The US Treasury announced it expects to borrow $569BN in privately-held net marketable debt in the Oct-Dec quarter down from the $590BN it projected for Q4 in July. The lower estimate is due to higher start of quarter cash balance, partially offset by lower projected net cash flows. The projection still assumes an end-Dec cash balance of $850BN, albeit some had been looking for this to increase to $900BN. Looking ahead to Q1 ’26 (Jan-Mar), the Treasury expects to borrow $578BN, assuming an end-March cash balance of $850BN.

During the July-September 2025 quarter, the Treasury borrowed $1.058TN in privately-held net marketable debt and ended the quarter with a cash balance of $891BN. In July 2025, Treasury estimated borrowing of $1.007TN and assumed an end-of-September cash balance of $850BN. The $50BN difference in privately-held net marketable borrowing resulted primarily from the higher end-of- quarter cash balance and lower net cash flows. Excluding the higher-than-assumed end-of-quarter cash balance, actual borrowing was $10BN higher than announced in July.

Turning to the Quarterly Refunding Announcement, Newsquawk notes that for the refunding, the Treasury maintained guidance that it expects to maintain nominal coupon and FRN auction sizes for at least the next several quarters; any change to this would be of note. However, Morgan Stanley expects current coupon sizes to remain steady until February 2027, with guidance expected to be maintained. Regarding TIPS, Morgan Stanley expects the Treasury will continue with incremental increases to the TIPS auction sizes, expecting the $19BN of 10yr TIPS re-opening auction to be maintained, with a $1BN increase to both the 5yr TIPS re-opening and the 10yr TIPS new issue.

We will have a look at the upcoming buyback operations too for any changes. The prior refunding saw the Treasury state in H1 2026, it plans to offer direct buyback access to a limited number of additional counterparties, based on their participation in Treasury auctions. Morgan Stanley “interpret this statement to mean that the additional eligible participants for buyback operations will be the largest participants in auctions by risk taken down”.

One thing to bear in mind is the Fed’s end of QT. From December 1st, the Fed will start to reinvest all maturing Treasury security holdings on its balance sheet, while it will continue to let mortgage-backed securities roll off the balance sheet; however, the payments will be reinvested into Treasury bills instead of MBS. Morgan Stanley writes that after QT ends, the Fed will deem an across-the-curve reinvestment strategy as most optimal, meaning more front-end UST demand relative to the status quo.

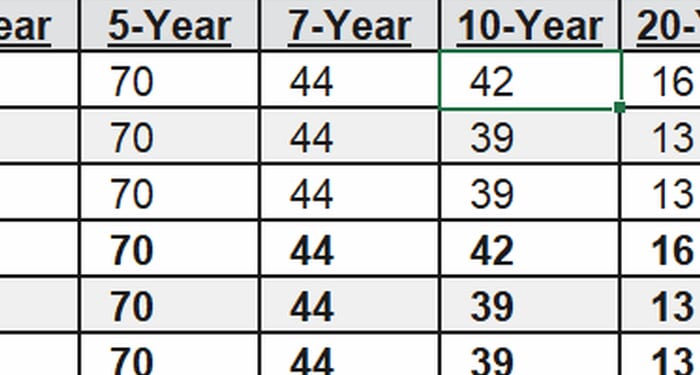

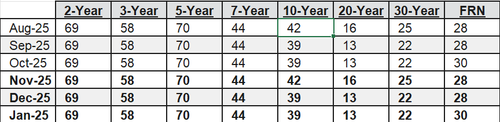

Providing the nominal coupon auction sizes are left unchanged as per guidance, this is what the auction sizes would look like.

Loading recommendations…