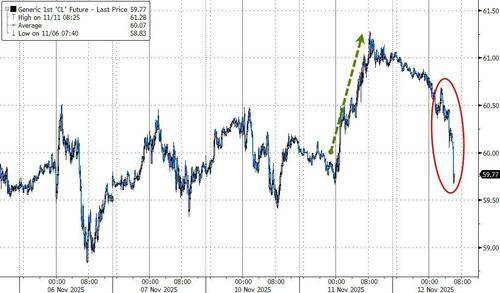

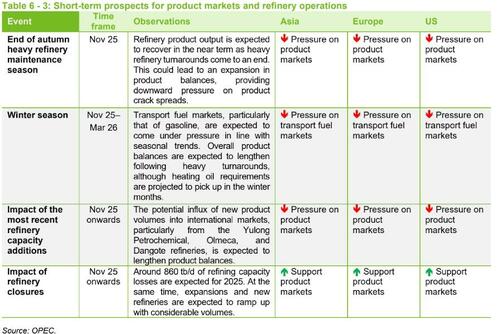

Oil prices are tumbling this morning, erasing yesterday’s gain as OPEC and IEA unveiled their latest global supply/demand outlooks…

OPEC flipped estimates for global oil markets in the third quarter from a deficit to a surplus, as US production exceeded expectations while the group itself ramped up supplies.

Demand:

-

The global oil demand growth forecast for 2025 remains at about 1.3mln BPD unchanged from last month’s assessment.

-

In the OECD, oil demand s forecast to grow by about 0.1mln BPD in 2025 while the non-OECD is forecast to grow by about 1.2mln BPD.

-

In 2026. global oil demand is forecast to grow by about 1.4mln BPD Y/Y, unchanged from last month’s assessment.

-

The OECD is forecast to grow by about 01mln BPD Y/Y. while the non-OECD is forecast to grow by about 1.2mln Y/Y.

Supply:

-

Non-DoC liquids product on (i.e. liquids production from countries net participating in the Declaration of Cooperation) is forecast to grow by about 0.9mln BPD Y/Y in 2025 revised up slightly by around 0.1mln BPD from last month s assessment, mainly due to received historical data n 2025.

-

The main growth drivers are expected to be the US. Brazil. Canada, and Argentina

-

The non-DoC liquids product on growth forecast for 2025 remains at 0 6mln BPD Y/Y. with Brazil. Canada. US and Argentina as the main growth drivers.

The report published this morning also indicated that the OPEC+ alliance pumped more crude than it estimated was needed last quarter.

Saudi Arabia has steered the coalition to fast-track the revival of halted supply this year in a bid to reclaim global market share.

This month, key members showed their first signs of slowing that strategy, agreeing to pause further production increases during the first quarter of 2026.

The organization cited a seasonal demand slowdown, though many analysts warn of a significant oversupply in global markets.

Heading into 2026, OPEC’s data does indicate a surplus, though on a more moderate scale than other forecasters. The alliance would need to produce 42.6 million barrels a day during the first quarter to balance global demand, less than the 43 million it pumped in October.

But, the International Energy Agency (IEA) leaned in hard in the demand side, stating that global demand for oil and gas will keep rising for the next 25 years unless governments change course, according to the Irish Times. In its latest World Energy Outlook, the Paris-based IEA warns that on the world’s current trajectory, fossil fuel use will continue to climb with “no meaningful fall in CO2 emissions.”

The new Current Policies scenario reflects a shift in governments’ priorities toward energy security and affordability, a slowdown in electric vehicle growth, and a “declining” focus on climate action. “Climate change is declining – and declining rapidly – in the international energy policy agenda,” said IEA head Fatih Birol.

Until this year, the IEA had assumed fossil fuel demand would peak this decade — a position fiercely opposed by the oil and gas industry and the White House. The agency denied that U.S. pressure prompted the change, noting that it consulted all member governments.

In July, U.S. energy secretary Chris Wright called the IEA’s previous “peak oil” modelling “total nonsense,” adding that Washington might “reform the IEA or withdraw its support.” The U.S. provides 14 per cent of the agency’s budget.

The Irish Times writes that major producers such as the U.S., Saudi Arabia, and the UAE argue the world still needs oil and gas to meet rising power demand from artificial intelligence and improving living standards.

The Current Policies scenario assumes existing laws remain unchanged for 25 years. Oil demand grows from 100 million barrels a day in 2024 to 113 million by 2050, while EV sales plateau at about 40 per cent by 2035. The Stated Policies case — reflecting announced but not enacted measures — sees oil peaking at 102 million b/d by 2030, with half of all cars sold in 2035 being electric.

Both scenarios show strong gas demand and a peak in coal use this decade. Electricity demand rises roughly 40 per cent by 2035, or 50 per cent under a more ambitious Net Zero path, with 80 per cent of growth in solar-rich regions.

“For some people it is very optimistic, for some people it is very pessimistic,” Birol said. “We just put the scenarios on the table.”

Clean energy advocates note that renewables dominate future power generation in every case. “Nearly all new electricity demand – driven by manufacturing growth, AI, cooling needs, and the shift to electric cars – will be supplied by renewable energy,” said Bruce Douglas of the Global Renewables Alliance.

Finally, we thought it noteworthy that OPEC’s secretariat hailed this shift by its counterparts at the IEA, which before today had in recent years has predicted consumption will stop growing this decade

The IEA, has had a “rendezvous with reality,” OPEC said.

Loading recommendations…