The administration’s focus heading into the swing was on building relations and investments with core regional allies, while defusing tensions with China. “There’s going to be very few people in the foreign policy world who would find any of that objectionable,” Czin said. “These are exactly the kind of things we should be doing with our allies and partners.”

The trip began last weekend with a visit to the Association of Southeast Asian Nations (ASEAN) summit in Kuala Lumpur, where Trump presided over the signing of a ceasefire between Thailand and Cambodia. The two nations have a long-standing border dispute, rooted in colonial-era boundary disagreements over contested temple sites in the Dangrek Mountains. After a May skirmish that killed a Cambodian soldier, tensions escalated in July with five days of intense fighting that left at least 38 dead and displaced more than 300,000 people. Under the agreement, both countries committed to withdrawing heavy weapons from their borders and to pursuing a diplomatic resolution to their recent dispute. Trump, clearly in a good mood, said that peacemaking was “much more fun for me than almost anything because you’re saving people, saving countries.”

The good feelings continued when Trump arrived in Tokyo to meet Japan’s new prime minister, Sanae Takaichi, whom you can read more about in the October 10 edition of TMD. Trump seems to hope that his relationship with Takaichi can be as warm as his friendship had been with her mentor Shinzo Abe, whom Trump called “a unifier like no other.” At Akasaka Palace in Tokyo, Trump told Takaichi, “I know from Shinzo and others, you will be one of the great prime ministers.” On arrival, Takaichi presented Trump with Abe’s own putter encased in glass, a golf bag signed by Japanese pro Hideki Matsuyama, and a golf ball covered in gold leaf.

Beyond the lavish gifts, Takaichi gave Trump no reason to doubt that Japan’s friendship would continue. Following up on an agreement signed by the U.S. and Japan in September, Takaichi added further specifics to a Japanese pledge to invest $550 billion in the U.S. over the remainder of Trump’s term in return for lowered tariffs on Japan’s auto industry. Japan’s Foreign Ministry released a fact sheet on Tuesday outlining interest from companies such as Westinghouse, Toshiba, and Mitsubishi in projects related to energy, minerals, and artificial intelligence. Takaichi also pledged to accelerate Japan’s military buildup by increasing defense spending to 2 percent of the country’s gross national product by March, two years ahead of the country’s original plan. On the sidelines of the Tokyo meeting, officials from both countries also signed a memorandum of understanding to cooperate on improving their respective shipbuilding industries.

A few days later, South Korea and the U.S. formalized a similar investment deal, in return for the U.S. lowering automobile tariff rates to match those on Japan. Most notably, further details were worked out about South Korea’s “investment fund” in the U.S. According to the South Korean government, the fund will be worth $350 billion total, with $200 billion paid in installments limited to $20 billion per year—a limit facially to prevent instability in the foreign currency exchange markets. The remaining $150 billion, according to officials, will consist of investment, financing, and guarantees by South Korean companies in the shipbuilding sector. Commerce Secretary Howard Lutnick will head a committee tasked with approving proposed projects, which will be limited to areas deemed commercially viable, and the Korean government has stated that it will primarily invest in Korean companies operating in the U.S. The U.S. also announced that it would share nuclear submarine technology with South Korea.

Though these initial stops all resulted in splashy announcements, the most anticipated meeting of Trump’s Asia swing was with the final foreign leader: Chinese President Xi Jinping. Held on the sidelines of the Asia-Pacific Economic Cooperation Summit in South Korea, Trump characterized the confab (in a social media post) as a “truly great meeting.” China’s foreign ministry said in a statement that the discussion involved an “in-depth exchange of views on important economic and trade issues, and reached consensus on solving various issues.”

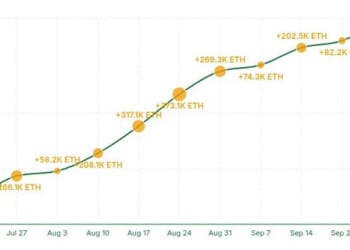

According to Trump and White House officials, the U.S. agreed to reduce tariff rates on China by 10 percentage points—lowering the average rate on most Chinese goods to 47 percent—in exchange for a promise from Xi to crack down on the production of fentanyl ingredients, and for Beijing to resume the purchase of American soybeans, which it had halted as part of the trade war between the two countries. Trump also stated that China would import U.S. natural gas, but he and his Chinese counterpart provided few specifics. Both countries also agreed to delay port fees they had imposed on each other’s ships earlier this month, a move that would have significant effects on China’s massive merchant fleet.

Chinese officials also said that they would suspend the enforcement of export controls on rare earths and other critical minerals, one of their most potent weapons in the trade war, until October 9 of next year. However, Beijing will maintain export controls on other critical minerals, including those used in semiconductor production. In return, the U.S. agreed to also pause export controls on semiconductors purchased by Chinese-owned companies for a year. Notably, though, while Trump said that China could “deal with Nvidia,” he told CBS News’ “60 Minutes” that Nvidia will not be allowed to sell its most advanced Blackwell AI chips to China.

Czin, the Brookings Institution fellow, told TMD that the announcements signaled more of a trade ceasefire than a full truce between China and the U.S. Problems around soybeans and rare-earth metals—which were primarily a result of the trade war itself—were put on hold to allow the two countries to continue negotiations.

China, in particular, might be playing for time. China can “go through this rinse and repeat cycle. I think they’ve gotten comfortable doing it,” Czin said. With Trump facing high-stakes midterm elections next fall, he noted, Chinese leaders will be even better poised to threaten the same measures they used to gain concessions in this round of negotiations: soybean purchases and export controls on critical minerals.

Trump is scheduled to meet with Xi in China next year, and negotiators from both sides will hold less high-profile meetings to finalize the details of a larger deal before that summit. But international diplomacy and economics operate on longer timetables than a single trip, even a relatively lengthy one. “Now that we have the deal,” Czin said, “the negotiations can begin in earnest.”