Enough Democrats caved in overnight to pass a key GOP funding bill as the federal government shutdown reached its record 40th day. There’s still significant work ahead to fully reopen the government, but this marks very solid progress. On the international front, progress is also evident, with a new report indicating that the U.S. and China have suspended port fees and reciprocal probes amid easing trade tensions.

Bloomberg reports that the Trump administration paused its probe into China’s shipbuilding industry for one year, prompting Beijing to suspend its retaliatory investigation and delay planned port fees on U.S. vessels. Both trade concessions were as expected, following breakthrough trade talks between President Trump and President Xi on the sidelines of the Asia-Pacific Economic Cooperation (APEC) summit last month in South Korea.

The U.S. Trade Representative stated that negotiations with China will proceed on the issues raised by the probe. The mutual suspensions relieve pressure on global shipping markets after tit-for-tat moves by both economic superpowers had threatened to snarl maritime trade routes and drive up freight costs if reciprocal port fees had taken effect.

“As long as the suspension remains, the potential risk to upend global shipping remains,” said Jayendu Krishna, a director at Drewry Maritime Services.

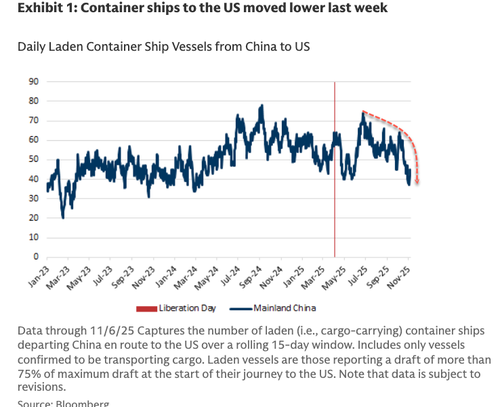

New data from Goldman analysts led by Jordan Alliger shows continued weakness in China-to-U.S. trade flows, with loaded vessels down for a fourth straight week (-10% WoW, -35% YoY) through October 30.

Alliger noted that China-to-U.S. trade flows will experience a brief improvement in mid-November (+6% YoY) before another steep drop (-30% YoY) by month’s end.

“Full ramifications from the recent tariff-related implementations and magnitudes have yet to play out – but the next few weeks could continue to illustrate shipper reactions as a potentially wait-and-see mode after the large pull forward over the summer,” the analyst said.

Key highlights from the report:

-

China freight flows (week ending Thursday, October 30) showed a sequential downtick in laden vessels from China to the U.S. (-10%), with YoY drop-off continuing at -35%.

-

Port Optimizer sequentials indicate a deterioration next week, with a return to positive the following week as TEUs appear to have found a floor of ~90k. Expected sequential imports into the Port of Los Angeles are set to be down -5% TEUs (November 14), while early readings suggest a +4% increase two weeks out. YOY trends show +6% and -30% over the next two weeks, reflecting volatility and challenges in timing YoY comparisons.

-

Rail intermodal volumes on the West Coast were -6% YoY, following last week’s -7%. The previously positive growth trends over the summer likely reflected a load/unload lag and freight moving out of warehouses, while recent declines may signal muted import trends after the earlier pull-forward.

-

Ocean container rates rose +48% sequentially, possibly due to attempts to push through GRIs ahead of contract season, but remain under heavy pressure YoY (-43%). Some normalization may occur soon following the surge.

-

Truckload availability on the West Coast continues to deteriorate during what is typically peak season, now down -30% YoY.

Key chart from the report:

The easing of U.S.-China trade tensions couldn’t have come at a better time, given the softening across major maritime shipping routes between Asia and the U.S.

ZeroHedge Pro subscribers can read the full report in the usual place.

Loading recommendations…