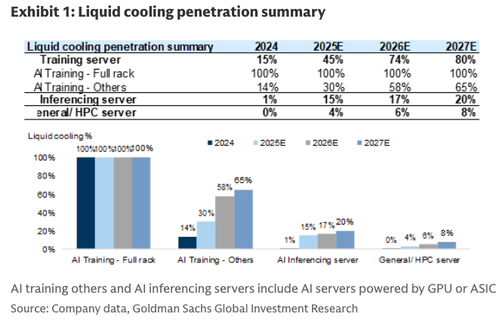

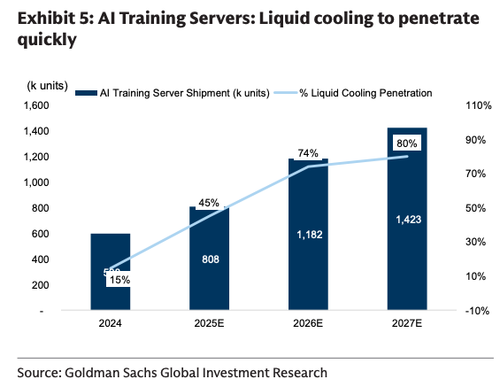

Chang modeled liquid cooling penetration to reach 15% / 45% / 74% / 80% (2024–27E) for AI training servers, 1% / 15% / 17% / 20% for AI inferencing servers, and 0% / 4% / 6% / 8% for general and high-performance computing servers.

Since Chang’s July 2025 report, he raised his Global Server Cooling TAM forecasts by +9% for 2025 and +16% for 2026, to $7.9 billion and $14.0 billion, representing +111% and +77% year-over-year growth, respectively, noting that the upward revision is mostly because of stronger demand for high-power AI servers. It’s very simple: more power equals more compute, which means more liquid cooling.

AI Training Servers: Liquid cooling to penetrate quickly

Chang’s note builds on the chilling opportunity theme:

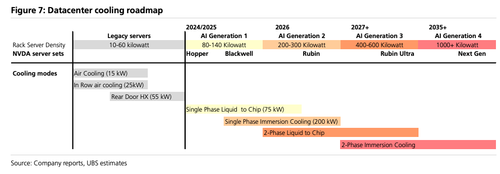

UBS analyst Joshua Spector showed clients in June a roadmap through 2035 illustrating how AI server rack power consumption could surge to as much as 1,000 kilowatts per unit, compared with legacy servers currently running between 10 and 60 kilowatts, and first-generation AI servers consuming around 80 to 140 kilowatts.

More compute equals more power … and by now, you know what that means: higher demand for liquid cooling.

ZeroHedge Pro Subs can view the full note in the usual place.

Loading recommendations…