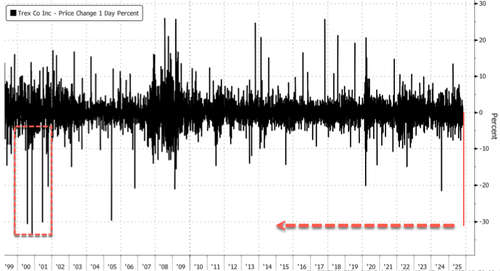

Shares of Trex Company, best known for its wood-alternative composite decking, plunged the most since the Dot Com bust in premarket trading after the company’s fourth-quarter net sales forecast came in below Bloomberg Consensus estimates. Analysts warned that soft consumer spending trends and a deteriorating home-improvement backdrop are weighing on demand.

Trex reported adjusted EPS of $.51 (vs. $.57 est.) and net sales of $285 million, up 22% year-over-year but millions below the $302 million consensus. EBITDA increased 27% to $86.4 million, missing the $96.8 million estimate.

Analysts focused on weaker outlooks. For Q4, Trex expects net sales of $140 million to $150 million, well below the $199 million consensus. For the full year, the company now sees EBITDA margins of 28% to 28.5%, down from prior guidance of above 31% and the 31% analyst estimate, signaling further margin compression.

“Given the lackluster outlook for consumer spending and ‘marketing war’ that has popped up in the industry, we lack confidence in our estimates and valuation,” William Blair analyst Ryan Merkel wrote in a note to clients. He downgraded the stock to market perform from outperform.

Merkel noted, “Our take is that Trex is protecting its share by matching marketing spending and channel incentives that competitors are offering in a soft market. This is a major business model reset for a category that was viewed as having secular growth and rational competitors.”

Truist analyst Keith Hughes warned, “The stock will take a substantial hit after a weak year already and the potential for M&A around TREX is now growing. We remain Buy on the long term secular growth story.”

The earnings showed “evidence of cracks in near-term fundamentals and a preview of competitive share dynamics to come,” Barclays analyst Matthew Bouley wrote. He said there’s a significant risk that “real share loss has not even begun” after James Hardie’s acquisition of Azek.

Trex shares plunged to early-2020 lows amid the dismal outlook.

Shares are down 32% in premarket trading, the most since the Dot-Com bust in late 2000.

Trex is often viewed as a home-improvement indicator within the discretionary spending segment tied to outdoor living and remodeling, given how expensive its composite decking boards can be, sometimes upwards of $140 for a 16-foot board, compared with about $18 for a treated lumber board of the same length.

Loading recommendations…