In another warning sign for the AI bubble, one we’ve been tracking closely, from the accelerating AI-linked debt binge and widening Oracle CDS spreads to repeated cautions from BofA’s Michael Hartnett and others – yet another red flag emerged Tuesday morning.

Masayoshi Son’s SoftBank Group cashed out its $5.83 billion stake in Nvidia in October and is now raising capital for new AI investments across data centers, robotics, and chip manufacturing. The sale underscores Son’s core strategy – buy low, sell high – while positioning SoftBank as a major funder across the global AI ecosystem.

CFO Yoshimitsu Goto told reporters earlier that the sale of its Nvidia stake was part of SoftBank’s cycle of “divesting and reinvesting,” describing it as the company’s “fate” to continually reallocate capital.

“Our investment in OpenAI is significant, so we plan to use some existing assets to help fund it,” Goto said. He declined to comment on whether the timing of the sale had any significance.

“I can’t say if we’re in an AI bubble or not,” Goto continued, adding that the sale is for “capital can be utilized for our financing.”

Despite our concerns about an AI bubble, outlined in four must-read reports here:

… SoftBank’s timing of the sale was very strategic: the Japanese conglomerate had exited Nvidia once before in 2019 but began rebuilding its position in 2020, about two years before the advent of ChatGPT sparked the AI investment boom.

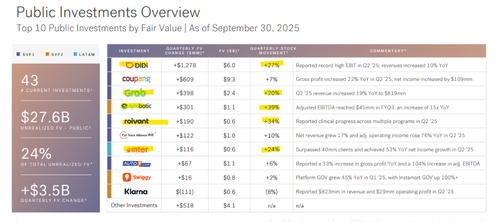

Bloomberg Intelligence analyst Kirk Boodry noted that SoftBank is on track to report its highest annual profit since 2020. “The sale of $5.8 billion in Nvidia shares highlights the company’s access to liquidity as it continues its AI investment program.”

Increased liquidity access allows Son to pursue broader investment plans, including the “Stargate” data center network and a $1 trillion AI manufacturing hub in Arizona.

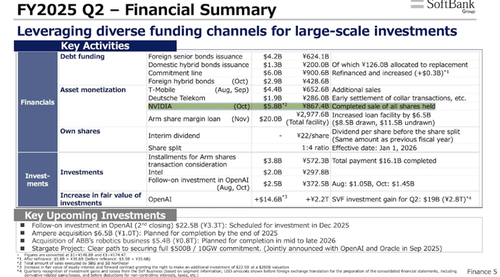

SoftBank has also lined up $20 billion in new loans backed by Arm Holdings and bridge loans to fund OpenAI and Ampere deals.

As a reminder, SoftBank bought a 2% stake in Intel for $2 billion to align with the Trump administration’s semiconductor expansion efforts. Goto reminded investors and reporters earlier that the current industry view is healthy enthusiasm and that greater risk lies in underinvesting.

Shares of SoftBank in Tokyo have tripled this year, peaking at 27,695 yen.

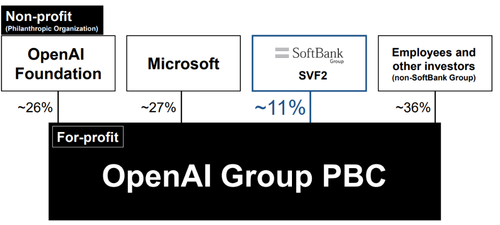

Goldman analyst Francois Theis reminded clients of SoftBank’s 11% stake in Sam Altman’s OpenAI, along with its publicly listed holdings and pipeline of upcoming listings.

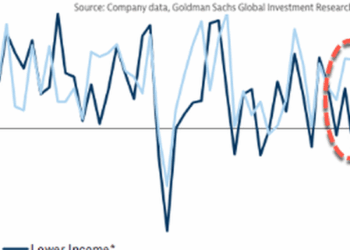

Softbank has traded as an OpenAI proxy over the summer (similarly to how it traded pre BABA listing) with a discount to NAV sharply shrinking (-14% using the company’s assumption post close marking to market their Open AI stake at latest round of valuations at $500B vs the $260B they participated in at earlier this year – model available on request). Post its recapitalisation, Softbank via its SVF2 has now a 11% stake in OpenAI Group PBC ($34.7B investment). They have completed their first tranche and set to proceed with the second and large tranche ($22.5B in Dec. this year)

Impact on listed investments

Pipeline for listing (filed)

Besides selling Nvidia, SoftBank also sold $9.17 billion worth of T-Mobile shares between June and September. Its Vision Fund is also preparing to list more Asian portfolio companies.

Loading recommendations…