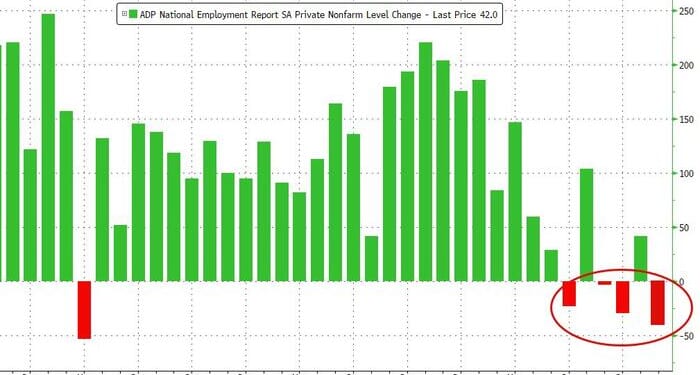

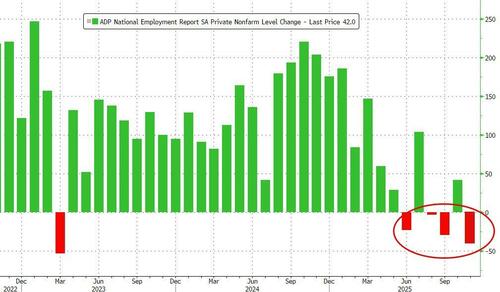

Recent announcements of large layoffs at a few prominent companies have raised concerns that the labor market could be weakening further, and today’s new weekly ADP employment report confirms that fear.

The ADP weekly jobless report pointed to a deterioration in US labor momentum, stating that “for the four weeks ending Oct. 25, 2025, private employers shed an average of 11,250 jobs a week, suggesting that the labor market struggled to produce jobs consistently during the second half of the month.”

Added together that is 45,000 job losses in the month (not including government workers), which would be the largest monthly drop in jobs since March 2023…

ADP started issuing more-frequent readouts on the labor market last month, to complement its long-running monthly report.

They are published with a two-week time lag and are based on a four-week moving average.

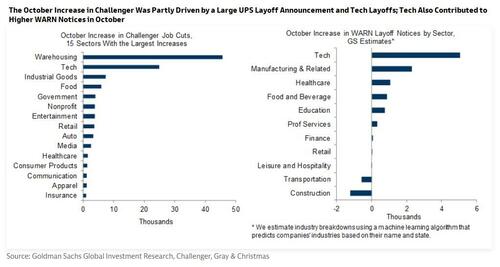

A sustained increase in layoffs would be particularly concerning now because the hiring rate is low and it is harder than usual for unemployed workers to find jobs.

So far, Goldman does not find clear evidence that most of the increase in these layoff measures is directly motivated by AI, although tech industries saw meaningful increases in layoffs in October across both measures.

At the same time, initial jobless claims – which are less noisy and more representative but could lag layoff announcements and WARN notices – remain low.

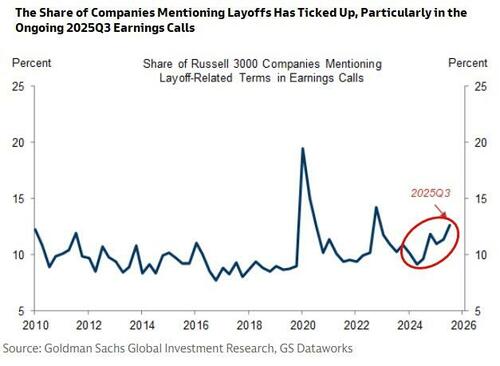

Goldman complements these data with a new tool to track layoff discussions among publicly listed companies based on earnings call transcripts.

Their tool suggests that layoff-focused discussions have increased recently, particularly in the ongoing 2025Q3 earnings calls. We find that layoff discussions increase after companies discuss AI in earnings calls at least a few times, although this pattern has only recently started to emerge for non-tech companies.

We combine Challenger announcements, WARN notices, initial claims, and earnings call mentions into a layoff tracker.

Goldman’s tracker has increased in October and is now higher than before the pandemic.

Our quantile regressions based on the level of our layoff tracker, the level of our job growth tracker net of the breakeven pace of job growth, and changes in our slack tracker indicate that the risk of labor market deterioration has increased recently, with the probability of a 0.5pp or higher increase in the unemployment rate over the next six months at 20-25% (vs. 10% six months ago).

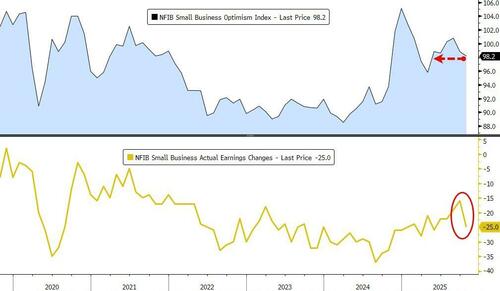

Finally, sentiment among US small businesses eased in October to a six-month low on a deterioration in earnings and less optimism about the economy.

The National Federation of Independent Business optimism index declined 0.6 point to 98.2, according to figures released Tuesday. Five of the 10 components that make up the gauge decreased while four improved.

The net share of owners reporting stronger earnings in the last three months fell 9 percentage points, the most since the pandemic and restrained by weaker sales and higher materials costs.

The result of all this is a rise in rate-cut odds and a drop in the dollar…

Cash bonds are closed for Veterans Day but futs signal a drop of about 4bps for the 10Y yield…

Stocks are largely unmoved.

Loading recommendations…