When Coreweave IPOed at the end of March, many wondered just how successful this former cryptocurrency miner turned GPU renter, would be in the long-term. Those questions were magnified after the close, when the stock of Coreweave slumped after the company slashed its annual revenue forecast after suffering a delay fulfilling a customer contract, marking a setback for a company that is racing to keep up with the artificial intelligence boom.

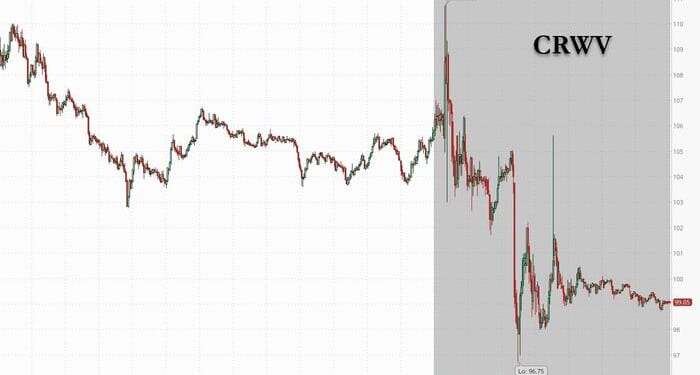

The company’s Q3 earnings were solid enough, generating $1.37 billion in revenue, above the median consensus of $1.28 billion, translating in a 22c per share loss (better than the 39c loss expected). But it was its guidance announced during a post-earnings conference call on Monday that slammed the stock 6% lower and back under $100: Coreweave now sees sales in 2025 between $5.05 billion and $5.15 billion, a drop from a range which had previously been as high as $5.35 billion.

The company said that its revenue backlog stood at $55.6 billion at the close of the quarter, almost twice the level of the previous period, although as Oracle’s recent slide demonstrated, such pie in the sky numbers are increasingly ignored by investors who are starting to demand results today, not in the years to come.

“We are affected by temporary delays related to a third-party data center developer who is behind schedule,” CEO Michael Intrator said during the call. Though the fourth-quarter results will reflect the snag, the client affected by the delay has agreed to adjust delivery schedules so “we maintain the total value of the original contract,” he said.

According to Bloomberg, the disappointing guidance “underscores the challenges of meeting the insatiable demand for AI.” Delays getting more AI computing capacity online are persistent across the industry, Intrator said in a BBG interview. And while CoreWeave was able to preserve the value of the contract, no one was happy about it.

“Everybody is frustrated — the data center provider is frustrated, we’re frustrated, the client is frustrated,” he said, while declining to name the parties involved. “For that matter, people who are waiting for the next iteration of AI are frustrated.”

The company is trying to make sure it has the right staff on site at various projects to catch issues early, Intrator said. “We’re doing all the right things. It’s just a challenging environment.”

Part of a group of companies known as neoclouds, CoreWeave rents out access to powerful AI chips. High demand for its services has pushed CoreWeave to rapidly expand its data centers and equip them with the latest gear. It’s also sought to diversify its customer base after years of depending heavily on Microsoft.

In September, CoreWeave announced an agreement to sell as much as $14.2 billion in computing power to Meta Platforms. Microsoft had accounted for 71% of CoreWeave’s revenue in the quarter that ended in June.

CoreWeave also made a recent attempt to acquire Core Scientific (another crypto miner), a partner and fellow data center operator. That bid was rejected by Core Scientific shareholders last month over concerns that the offer undervalued the business.

CoreWeave said it would move forward without making the purchase and even announced a different, smaller acquisition within minutes of the deal failing.

Loading recommendations…