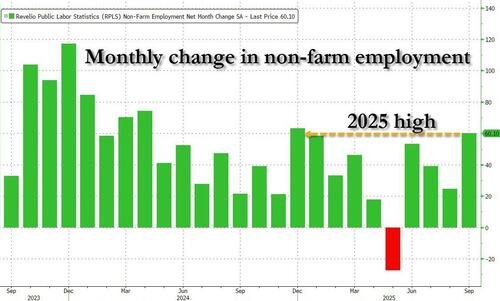

One month ago, when the market was freaking out by the lack of official government data (it has since realized again, that whether the government is open or closed, or what the jobs number is – certainly not until it is revised 3 or 4 times, does not matter), everyone scrambled to find private sources of economic data. That’s when the jobs data compiled by Revelio Labs quickly emerging as one of the favorites. It also showed that contrary to fears prompted by ADP that the US was now in a labor recession, in September the US actually added 60K jobs, the biggest monthly increase of 2025.

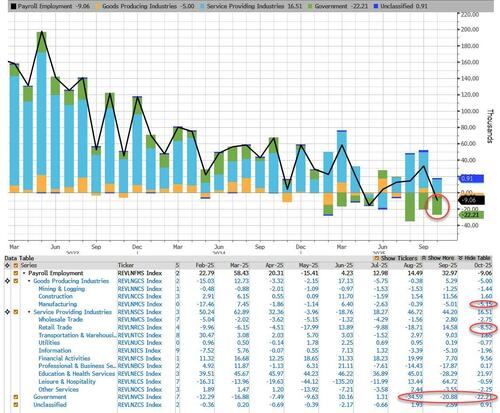

Fast forward one month when the news was far uglier: according to the latest Revelio Labs data, not only was Sept revised almost 50% lower from 60K to 33%, but October was ugly, plunging to -9,100, the second worst print of 2025, and the second worst on record (Revelio only goes back to 2021).

Looking below the surface revealed that the actual number is not quite as bad as the entire drop and then some was the result of 22,210 government job losses, but there also losses in manufacturing and trade.

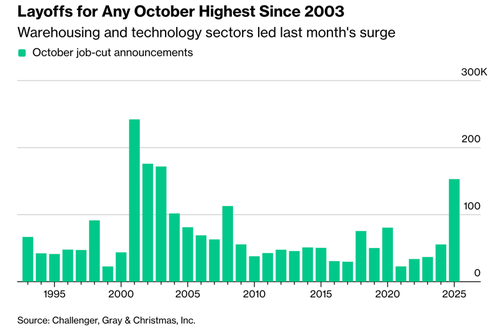

Coupled with the surge in government layoffs noted earlier as tracked by Challenger…

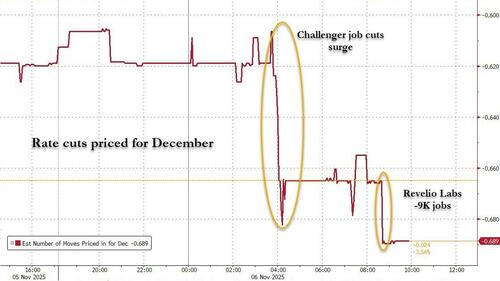

… and suddenly rate cut odds are spiking, with 0.69 rate cuts priced in for December, up from 0.62 yesterday.

The data has resulted in a broad-based risk off move, with stocks sliding to session lows, and 10Y yields tumbling 5bps to session lows below 4.10%

Loading recommendations…