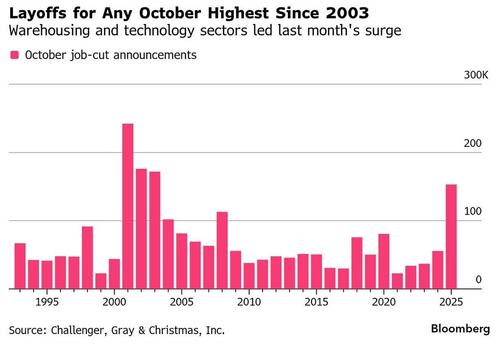

US equity futures are higher, rebounding from session lows for the second day in a row, amid headlines that layoffs are surging due to AI which in turn is raising odds of a Dec rate cut, with JPM saying that “the market is weighing a weaker labor market and potential spending vs. evidence on the efficacy (and ROI) of AI plus productivity gains.” Challenger job cuts jumped to over 150K in October, nearly triple the year-earlier period and the most in more than two decades. As of 8:00am ET, S&P futures are 0.2% higher ahead of the last major earnings day of a season that’s delivered stellar results; Nasdaq futures are also up 0.2%, with Semis catching a bid driven by MRVL (+11%, takeover chatter) and NVDA (up +1.4% after yesterday’s roll on the OpenAI govt backstop headlines). TSLA rose 0.5% ahead of a vote on granting Elon Musk a potential $1 trillion pay package. In the premarket, cyclicals look flat to Defensives, while commodity-related plays are bid. The commodity complex is higher led by Energy and Metals. Asia closed higher (Shanghai +97bps/Hang Seng +2.12%/Nikkei +1.34%) driven by strength in growth/tech/ai names, while Europe is down small (FTSE -25bps/DAX -10bps/CAC -45bps). US 10 year yield down small at 4.13% on quiet macro news as the curve bull steepens, and the USD is weaker. The macro data focus is on Challenger Job Cuts which soared to 153,074K, the highest for October since 20023, and state-level initial jobless claims. Today also brings another heavy dose of earnings (pre-open we get APD, BDX, CMI, COP, H, PENN, PH, RL, ROK, TPR…post-close we get AKAM, CE, EXPE, MCHP, SNDK, TTWO, WYNN), a handful of Fed speakers, the BOE rate decision and TSLA’s annual meeting (which includes voting on Musk’s pay package). Markets also digest the likelihood of the Supreme Court striking down Trump’s IEEPA tariffs after oral arguments yesterday (Goldman expects a ruling in Dec of Jan ’26 // GIR full take).

In premarket trading, Mag 7 stocks are mixed: Tesla (TSLA) +0.6% after the deadline for investors to vote on Elon Musk gargantuan compensation plan expired at midnight (Nvidia +1.4%, Meta +0.8%, Alphabet +0.7%, Apple -0.2%, Amazon -0.03%, Microsoft -0.1%).

- CarMax (KMX) falls 11% after the used car retailer’s board terminated the employment of CEO Bill Nash.

- Coherent (COHR) soars 18% after the semiconductor device company’s results and forecast underlined AI tailwinds.

- DoorDash (DASH) falls 11% after its forecast for fourth-quarter adjusted Ebitda fell short of the average analyst estimate at the midpoint.

- Duolingo (DUOL) is down 23% after the language-learning software company gave a weak fourth-quarter bookings forecast. Analysts note that the management’s focus on user growth weighs on the bookings outlook.

- Elf Beauty (ELF) sinks 21% after the cosmetics company’s full-year outlooks for adjusted earnings per share and net sales both missed analysts’ estimates.

- Fastly (FSLY) jumps 19% after the software company’s results and raised full-year revenue forecast showed a strong growth recovery.

- HubSpot (HUBS) falls 10% after the software company reported its third-quarter results and gave an outlook.

- LegalZoom.com (LZ) rises 27% after the legal services company gave an outlook that is seen as reinforcing positive growth trends, prompting William Blair to upgrade the stock.

- Marvell (MRVL) is up 8% as people familiar say that SoftBank Group Corp. explored a potential takeover of the US chipmaker earlier this year.

- Papa John’s (PZZA) falls 7% after the pizza company reported adjusted earnings per share for the third quarter that missed the average analyst estimate.

- Qualcomm Inc. (QCOM) falls 1.8%, becoming the latest chipmaker to deliver an upbeat forecast and still leave investors underwhelmed.

- Snap (SNAP) surges 19% after the company announced a $400 million partnership with Perplexity AI Inc. to incorporate its AI-powered search engine into Snapchat.

- Stagwell Inc. (STGW) soars 80% after announcing a partnership with Palantir.

Trading this week has been marked by a pullback in the biggest beneficiaries of the artificial-intelligence race, which have powered much of this year’s rally, before dip-buyers stepped in to offer support. Corporate America has continued to deliver robust results, with 82% of the 413 S&P 500 companies reporting this quarter beating earnings expectations, 14% have missed.

“You stay sane by trying to stay long-term,” Carmignac fund manager Obe Ejikeme told Bloomberg TV. AI “is a megatrend and will pay off over the next five to ten years, no doubt about that. But staying sane is not putting all your eggs in that basket.”

Price action divergence to results continues, even within AI-related momentum sectors. Qualcomm became the latest semiconductor firm to deliver an upbeat forecast that failed to impress investors, while ARM rose on a bullish outlook pointing to an AI chip demand surge. Meanwhile, semiconductors remain top of mind: Softbank had explored acquiring Marvell earlier in the year to combine it with ARM, in what would have represented the largest semiconductor deal in history. Open AI’s CFO suggested the market should have more ‘exuberance’ for AI’s potential, while hinting the US government could backstop AI financing.

Caution over lofty tech valuations that weighed on markets earlier in the week continued to linger. Qualcomm, the biggest maker of smartphone chips, became the latest semiconductor firm to issue an upbeat forecast that failed to impress investors, sending its shares 1.8% lower.

Treasuries rebounded after the latest Challenger job cuts jumped to over 150K in October, nearly triple the year-earlier period and the most for the month in more than two decades. YTD job cuts have exceeded 1M, the most since the pandemic. The yield on 10-year notes fell two basis points to 4.14%, while the dollar headed for its biggest drop in three weeks.

Traders will also weigh the implications of the US Supreme Court hinting it is ready to put significant limits on Trump’s far-reaching agenda, adding to uncertain sentiment. US layoffs remain a focus too, with October seeing the most job cuts in more than two decades. US shutdown impact is spreading to aviation with plans to cut flight capacity by 10% at 40 high-volume markets to alleviate pressure on air traffic controllers.

Following days of mixed signals from Fed officials and scant economic data during the longest US government shutdown in history, investors will also closely watch a slate of policymaker speeches Thursday for clues on the interest-rate outlook. The Bank of England held interest rates at 4% in a five-to-four vote that laid the groundwork for a December cut. The pound pared gains of as much as 0.4% against the dollar. Gilts rose across the curve, with the two-year yield down three basis points to 3.76%.

Traders have gradually trimmed bets on a quarter-point rate cut next month to around 50% over the past week, before the job-cuts report from outplacement firm Challenger, Gray & Christmas Inc. bumped those odds back up to 60%. Still, “the overall nudge pressure is up for yields,” wrote Padhraic Garvey and Michiel Tukker at ING. “This, of course, partly reflects the ‘driving in the fog’ metaphor for the government shutdown, but also with a dose of inflation concern and a pinch of risk-on ebullience.”

Europe’s Stoxx 600 is down 0.2% with construction underperforming and miners rising. Legrand shares sank as demand for data center infrastructure started to ebb. The construction and insurance sectors are among the biggest laggards, while mining and telecom shares outperform. Here are some of the biggest movers on Thursday:

- Novo shares rise as much as 3.9% after a judge denied Pfizer’s request to temporarily block the Danish drugmaker’s $10 billion bid to acquire the obesity startup Metsera, saying the US pharmaceutical company’s objections to the deal don’t warrant a delay.

- Rheinmetall shares rise as much as 3.1% after the German defense firm maintained its guidance for the full year in a move Bernstein said could reassure investors who had expected a softer quarter.

- Sainsbury shares rise as much as 1.7% as the British retailer increased its full-year profit guidance to exceed the £1 billion set out in previous updates.

- Deutsche Post shares gain as much as 6.7% after the logistics company reported earnings well ahead of expectations, a performance analysts say was aided by its tight cost control.

- Novonesis shares jump as much as 8.2% after the Danish maker of industrial enzymes reported better-than-expected organic sales growth for the third quarter and lifted the bottom of its forecast range for the full year.

- Adecco climbs as much as 11% after third-quarter results which analysts view as “strong across the board.”

- DiaSorin falls as much as 16% after the Italian medical-diagnostics company lowered its guidance for the year and delivered third-quarter results below expectations.

- Legrand drops as much as 13% after its third-quarter missed expectations and full-year guidance was left unchanged.

- Air France-KLM shares slide as much as 14%, the steepest drop in three years. The airline group reported a miss on Ebit in the third quarter, driven by lower-than-expected unit revenue.

- HelloFresh shares fall as much as 15% after Grizzly Research published a report on the meal-kit company.

- Wise shares drop as much as 9.9%, slumping to a seven-month low, after the payments company reported a sharp drop in underlying pretax profit in the first half.

- Teleperformance drops as much as 8.6% after lowering its guidance for the full year, citing “an increasingly volatile business environment.”

- Worldline shares lost as much as 12%, erasing an earlier advance, after the digital payment company announced a share sale and provided a weak outlook for 2026.

- Maersk shares fall as much as 7.5% after the Danish shipping giant reported its latest earnings.

Earlier, Asian stocks climbed the most in over a week, as dip buyers lifted technology shares after a two-day selloff. The MSCI Asia Pacific Index rose 1.2%, its biggest advance since Oct. 27, with TSMC, Tencent and SK hynix among the key boosts to the gauge’s gain. Shares advanced in Hong Kong, Japan and South Korea. Indian stocks were steady. The rebound underscores investors’ continued confidence in the long-term potential of artificial intelligence, even as concerns over stretched valuations and market concentration linger. The risk-on sentiment was also helped by the positive mood from Wall Street as dip-buyers emerge.

In FX, the dollar is weaker following the surprise release of Challenger job data, showing the worst October for cuts since 2003. Krone is the strongest G-10 currency after Norges Bank kept rates on hold and reiterated the pace of reductions will be slow. Sterling higher, gilts slightly underperforming ahead of the Bank of England decision, also expected to be a hold.

In rates, yields are 2bp-3bp lower across the curve led by intermediates, with 5s30s spread steeper by around 1bp supported by soft job cuts data and gains for gilts after Bank of England’s 5-4 decision to hold rates at 4%, with dissenters preferring a cut. US 10-year yields near 4.12% is about 4bp lower on the day; UK counterpart had a steep 3bp drop after Bank of England rate announcement.

In commodities, gold prices rising and back above $4,000/oz. Oil prices jumping too, with Brent futures up 0.7% and about $64/barrel.

Looking to the day ahead, the main highlight will be the Bank of England’s latest policy decision. There’s also plenty of speakers, including ECB Vice President de Guindos, the ECB’s Kocher, Schnabel, Villeroy, Nagel and Lane, along with the Fed’s Williams, Barr, Hammack, Waller and Musalem. On the data side, we’ll get German industrial production and Euro Area retail sales for September. The US economic calendar — including 3Q preliminary productivity and unit labor costs, weekly jobless claims and September wholesale trade — will be empty again as US government data continue to be postponed by the govt shutdown. ConocoPhillips, DataDog, Ralph Lauren and Warner Bros Discovery are among companies expected to report results before the market opens. Conoco is expected to post its worst third-quarter profit in four years amid lower crude prices brought on by higher output globally.

Market Snapshot

- S&P 500 mini +0.2%,

- Nasdaq 100 mini 0.2%,

- Russell 2000 mini +0.1%

- Stoxx Europe 600 little changed,

- DAX little changed,

- CAC 40 -0.4%

- 10-year Treasury yield -2 basis points at 4.14%

- VIX little changed at 17.97

- Bloomberg Dollar Index -0.1% at 1223.31,

- euro +0.2% at $1.1515

- WTI crude +0.7% at $60.01/barrel

Top Overnight News

- US companies announced the most job cuts for any October in more than two decades as artificial intelligence reshapes industries and cost-cutting accelerates. Companies last month announced 153,074 job cuts, nearly triple the number during the same month last year. BBG

- 8 centrist Democrats in the Senate could be prepared to vote in favor of reopening the government, but they are receiving pushback from more progressive corners of the party. The Hill

- Senate Democrats ended their workday Tuesday agonizing over what to do about the record-setting government shutdown. Many of those same lawmakers woke up Wednesday morning ready to fight on following Tuesday’s party success. The sweeping democratic gains in this week’s election has bolstered party senators insisting democrats dig in and force Republicans to accede to their demand for an extension of key health insurance subsidies. Politico

- Trump and Hill Republicans are now in completely different places on the political impacts of this seemingly endless shutdown: Punchbowl

- Trump said regarding the US shutdown, that it was a big factor in elections, while he does not think Democrats will act soon on the shutdown, and does not think it will be sorted soon. Trump reiterated the call to kill the filibuster and reopen the government immediately.

- The US Supreme Court appeared skeptical of Donald Trump’s sweeping tariff powers, with some justices suggesting he’d overstepped his authority. Yet even if the duties are struck down, the president has other legal options, leaving companies and countries in limbo. BBG

- President Trump has recently expressed reservations to top aides about launching military action to oust Venezuelan President Nicolás Maduro, fearing that strikes might not compel the autocrat to step down. WSJ

- U.S. Transportation Secretary Sean Duffy said on Wednesday that he would order a 10% cut in flights at 40 major U.S. airports, citing air traffic control safety concerns as a government shutdown hit a record 36th day. RTRS

- China has issued dollar bonds at rates equivalent to US Treasury yields, in what bankers on the deal said was the first time Beijing’s borrowing costs has matched Washington’s. the bond offering is the latest example of countries taking advantage of being able to issue international debt cheaply, as their borrowing costs in relation to US Treasuries fall to some of the lowest levels on record. FT

- Japan’s underlying wage growth remained steady in September, keeping the BOJ on track for policy tightening. One of Japan’s largest labor union groups said it plans to push for a 6% pay bump next year. BBG

- The Bank of England held interest rates at 4% in a five-to-four vote that laid the groundwork for a December cut. The pound pared gains of as much as 0.4% against the dollar. Gilts rose across the curve, with the two-year yield down three basis points to 3.76%: BBG

- The Fed finalized new standards for grading large banks and said that the new large bank supervisory standards are substantially similar to changes proposed in July.

Trade/Tariffs

- China bought two cargoes of around 120,000 tons of US wheat for December shipment, according to traders cited by Reuters. It was also reported that the US Grains and Bioproducts Council Chairman said a US sorghum shipment was sent to China last week.

- Japanese PM Takaichi said Japan will consider specific ways for Japan and the US to advance cooperation in the development of rare earth mining in waters around Minamitori Island.

- Chinese Commerce Ministry, on semiconductor flows, says China is committed to stability and security of global chip industry; will approve relevant export license applications of qualified Chinese exporters.

A more detailed look at global markets courtesy of Newquawk

APAC stocks were higher as the region took impetus from the rebound on Wall St, where all major indices gained amid dip buying and following stronger-than-expected ADP and ISM Services data releases. ASX 200 eked mild gains amid strength in miners, but with the upside limited as the top-weighted financials sector lagged after Big Four bank NAB reported a decline in full-year profit. Nikkei 225 rebounded from the prior day’s selling and briefly reclaimed the 51,000 level before paring some of its gains. Hang Seng and Shanghai Comp benefitted from the improving US-China trade ties after China’s Commerce Ministry suspended the unreliable entity list announced in April and adjusted its export control lists, while there were comments from US President Trump who reiterated that Chinese President Xi is a good friend.

Top Asian News

- Japanese PM Takaichi looks to finalise an economic stimulus package to address inflation by late November and pass a supplementary budget to fund it, with some in the government eyeing a cost of over JPY 10tln, according to Nikkei.

- Japan Innovation Party co-leader Fujita said an early BoJ rate hike may give a mixed signal to businesses, while he added it is not a time for BoJ moves that have a big impact and they will not raise taxes to fund an earlier defence budget jump.

- One of Japan’s largest labour unions, UA Zensen, is reportedly planning to push for a 6% wage hike for regular workers in next year’s talks, according to Bloomberg.

European bourses (STOXX 600 -0.2%) opened modestly lower and have traded with a negative bias throughout the European morning. Nothing really behind the sentiment today, but with traders mindful of looming US data and the BoE policy decision. European sectors are mixed; Banks take the top spot, joined closely by Retail and then Real Estate. To the downside, Construction & Materials lags, followed by Insurance. In terms of key movers; AstraZeneca (U/C, strong headline metrics), Maersk (-5.2%, strong Q3 metrics but faces “challenging” 2026), Commerzbank (-2.5%, boosts outlook but Net Income not so strong).

Top European News

- ECB’s Schnabel says quantitative normalisation is proceeding smoothly, with strong liquidity positions of banks and abundant excess liquidity; on new structural portfolio, says factors suggest tilting the structure towards shorter-dated assets. “policy stance neutrality, the need to maintain policy space and considerations related to financial soundness are important factors that will guide the maturity of assets the ECB will buy under a new structural securities portfolio. These factors suggest tilting the structure towards shorter-dated assets.”

- ECB’s de Guindos states slight optimism on growth; adds that inflation news is positive. More optimistic on services inflation. Evolution of wages are fully aligned with projections. The level of uncertainty is huge. Comfortable with the current level of rates. Undershooting of inflation will be temporary. No discussion on modifying QT.

- Norges Bank keeps rates unchanged at 4.00%, as expected; Governor Bache says, “The job of overcoming inflation is not complete, and we are in no hurry to lower interest rates”.

FX

- DXY is softer following rangebound trade, with a surprise early release of the US Challenger job cuts data prompted a cleaner breach back under 100.00, with the current intraday range between 99.89 – 100.11, and compared to yesterday’s 100.06-100.36 range. Challenger October US Job Cuts jump 175.3% to a 7-month high at 153.074k (prev. 54.064k in September), according to Bloomberg. The release led to some upside in T-note futures and downside in the USD. On the tariff front, the US Supreme Court yesterday sharply questioned President Trump’s broad use of emergency powers to impose global tariffs, although this risk event is likely to be a slow burner, touted to end in Q1/Q2 2026, while ING’s baseline is that tariffs will stay regardless of the ruling.

- EUR is slightly firmer against the USD, largely amid USD weakness, whilst little action was seen following a variety of comments from ECB’s Schnabel and de Guindos, and largely pessimistic Construction PMI. EUR/USD resides in a 1.1490-1.1524 intraday range, with traders also cognizant of the converging 50 DMA (1.1670) and 100 DMA (1.1664).

- USD/JPY faded some of the prior day’s advances and gave back the 154.00 status following an acceleration in wages, with USD weakness further weighing on the pair in early European hours. Aside from that, there is little else to mention for the JPY, with the pair comfortably tucked within yesterday’s 152.96-154.35 range. Furthermore, one of Japan’s largest labour unions, UA Zensen, is reportedly planning to push for a 6% wage hike for regular workers in next year’s talks, according to Bloomberg.

- Sterling in focus as the clock ticks down to the Bank of England rate decision, minutes, and MPR are due at 12:00GMT/07:00EST, with the press conference at 12:30GMT/07:30EST. The MPC is expected to keep the Bank Rate at 4.0%, likely via a 6-3 vote, with focus on any signals regarding future easing. Despite softer-than-expected September inflation, elevated Y/Y CPI is expected to keep policymakers on hold, though three members may favour a cut. GBP/USD resides in a current 1.3042-1.3089 range after topping yesterday’s peak at 1.3054.

- Diverging as the AUD/NZD cross rises above 1.1500 from a 1.1486 intraday low, with the AUD propped up by the base metals and the NZD hampered by cautious RBNZ commentary. Overnight, RBNZ Governor Hawkesby said he doesn’t think they are out of the worst on global trade tensions, while he added the labour market has deteriorated, which is something they anticipated. AUD/USD resides in a 0.6497-0.6518 range and is still some way off its 100 DMA (0.6539). NZD/USD is contained in a 0.5651-0.5669 range at the time of writing.

- EUR/NOK stopped just shy of its 100 DMA (11.7519) following the policy decision by Norges Bank, which opted to keep rates steady at 4.00% as expected. The Bank largely reiterated the statement from the prior meeting, suggesting that “no information has been received that indicates that the outlook for the Norwegian economy has changed significantly since the September policy meeting”.

- PBoC set USD/CNY mid-point at 7.0865 vs exp. 7.1222 (Prev. 7.0901)

- Brazilian Central Bank maintained the Selic rate at 15.00%, as expected, with the decision unanimous. BCB evaluated that maintaining the interest rate at the current level for a very prolonged period is enough to ensure convergence of inflation to the target. Furthermore, it said that future monetary policy steps can be adjusted, and it will not hesitate to resume the rate hiking cycle if appropriate.

Fixed Income

- USTs are contained overnight as newsflow at the time was relatively limited and participants awaited a packed docket of Fed speak, texts are expected from Williams (voter) and Paulson (2026). Spent the morning near enough unchanged and just above the 112-10 session low. Thereafter, a bout of support was seen for havens generally around the European cash equity open; potential drivers include the Israeli comments on Egypt. Thereafter, the docket ahead was lightened by an early release of October’s Challenger job cuts. Printed at 153k (prev. 54k), to a seven-month high. This added to the modest strength seen in USTs and took them to a 112-18 high with gains of eight ticks at best. A print that has added a little bit of dovishness back into Fed pricing, though the odds of a 25bps cut in December remain at around 65% after losing the 70% handle yesterday following ADP and ISM Services. Markets see more job market indicators today via the Chicago Fed BLS unemployment forecast and the latest Revelio statistics.

- Bunds initial action was similar to that outlined above in USTs. Bunds spent the first part of the day holding near enough unchanged and just above the 129.03 opening mark. Thereafter, a pickup occurred around the European cash equity open before a 129.18 peak printed alongside Challenger; again, detailed in USTs above. Prior to this, an interesting speech from ECB’s Schnabel, where she said there are factors that are suggestive of tilting the structure of the ECB’s portfolio towards shorter-dated assets, but no move in Bunds at the time. Construction PMIs passed without impact this morning. Ahead, traders look to the referenced US events before remarks from ECB’s Nagel and Chief Economist Lane; particularly regarding the ECB’s portfolio, in light of Schnabel. No move to supply from Spain and France this morning. Overall, the auctions were well received with the long-dated French metric in particular garnering strength, a welcome sign amid the ongoing political turmoil.

- Gilts opened firmer by around 15 ticks and then quickly extended a handful more to a 93.33 high, a move that acknowledged the modest bullish action seen at the time, as outlined above. Price action for Gilts was a little more pronounced than that seen in peers, nothing too significant behind this but potentially a function of the relative underperformance seen in Gilts vs Bunds for much of Wednesday and/or positioning into the BoE. The BoE is expected to maintain the policy rate at 4.00%, though the decision will almost certainly be subject to dissent; expectations are broadly for either 7-2 or 6-3, however a split where Governor Bailey has to cast the deciding vote cannot be ruled out.

- Spain sells EUR 4.503bln vs exp. EUR 4-5bln 3.00% 2033, 1.85% 2035, 3.50% 2041 Bono & EUR 0.534bln vs exp. EUR 0.25-0.75bln 1.15% 2036 IL Bono.

Crude

- Crude benchmarks have pared back on Wednesday’s losses following comments from Israeli Defense Minister Katz and sellers failing to extend through the lows of the 7-day range. After testing prior support lows, crude benchmarks sold off, reversing APAC gains, and troughed at USD 59.46/bbl and 63.37/bbl. However, this selloff was short-lived and benchmarks bid higher to a peak of 60.51/bbl and 64.34/bbl respectively. Saudi Arabia cut its December Light Crude OSP to Asia, in line with expectations. This confirms that the kingdom is comfortable with Brent prices holding between USD 60-65/bbl. Slight downticks were seen in crude benchmarks but move wasn’t sustained.

- Spot XAU has followed on from Wednesday’s gains as the yellow metal continues to consolidate following its 11% selloff from ATHs. XAU dipped to a trough of USD 3964/oz early in the APAC session but reversed higher and extended through Wednesday’s high at USD 3990/oz as the European session risk sentiment started off weak. Currently, the yellow metal is trading near session highs at USD 4017/oz. A surprising Challenger Layoff release had little impact on spot gold action.

- Base metals are trading mixed, with iron ore continuing to sell off as China steel industry heads into the low season while copper gains following risk-on tone during the APAC session. 3M LME Copper dipped to a low of USD 10.69k/t before driving higher as it followed the CME Copper bid back above USD 5/lb. 3M LME Copper peaked at USD 10.79k/t and remains in a c. USD 40/t band near session highs.

- Saudi Arabia set the December Light Crude OSP to Asia to + USD 1.00/bbl vs Oman/Dubai average (prev. + USD 2.20), to Europe at + USD 1.35/bbl vs ICE Brent (prev. +1.35), and to US at + USD 3.20/bbl vs ASCI (prev. + USD 3.70).

Geopolitics

- “Israeli Defense Minister Yisrael Katz: Declaring war on smuggling operations through drones on our border with Egypt”, according to Al Jazeera; “ordered the border area with Egypt to be turned into a closed military zone”, via Iran International

- US President Trump warned the Nigerian government that they had better move fast to stop the killing of Christians.

- US President Trump recently expressed reservations to top aides about launching military action to oust Venezuelan President Maduro, fearing that strikes might not compel Maduro to step down, according to sources cited by WSJ.

US Event Calendar

- 8:30 am: 3Q P Nonfarm Productivity, est. 3.35%, prior 3.3%

- 8:30 am: 3Q P Unit Labor Costs, est. 0.85%, prior 1%

- 8:30 am: Nov 1 Initial Jobless Claims, est. 225k

- 8:30 am: Oct 25 Continuing Claims, est. 1948k

- 10:00 am: Sep F Wholesale Inventories MoM

Central Bank Speakers

- 11:00 am: Fed’s Williams speaks at Goethe University Frankfurt

- 11:00 am: Fed’s Barr Participates in Moderated Discussion

- 12:00 pm: Fed’s Hammack Speaks at the Economic Club of New York

- 3:30 pm: Fed’s Waller in Panel on Central Banking and Payments

- 4:30 pm: Fed’s Paulson speaks on Consumer Finance Institute

- 5:30 pm: Fed’s Musalem Speaks at a Fireside Chat on Monetary Policy

DB’s Jim Reid concludes the overnight wrap

The risk-on tone has returned to markets over the last 24 hours, with the S&P 500 (+0.37%) recovering from the previous day’s selloff. The main driver was stronger-than-expected data, alongside growing speculation that the government shutdown might come to an end soon. So that helped to boost investor optimism about the near-term outlook, with risk assets doing well across the board. Indeed, US HY spreads (-9bps) tightened for the first time in a week, and Bitcoin (+3.38%) stabilised after its losses in recent days. Moreover, that trend has continued overnight, with several indices in Asia seeing strong gains, including the Nikkei (+1.48%) and the Hang Seng (+1.61%).

That US data was pivotal for the market recovery, as it pushed back against the building narrative about an economic slowdown, particularly after the weaker ISM manufacturing print on Monday. First, we had the ADP’s report of private payrolls, which showed private payrolls were up by +42k in October (vs. +30k expected), which was a clear rebound from the -29k contraction in September. That’s a release that’s taken on more significance than usual, given we’re missing the usual jobs report because of the shutdown. Then shortly after, we had the ISM Services index for October, which rose by more than expected to 52.4 (vs. 50.8 expected). So again, that reassured investors that the US outlook was more resilient than feared, and we even saw the new orders subcomponent rise to a 12-month high of 56.2 (vs. 51.0 expected).

Those prints meant investors dialled back their expectations for Fed rate cuts in the months ahead. Moreover, there was fresh momentum in that direction from the prices paid component of the ISM services, which ticked up to 70.0. That now takes it to levels last seen in late-2022, back when the Fed were rapidly hiking rates to clamp down on inflation. So that added to concerns about tariff-driven inflation, and investors felt it made future cuts less likely. For instance, the likelihood of a rate cut in December fell from 70% to 62% by the close, and if we look further out, the number of cuts priced by December 2026 fell -6.0bps on the day to 77bps. So that meant Treasury yields moved higher across the curve, with the 2yr yield (+5.5bps) rising to 3.63%, whilst the 10yr yield (+7.4bps) moved up to 4.16%.

In the meantime, there were also fresh headlines on the government shutdown, as speculation continued as to whether some sort of deal might be reached. Notably, the Washington Post reported yesterday that around a dozen Senate Democrats were considering voting to end the shutdown, saying that a bipartisan group was working on a deal.

According to the article, it said that Republicans would agree in return to hold a vote on extending Affordable Care Act subsidies. But later in the day, there was a Politico article saying that the Democratic wins in the elections had boosted those arguing they should dig in. So the Polymarket chances have moved around considerably, although they still point to a 50% chance that the shutdown ends by November 15.

On the tariffs, the Supreme Court heard arguments yesterday in the case against Trump’s use of tariffs under the International Emergency Economic Powers Act (IEEPA), which were previously ruled invalid by the lower courts. The questioning left a sense of key justices suggesting that the President may have overstepped his authority with this use of emergency powers. For instance, the Polymarket odds that the Supreme Court would rule in favour of the IEEPA tariffs declined from 38% to 25%. However, even if the current broad tariffs are ruled invalid, the details of the ruling and which alternative avenues the administration end up pursuing will be important for the eventual tariff outcome.

This backdrop proved to be a positive one for equities, with the S&P 500 (+0.37%) recovering from its selloff the previous day, though it did give up about half of the day’s gains in the final hour of trading. And while the Magnificent 7 (+0.88%) outperformed, it was a good day all round, as the small-cap Russell 2000 rose +1.54%, and more than 60% of the S&P 500 were higher on the day. Meanwhile in Europe, there was a similarly positive trend, which was reinforced by the final PMIs from across the continent. Indeed, the Euro Area composite PMI was revised up to 52.5 (vs. flash 52.2), leaving the reading at a two-year high. So that helped the STOXX 600 (+0.23%) to advance, alongside gains for the FTSE 100 (+0.64%) and the DAX (+0.42%). But the risk-on move didn’t extend to commodities, as Brent crude (-1.43%) fell to a two-week low of $63.52/bbl as the focus again shifted to emergent excess oil supply , whilst gold (+1.21%) recovered most of Tuesday’s losses.

Overnight in Asia, the equity rally has continued, with the major indices advancing across the region. That’s been clear across the board, with gains for the Nikkei (+1.48%), the Hang Seng (+1.61%), the CSI 300 (+1.23%), the Shanghai Comp (+0.86%), and the KOSPI (+1.44%). However, US and European equity futures are broadly steady this morning, with those on the S&P 500 (-0.02%) and the DAX (+0.02%) currently little changed.

Looking forward, a key focus today will be on the Bank of England’s latest policy decision, which is being announced at 12:00 London time. The consensus and market pricing is expecting rates to stay on hold at 4%, but at time of writing markets are pricing in a 26% probability of a 25bp cut, so there’s a bit of uncertainty in market pricing. In his preview, our UK economist also expects a hold, but his call is now finely balanced, and he thinks the case for a 25bp rate cut has strengthened materially after a dovish round of data. Ahead of that, sovereign bond yields moved higher across Europe, in line with the moves for US Treasuries. Gilts saw the biggest increase, with 10yr yields up +3.8bps on the day, but there were also increases for yields on 10yr bunds (+1.9bps), OATs (+1.9bps) and BTPs (+2.2bps).

To the day ahead now, and one of the main highlights will be the Bank of England’s latest policy decision. There’s also plenty of speakers, including ECB Vice President de Guindos, the ECB’s Kocher, Schnabel, Villeroy, Nagel and Lane, along with the Fed’s Williams, Barr, Hammack, Waller and Musalem. On the data side, we’ll get German industrial production and Euro Area retail sales for September.

Loading recommendations…