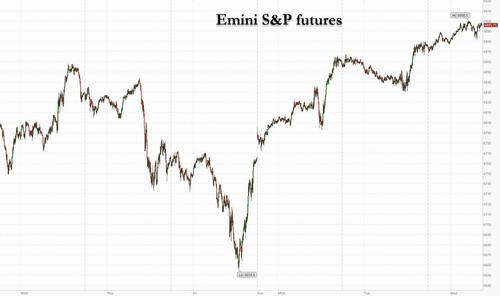

US futures are higher as the US takes another step to reopen with a House vote (expected to pass early evening on Wednesday, with Trump’s approval. As of 8:15am, S&P futures are 0.4% higher with the mood buoyed by expectations of an imminent end to the government shutdown and a Fed rate cut next month. Bullish datapoints in the AI story from AMD and FoxConn/Hon Hai Precision are also helping lift Nasdaq futures 0.7% as Nvidia led gains across the Magnificent Seven in premarket trading. Pre-market, Mag7 names are all higher and NVDA (+1.5%) and AVGO (+1.4%) boosting Semis while Nvidia partner Hon Hai Precision Industry Co. and Europe’s Infineon Technologies AG offered rosy forecasts. Cyclicals (ex-Energy) poised to outperform as the yield curve bull steepens with traders buying bonds to match yesterday’s rally in Treasury futures follower weaker than expected jobs data. USD is bid up pre-mkt; commodities are mixed with Energy and Ags weaker with Base higher, gold flat, and silver +1.2%. The macro focus today is on the House vote and mtge applications; XHB has outperformed the SPX by ~1% MTD; IYR and XLRE have outperformed by almost 2% MTD. On the calendar, there is no macro again, Trump is hosting Wall Street execs for dinner tonight. There is a firehose of Fed speaker: Williams (9:20am), Paulson (10am), Waller (10:20am), Bostic (12:15pm), Miran (12:30pm) and Collins (4pm)

In premarket trading, Mag 7 stocks are all higher (Nvidia +1.5%, Alphabet +0.7%, Apple +0.2%, Amazon +0.5%, Tesla +0.4%, Meta +0.3%, Microsoft +0.4%)

- Alcon (ALC) rises 5% after the eye-care company reported core earnings per share for the third quarter that beat the average analyst estimate.

- Advanced Micro Devices (AMD) gains 5% after the semiconductor company projected accelerating sales growth over the next five years.

- Bill Holdings Inc. (BILL) is exploring options including a potential sale, people familiar with the matter said. Shares are up 11%.

- Black Rock Coffee Bar (BRCB) declines 7% after the operator of drive-thru coffee bars announced its first earnings report since going public in September.

- Circle Internet (CRCL) falls 4% after the stablecoin issuer reported third-quarter reserve income hurt by a decline in the reserve return rate.

- Clearwater Analytics Holdings Inc. (CWAN) is considering a potential sale after receiving takeover interest, according to people familiar with the matter. Shares climb 9%.

- GlobalFoundries (GFS) gains 6% after the semiconductor-manufacturing company reported adjusted earnings per share for the third quarter that beat the average analyst estimate.

- Oklo shares (OKLO) rises 4% as analysts see the company’s US Department of Energy Nuclear Safety Design Agreement approval accelerating the licensing process.

- On Holding (ONON) climbs 9% after the Swiss sneaker brand boosted its sales forecast for the year after better-than-expected third-quarter results.

- RLJ Lodging (RLJ) gains 2.9% after Raymond James upgraded to strong buy following the stock’s significant underperformance this year.

In corporate news, Eli Lilly is dropping CVS’s drug benefit plan for its employees after CVS stopped covering its weight-loss drug in favor of a rival medication from Novo Nordisk. Visa is testing the ability for businesses to send stablecoins directly to consumers’ cryptocurrency wallets for global payouts. JPMorgan has started rolling out a deposit token JPM Coin.

Markets are anticipating an end to the 43-day US government shutdown, with House members set to return to Washington to vote on a spending deal. Traders are betting that the resumption of data releases could bolster the case for interest-rate cuts amid lingering uncertainty over policymakers’ next move. Soft ADP jobs data on Tuesday has already prompted traders to price in a higher chance of rate cut. However, it won’t all be smooth sailing, with the Wall Street Journal’s Nick Timiraos warning that the data blackout has fueled Fed divisions.

“What I see is a wind of optimism and momentum in the US,” said Roland Kaloyan, head of European equity strategy at Societe Generale SA. “Markets are currently buying 2026 amid a positive cocktail of resilient growth, AI investments, Fed cuts and a weaker dollar.”

AI remains front and center, with AMD predicting accelerating sales growth over the next five years, driven by strong demand for its data center products, and Nvidia partner Hon Hai Precision giving a rosy outlook. Meanwhile, a senior researcher at AI startup DeepSeek warned that a severe labor market crisis is coming as automation wipes out most jobs, according to the South China Morning Post. And Fed Governor Barr said there need to be clear guardrails to prevent risks as the financial sector looks to adopt AI.

In strategy, Citi’s Beata Manthey said that near-term choppiness won’t stop global equities from realizing modest gains through the middle of 2026. And Goldman strategists expect emerging markets to deliver higher returns than US stocks in the next decade, helped by a weaker dollar and higher growth

Trump said the US needed skilled workers from abroad even as his administration has taken steps to make it harder for businesses to use the H-1B visa system. Trump is also said to be hosting financial industry executives for dinner Wednesday at the White House. The FDA named Richard Pazdur, a 26-year veteran of the agency, as its lead drug regulator.

Looking at earnings, out of the 457 S&P 500 companies that have reported so far in the earnings season, 81% have topped analyst forecasts, while 15% have missed. Alcon is rising in premarket trading after the eye-care company reported core earnings that beat the average analyst estimate. TransDigm, GlobalFoundries and Circle Internet are among companies expected to report results before the market open. Earnings from Cisco, Flutter Entertainment and Tetra Tech follow later in the day.

Europe’s Stoxx 600 is up by 0.6%, with autos and banks outperforming. SSE shares rose to a record high on the electricity supplier’s new investment plan, lifting utilities shares. The autos sector also outperforms, while personal care products lag. Here are some of the biggest movers on Wednesday:

- SSE shares rise as much as 13%, hitting record high, after the utility company outlined its intention to spend £33 billion as part of a new investment plan.

- Alcon shares gain as much as 8.1%, the most since April, with the eyecare firm’s outlook confirmation coming as a relief to investors after two disappointing quarters.

- Azelis shares rise as much as 6.9% after EQT agreed to sell about 44 million shares of the Belgian chemical distributor to existing shareholders.

- ABN Amro gains as much as 4.9%, the most since Sept. 22, with a surprise announcement that the Dutch lender will buy NIBC for €960 million overshadowing a mixed-to-weak third quarter print.

- Bayer shares rise as much as 5% after the German company reported better-than-expected adjusted Ebitda for the third quarter, helped by the crop science division.

- Games Workshop shares rise as much as 6.3%, the most since late July, after Jefferies upgraded its price target by 54% to a street-high.

- Bidcorp rises as much as 4.7% in Johannesburg, the most since May after the food and beverage wholesaler reported 8.6% growth in trading profit for the four months to October.

- Edenred shares drop as much as 12% after Brazil’s president issues a decree regarding major regulatory changes to the country’s meal voucher and food voucher system.

- Taylor Wimpey shares fall as much as 4.1% after warning that uncertainty about potential tax changes in the upcoming UK budget is weakening the housing market.

- A2A shares fall as much as 7.6% after the firm reported Ebitda for the nine month period which declined year-on-year.

- FLSmidth’s shares fall as much as 9.8% after the firm lowered the range of its forecast for 2025 revenue below the average analyst estimate.

- Tesco shares slide as much as 3% after new data from NielsenIQ affirmed a weak October for food spend.

Earlier in the session, Asian stocks climbed, on track for a third-straight day of gains, as optimism grew over easier Federal Reserve policy and a likely end to the longest US government shutdown on record. The MSCI Asia Pacific Index jumped 0.6%, set for its longest daily win streak in over a month. TSMC, Mitsubishi UFJ Financial and Sony were among the top contributors to the gauge’s advance Wednesday. Major benchmarks rose in South Korea, Japan, Taiwan, Hong Kong, India, Vietnam and the Philippines. Japan’s Topix index jumped over 1% while the blue-chip gauge Nikkei 225 saw a 0.4% gain. The performance gap was driven by a rotation away from technology shares after SoftBank Group sold its entire stake in Nvidia Corp., reviving concerns that valuations in the sector have become overstretched.

In FX, the Bloomberg Dollar Spot Index is up 0.1%. Yen lags G-10 FX peers, despite a warning on the currency’s level from Japan’s finance minister.

In rates, treasury yields are lower by 1bp-4bp, with the curve steeper, after gapping when the cash market reopened after Tuesday’s US holiday. The move narrowed the gap with futures, which had a regular trading day and rallied on soft private-sector employment figures from ADP Research. US 10-year yields, richer by around 2bp on the day at 4.08%, opened below 4.07%; long-end tenors lag front-end and belly, steepening 2s10s spread slightly and 5s30s by more than 2bp. A curve-steepening selloff in gilts is a factor; UK 30-year yields are about 5bp cheaper on the day with politics in focus, after Health Secretary Wes Streeting denied plotting to oust Prime Minister Keir Starmer. Treasury auctions resume with $42 billion 10-year new issue at 1pm New York time notes, to be followed Thursday by $25 billion 30-year bond sale. Monday’s 3-year notes drew good demand. The WI 10-year yield at around 4.1% is about 2bp richer than last month’s, which tailed by 0.8bp. Wednesday’s session includes 10-year note auction and several Fed speakers.

In commodities, Oil prices are lower, with Brent futures below $65/barrel. Gold is sanguine, holding close to $4,125/oz.

The US economic calendar is blank, while Fed speaker slate includes Williams (9:20am), Paulson (10am), Waller (10:20am), Bostic (12:15pm), Miran (12:30pm) and Collins (4pm)

Market Snapshot

- S&P 500 mini +0.4%

- Nasdaq 100 mini +0.7%

- Russell 2000 mini +0.2%

- Stoxx Europe 600 +0.6%

- DAX +1.2%

- CAC 40 +1%

- 10-year Treasury yield -4 basis points at 4.08%

- VIX -0.1 points at 17.21

- Bloomberg Dollar Index +0.1% at 1219.38

- euro little changed at $1.1571

- WTI crude -0.9% at $60.51/barrel

Top Overnight News

- US House lawmakers are expected to vote today to end the 43-day government shutdown. It may still take days for air travel to return to normal and probably longer for SNAP recipients to receive delayed benefits. BBG

- GM asked thousands of its suppliers to eliminate parts sourced from China and shift to alternative supply chains to mitigate the risks of geopolitical disruptions. Some suppliers now have a 2027 deadline to completely end their China sourcing ties. RTRS

- The path for interest-rate cuts has been clouded by an emerging split within the central bank with little precedent during Federal Reserve Chair Jerome Powell’s nearly eight-year tenure. Officials are fractured over which poses the greater threat—persistent inflation or a sluggish labor market—and even a resumption of official economic data may not bridge the differences. WSJ

- President Donald Trump is expected to host a private dinner at the White House on Wednesday with several top business executives, including the chief executives of Nasdaq and JPMorgan Chase. The gathering underscores Trump’s effort to deepen ties with corporate leaders as his administration rolls out new initiatives aimed at strengthening U.S. capital markets and rebuilding critical domestic supply chains seen as vital to national security. RTRS

- Beijing is taking an aggressive approach to help its technology giants squeezed by America’s chip restrictions. Shortages of advanced semiconductors are so acute that the government has begun intervening in how the output of China’s largest contract chip maker, Semiconductor Manufacturing International, is distributed. Chinese authorities are trying to give priority to the needs of tech conglomerate Huawai. WSJ

- China’s purchases of American soybeans appear to have stalled, less than two weeks after the US touted a wide-ranging trade truce that signaled thawing relations between the world’s two biggest economies: BBG

- China is grappling with a glut of soybeans after months of record imports, curbing prospects for U.S. exports despite a recent trade truce that Washington said includes a pledge by Beijing to resume heavy purchases. Traders and analysts warn that vast stockpiles at ports and in state reserves, coupled with weak crush margins, limit Beijing’s appetite for further purchases. RTRS

- Economists are questioning the unexpected rise in UK unemployment to 5%, which rattled markets and sparked political criticism of Labour’s economic policies. BBG

- Venezuela has placed its entire military on alert as tensions ratchet higher with the US. WaPo

- Global oil and gas demand will rise for the next 25 years if the world does not change, the IEA has said, in a new scenario that reflects governments’ fading commitment to climate change. The IEA previously thought it would peak this decade, which was hotly contested by the oil and gas industry and the White House. FT

- Coming out of the government shutdown, -50K (new Goldman jobs call) would be worst NFP print since Dec 2020 (omicron surge). Jobs/Payroll data: Potential for Oct + Nov reports to be published in a concentrated 7 day window at the start of December, or even on the same day on 5th Dec. This is setting up the market for a highly consequential window of data just before the Dec FOMC. Goldman

- White House is exploring rules that would upend shareholder voting with the Trump admin examining new measures to curb the influence of proxy advisers and index-fund managers: WSJ.

Trade/Tariffs

- US President Trump said that they are going to lower some tariffs on coffee, according to a Fox News interview.

- Dutch Economy Minister Karremans said he spoke to EU Trade Commissioner Sefcovic about Nexperia and said they are both determined to ensure that supply chains are restored as quickly as possible, while they are committed to securing supply in the semiconductor space and are working closely with European and International partners.

- US and Saudi officials have held intense negotiations in recent weeks to finalise a number of agreements, including a defence pact, ahead of Saudi Crown Prince MBS meeting US President Trump in the US next week, via Axios citing sources.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed with the region indecisive amid light fresh catalysts and as participants digested earnings. ASX 200 was rangebound with upside limited as strength in the commodity-related sectors was offset by weakness in tech, telecoms, consumer discretionary and financials, while the latest Home Loans data from Australia firmly topped estimates. Nikkei 225 swung between gains and losses and traded on both sides of the 51,000 level in the absence of any key data and following a slew of earnings, including from SoftBank, which is pressured despite reporting a 191% rise in 6-month net, as it also announced a 4-for-1 stock split and that it offloaded its entire stake in NVIDIA. Hang Seng and Shanghai Comp were mixed despite the PBoC’s Q3 monetary policy implementation report, in which it reiterated to implement an appropriately loose monetary policy and strengthen the transmission of policy, while an NDRC official recently noted private investment has slowed down this year, and there are challenges in private investment but also flagged a plan to support private investment to flow to high-value service sectors.

Top Asian News

- Chinese President Xi said in a meeting with Spain’s King that China is willing to work with Spain to build a comprehensive strategic partnership that is steadier, while he added that a relationship of trust has been forged between China and Spain.

- RBA Deputy Governor Hauser said their best guess is that monetary policy is still restrictive, and the committee is debating this, while he added that if it turns out they are no longer mildly restrictive, that has important implications for future policy. Hauser also stated that there are some ups and downs in consumption readings, with the central case being for a gradual, modest recovery and noted there are no levels of unemployment that will make the central bank happy.

- Japanese PM Takaichi says appropriate monetary policy is very important and they will be coordinating closely with the BoJ to attain economic growth.

- Two new members of Japan’s top government economic panel are calling for larger economic stimulus Y/Y.

European bourses (STOXX 600 +0.6%) have opened largely firmer, once again carrying on the positive momentum displayed over the last two days. The FTSE 100 underperforms with sentiment in the region hit amidst fears that PM Starmer’s leadership is “vulnerable”. European sectors are also primarily in the green. The biggest winners thus far today are Utilities (+1.1%), Banks (+1.1%) and Automobiles & Parts (+1.3%). The latter has been boosted by a broker upgrade for Ferrari (+2%). For the Tech sector, Infineon (+6.6%) soars after reporting strong Q3 metrics and providing solid AI-related commentary.

Top European News

- UK Health Secretary Wes Streeting announces his support for UK PM Starmer Any talk of a challenge against PM Starmer is self-defeating and not true. Have not had talks with anyone about getting rid of Starmer. Adds that the PM is not fighting for his job.

- UK Chancellor Reeves is reportedly considering an increase in taxes on alcohol in line with elevated inflation, via CityAM citing sources.

- ECB’s Kocher says that given recent data, a somewhat stronger growth outlook is not impossible. Would not be too surprising if ECB hold rates steady in 2026. If inflation and growth projections play out, rates may not change for a long time.

FX

- DXY is flat/modestly firmer and trades in a very busy 99.44 to 99.61 range, with newsflow exceptionally quiet today. Focus in the prior session was ultimately on the dire weekly ADP prelim estimate, which led to some pressure in the USD. Docket today thins out from a data perspective, but a slew of Fed speakers will take the spotlight; Fed’s Paulson, Bostic, Williams, Barr, Waller, Miran, Collins and Treasury Secretary Bessent are all on the docket. Markets remain focused on government shutdown developments. To recap briefly, the US passed a funding bill to end the longest-ever shutdown in the prior day – this was then voted 8-4 by the House Rules Committee to advance it to the House Floor for consideration. Expectations are for the bill to be passed (albeit subject to dissent); overall, this will keep the US government funded till at least January 30th.

- EUR is essentially flat vs the USD. Failed to breach 1.16 to the upside in overnight trade, making a peak at 1.1588, to then fall back towards session lows of 1.1571. It is worth highlighting that the EUR is mildly stronger vs the broadly weaker GBP (which is suffering from political related pressure). European-specific newsflow has been exceptionally light today. Featuring an unrevised German inflation report, whilst Italian Industrial Output topped the most optimistic of analyst expectations. Docket should pick up later in the day, in the form of ECB speak via Schnabel (Hawk) and de Guindos (Dove) – no text release is expected from either.

- JPY is the worst-performing G10 currency today, given the generally positive risk environment with other haven assets generally sold (ex-gold). ING opines that one reason to keep the USD/JPY higher, is Japan’s agreement to invest directly in the US. This pressure in the JPY has led to continued jawboning from the Japanese officials; overnight, Finance Minister Katayama said she has seen “one-sided and sharp foreign exchange moves” recently, adding that it is being watched with a “high sense of urgency”. Whilst in the past similar jawboning has helped strengthen the JPY, the comments overnight were unable to boost the currency today.

- GBP is pressured vs the USD today, with regional political uncertainty on the forefront of traders minds. On that, in the prior session, The Guardian reported that Downing Street was fearing that some of the PM’s closest viewed PM Starmer as “vulnerable” to leadership change in the wake of the Budget. More recently, Wes Streeting has come out to clarify his support for Starmer, adding that he has not had talks with anyone, regarding any attempts to oust his leader.

- Antipodeans are mixed today, with the Aussie sitting towards the top of the G10 pile whilst the Kiwi is essentially flat. Nothing really driving the modest outperformance in the Aussie today, but it is worth highlighting some massive option expiries in the Aussie; 0.6495-0.6505 (2.4bln), 0.6525-30 (1.2bln), 0.6550-60 (906mln).

Fixed Income

- USTs are pressured today, in-fitting with global bonds, as US paper scales back some of the ADP-related upside seen in the prior session and as risk sentiment today is boosted (equity futures firmer across the board). USTs currently trade at the bottom end of a 112-27 to 113-00+ range, and with price action relatively muted so far. Not really much on the data docket today, but a slew of Fed speakers will take the spotlight; Fed’s Paulson, Bostic, Williams, Barr, Waller, Miran, Collins and Treasury Secretary Bessent are all on the docket. Markets remain focused on government shutdown developments. To recap briefly, the US passed a funding bill to end the longest-ever shutdown in the prior day – this was then voted 8-4 by the House Rules Committee to advance it to the House Floor for consideration. Expectations are for the bill to be passed (albeit subject to dissent); overall, this will keep the US government funded till at least January 30th.

- Bunds lower at the start of the European day, opened at 129.19 with losses of a handful of ticks, briefly rebounded to a 129.24 peak with gains of a tick before getting dragged lower as the European risk tone continues to improve. Currently holding just off a 129.02 trough with downside of 21 ticks at most, if the move continues and the figure is breached then yesterday’s 128.97 base comes into view. Bunds also potentially lower in sympathy with Gilts (see below) given the speculation around UK PM Starmer and associated price action as we get ever closer to the November Budget. For Germany, no move to Final CPI, which was unrevised, as expected. More recently, remarks from ECB’s Kocher of note, as he said it would not be too surprising if the ECB holds rates steady in 2026, especially if inflation and growth projections play out as expected. A mixed Bund auction (2046 strong, but 2056 line garnered a 1.3x b/c), had little impact German paper at the time.

- This afternoon, the French National Assembly is to hold the first reading on the Social Security articles, with reference to the suspension of pension reform, set to occur around 14:00GMT. Politico writes that the articles should be adopted. Into this, OATS trade better than peers with the mood-music relatively constructive for PM Lecornu at this particular stage. Narrowing the OAT-Bund 10yr yield spread down to 74bps, the lowest since August.

- Gilts are underperforming vs peers, scaling back some of jobs-related upside seen in the prior session, which saw odds of a December BoE rate cut boosted. Moreover, political uncertainty in the region has crept back into the markets following a report in The Guardian. On that, in the prior session, The Guardian reported that Downing Street were fearing that some of the PM’s closest viewed PM Starmer as “vulnerable” to leadership change in the wake of the Budget. More recently, Wes Streeting has come out to clarify his support for Starmer, adding that he has not had talks with anyone, regarding any attempts to oust his leader. Obviously today’s PMQs from around 12:00GMT onward will draw significant attention and both GBP and Gilt trades will watch for any signs of a drop in support for Starmer as we count down to the Budget; equally, a particularly strong performance could offset some of the pressure seen in Gilts this morning.

Commodities

- Crude benchmarks grinded lower throughout the APAC session and have continued to move lower as the European session gets underway, despite the IEA releasing a report indicative of oil demand growth. After closing +1.6% in Tuesday’s session, WTI and Brent initially c. USD 0.50/bbl to a trough of USD 60.54/bbl and 64.71/bbl, respectively, as the market awaits reports from the EIA and OPEC. Most recently, Tass reported that Russia is prepared to continue talks with Ukraine in Istanbul. While there was no significant price action at the time, the complex has continued lower to USD 60.41/bbl and USD 64.30/bbl, respectively. Later today, the EIA and OPEC are expected to release their monthly oil reports. In its prior report, EIA raised its 2025 demand forecast and its view on global oil production, while OPEC maintained its 2025 and 2026 oil demand forecasts.

- Spot XAU continues to oscillate within Tuesday’s USD 4097-4149/oz band as the market awaits a flurry of Fed speakers that could hint of the direction of travel for rates. After peaking at USD 4145/oz, XAU fell lower as it was weighed on by a stronger dollar and the generally constructive risk tone. The yellow metal troughed just shy of Tuesday’s low before rebounding back higher and currently trading at USD 4125/oz.

- Base metals remain rangebound as the market waits for a fresh specific catalyst and having struggled to make any headway overnight amid an indecisive APAC session. Currently, 3M LME Copper is oscillating in a tight USD 10.79k-10.86k/t band despite the positive risk tone across Europe and stateside.

- ANZ sees gold prices peaking around USD 4,800/oz by mid-2026.

- IEA’s World Energy Outlook report stated that LNG supplies are to grow 50% or by 300bln cubic meters by 2030, while IEA sees no demand peak for oil before 2050 under the current policies scenario.

Geopolitics

- Russian defence units destroyed a Ukrainian drone heading towards Moscow.

- Russia is reportedly ready to resume talks with Ukraine in Istanbul, via Tass.

- Russia’s Kremlin says the reports of contact with London was true, adds that dialogue with the UK not continued as the UK showed no desire to listen to Russia’s position.

- Australian PM Albanese said Indonesia and Australia have concluded negotiations on a new bilateral treaty on common security, and if either or both countries’ security is threatened, the treaty commits them to consult and consider what measures may be taken, individually or jointly, to deal with those threats. Furthermore, the treaty commits Australia and Indonesia to consult at a leader and ministerial level on a regular basis on matters of security, while it represents a major extension of existing security and defence cooperation.

- US President Trump has sent a letter to the State of Israel President Herzog requesting that Israel PM Netanyau is pardoned, describing the trial as “unjustified”, via Jerusalem Post.

US Event Calendar

- 7:00 am: Nov 7 MBA Mortgage Applications 0.6%, prior -1.9%

- 9:20 am: Fed’s Williams Delivers Keynote Speech

- 10:00 am: Fed’s Paulson speaks on Fintech

- 10:20 am: Fed’s Waller Speaks on Payments

- 12:15 pm: Fed’s Bostic Speaks at Atlanta Economics Club

- 12:30 pm: Fed’s Miran Speaks in Fireside Chat

- 4:00 pm: Fed’s Collins Speaks at Community Banking Conference

DB’s Jim Reid concludes the overnight wrap

Could today finally be the day that we know that the longest US government shutdown in history might be coming to an end? Assuming all their members have made it back to Washington through all the air traffic delays, the House is expected to vote today on a bill to keep most of the government open until January 30th and some agencies until September 30th next year. At this stage who knows whether we’ll see a mini version of what we’ve been through over the last 43 days as the end of January approaches, but that’s a topic for another day.

US markets struggled for much of yesterday following the euphoria of the shutdown ending over the previous 36 hours, weighed down by weakness in Nvidia (-2.96%) and a soft weekly ADP report. However, the S&P 500 (+0.21%) managed to turn higher after Europe closed, on what was otherwise a quiet day due to the Veterans Day holiday, which kept the US bond market shut. US futures continue to edge higher this morning. Meanwhile, Europe surged ahead yesterday, with the STOXX 600 (+1.28%) hitting a record high and posting its strongest two-day performance since the Liberation Day turmoil in April.

In terms of those various drivers, matters originally weren’t helped in the US by the ADP’s report of private payrolls, which is still getting outsized attention given the government shutdown. That showed the US lost an average of 11,250 private-sector jobs over the four weeks ending on October 25, which added to fears that the labour market hadn’t held up into the shutdown. To be fair, this is a new high-frequency series, so it doesn’t have a long track record, but those fears were then compounded by the NFIB’s latest survey of small businesses. That showed a decline in the optimism index to a 6-month low of 98.2 in October (vs. 98.8 expected), and for the first since May, we also saw the share planning to increase employment fall slightly (to net +15% vs. net +16% previously).

That data backdrop initially led to a risk-off move in the US, which was compounded by a fresh tech selloff. That came as Softbank announced it had sold its entire stake in Nvidia for $5.83bn, as it plans to use the revenue to back further AI spending instead. So that led to a fall in Nvidia’s shares (-2.96%), which made it the worst performer in the Magnificent 7 (-0.21%), and dragged down US equities more broadly before the late rally. And even though US Treasury markets were closed for Veterans Day, bond futures pointed to lower yields across the curve, including at the 2yr and 10yr maturity. This morning they are -3.1bps and -3.3bps lower respectively. Fed funds futures dialled up the likelihood of another rate cut in December, which moved up to a 66% probability by last night’s close from around 63% the day before. So all this weighed on the dollar index (-0.15%) as well, which posted a 5th consecutive decline.

Over in Europe, there was a completely different tone for risk assets from the jump, as the STOXX 600 (+1.28%) hit an all-time high, whilst the FTSE MIB (+1.24%) finally surpassed its 2007 peak yesterday to reach its highest closing level since 2001. Interestingly, that came despite some underwhelming data across the continent. For instance, the UK unemployment rate for the three months to September came in higher than expected at +5.0% y/y (vs. +4.9% est), whilst the number of payrolled employees dropped by -32k in October after an already-sizable downward revision in September. So that led to a clear reaction among UK assets as investors dialled up the likelihood of a BoE rate cut in December. Indeed, the probability of a cut went up from 72% at Monday’s close to 86% yesterday. And in turn, gilts saw a big outperformance, with the 10yr yield (-7.4bps) closing at its lowest level since December, at 4.39%. But outside of rates, the impact was more limited, with the pound sterling only down -0.19% against the US Dollar (after a bigger fall post data), whilst the FTSE 100 still advanced +1.15%.

That negative data theme was clear elsewhere in Europe too. For instance, the German ZEW survey disappointed in November, with the economic sentiment indicator unexpectedly falling to 38.5 (vs. 41.0 expected), and the DAX (+0.53%) was the weakest performer among the major European indices. However, this survey is more second tier relative to the IFO. It was still an incredibly solid session, with most of the other big indices rising at least +1%, including the CAC 40 (+1.25%), and the IBEX 35 (+1.27%). Moreover, there was also a rally for sovereign bonds, with yields on 10yr bunds (-1.0bps), OATs (-1.5bps) and BTPs (-1.1bps) all falling back. In France, that comes ahead of an expected vote on the Social Security financial bill today, before the budget’s revenue vote on November 17. Our French economist has an update on both of those (link here), and he even points out that neither might actually happen given the amendments for each that are yet to be discussed.

Asian equity markets are mostly higher this morning outside of Mainland China. The Hang Seng (+0.52%) is climbing, led by technology stocks, and reaching a level not seen in over a month. The KOSPI (+1.08%) is also strong. The Nikkei index (+0.22%) has turned higher while I’ve been writing this, with Softbank recovering from -8% losses to around -3% as I type. Mainland Chinese stocks are lower, with the CSI index down by -0.40% and the Shanghai Composite decreasing by -0.25%, on reports suggesting that Beijing intends to limit US military access to rare earth materials. S&P 500 futures are up +0.17% and NASDAQ 100 futures +0.40%.

To the day ahead now, and data releases include Germany’s September current account balance, Italy’s September industrial production, and Canada’s September building permits. From central banks, we’ll also hear from the Fed’s Barr, Williams, Waller, Miran, Paulson and Bostic, the ECB’s Schnabel and de Guindos, and the BoE’s Pill. Finally, earnings include Cisco and TransDigm

Loading recommendations…