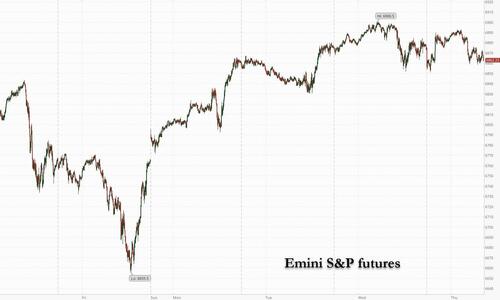

Futures are slightly lower as the market sells the news that the US government has finally reopened, and as traders now seek to identify a near-term catalyst before NVDA’s Nov 19 earnings release while the data vacuum is likely to persist for at least several days. As of 8:00am ET, S&P futures are down 0.2% as the government reopening rally runs out of fuel; Nasdaq futures slip 0.1% with Mag7 names mixed premarket. Semis are under pressure, cyclicals are mixed, defensives are bid (healthcare and staples), and commodity-related plays are poised to outperform. Bond yields are flat/ up 1bp and USD weakness continues. In commodities, WTI is rebounding as precious metals lead (gold +92bp, silver +1.4%). With the government reopening the question is when we receive data again and we gave an answer yesterday. For today, the key data focus will be state-level jobless data released this afternoon and earnings, with bellwethers AMAT and DIS.

In premarket trading, tech stocks moved largely in line with the broader market amid worries that the the AI-led rally has gone too far, too fast. Investors have shunned tech in recent days in favor of defensive and value shares. Mag 7 stocks are mostly lower mixed (Meta +0.5%, Apple +0.1%, Amazon is flat, Tesla -0.9%, Microsoft -0.2%, Alphabet -0.5%, Nvidia -0.6%).

- Ardent Health (ARDT) shares sink 29% after the health-care services firm cut its adjusted Ebitda guidance for the full year. The reduced outlook trailed the average analyst estimate.

- Canadian Solar (CSIQ) rises 12% after the solar-equipment manufacturer reported third-quarter net revenue that beat the average analyst estimate.

- Cellebrite (CLBT) soars 18% after the digital-forensic firm said third-quarter adjusted Ebitda topped the high end of management’s guidance.

- Cisco (CSCO) rises 7% after the maker of networking equipment boosted its adjusted earnings per share guidance for the full year that beat the average analyst estimate as the firm captures more artificial-intelligence spending.

- Dlocal (DLO) shares are down 10% after the payment-solutions company reported third-quarter earnings. The result, although an earnings beat, pointed to weak underlying trends and softness in certain geographies, according to Citigroup.

- Dollar Tree (DLTR) drops 2% following a double-downgrade to sell by Goldman, which says any further upside for the retailer now “gets harder.”

- Firefly Aerospace (FLY) rises 20% after the spacecraft maker said it plans to resume launches of its Alpha rocket between late 2025 and early next year. The firm also reported revenue for the third quarter that beat the average analyst estimate.

- Flutter (FLUT) is down 2% after the FanDuel owner reported revenue for the third quarter that missed the average analyst estimate

- Ibotta (IBTA) drops 17% after the digital-marketing-software firm gave a weak fourth-quarter revenue forecast.

- KinderCare (KLC) sinks 19% after the daycare operator reduced its full-year outlook.

- Mersana Therapeutics (MRSN) rises 200% after Day One Biopharmaceuticals agreed to acquire the company. Shares of Day One (DAWN) are down 14%.

- Nike (NKE) is up 2% as Wells Fargo upgrades the sportswear giant to overweight from equal-weight, saying it is “lacing up for liftoff.”

- Sealed Air Corp. (SEE) climbs 21% premarket as Clayton Dubilier & Rice is exploring a potential acquisition of the company, according to people with knowledge of the matter.

- Walt Disney Co. (DIS) slips 3% after reporting sales that fell short of Wall Street estimates and said a slate of big-budget films, including a new Avatar picture, will weigh on results for the first quarter of its new fiscal year.

- Webtoon (WBTN) shares tumble 25% after the company — which lets creators and users make and discover digital comics — forecast revenue for the fourth quarter that fell short of expectations. The firm also reported revenue for the third quarter that Evercore called “lackluster.”

In corporate news, Alibaba is preparing an overhaul of its main mobile AI app in coming months to help it more closely resemble OpenAI’s ChatGPT. FanDuel is launching a prediction market product, allowing it to open up in states where traditional sports betting is illegal. Elsewhere, the FTC is said to be investigating whether proxy advisory firms ISS and Glass Lewis breached US antitrust laws by guiding shareholders on how to vote on politically charged topics. Fed’s Raphael Bostic announced he plans to retire at the end of his current term in February.

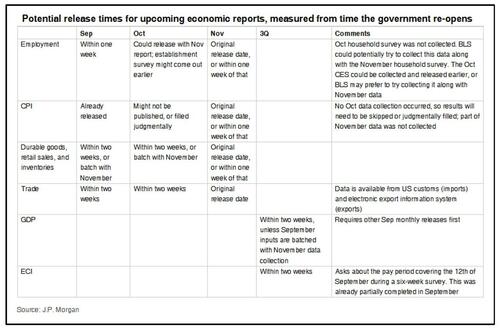

The shutdown is over, but it could take some time for normal operations to resume, and the October jobs and CPI reports are unlikely to be released at all. The jobs and the consumer price index reports for October are unlikely to be published, the White House said on Wednesday. The Bureau of Labor Statistics is expected to release a calendar in the coming days for other delayed data.

Money markets see about even odds of a Fed cut next month, while Boston Fed’s Collins and Atlanta Fed’s Bostic have both said they favor keeping rates steady to cool inflation. Bostic also announced his plans to retire at the end of his current term in February.

“There will be some caution around upcoming employment and inflation releases, particularly as we approach the Fed meeting that Powell has encouraged markets to treat with care,” said Florian Ielpo, head of macro and multi asset at Lombard Odier Investment Managers.

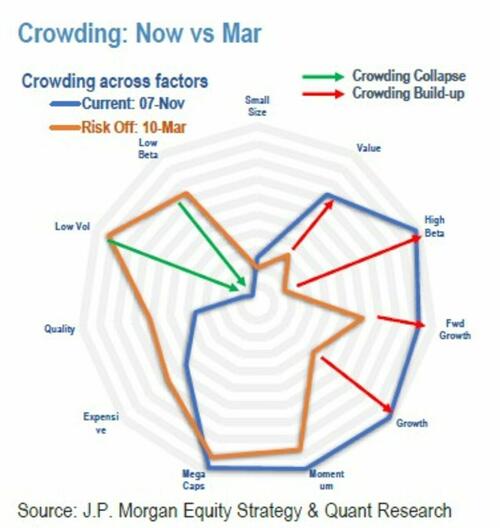

According to JPM, hedge fund positioning suggests room for a rally into the year end, though sector rotation indicates caution emerging over this year’s AI euphoria.

Notes of caution around the AI trade come as Bloomberg Intelligence equity strategists write that tech sector valuations have turned “from just hot to extreme.” Gains have been fueled by a revenue surge, not speculation, “but with premiums this stretched, fundamentals will need to keep sprinting just to stay in place,” they write. How that’s playing out in the market varies from company to company. Debt investors are taking a more cautious view of the latest junk bond deal aimed at funding a CoreWeave-tied data center construction, while Softbank has retreated more than 20% since recent highs on concerns over its AI investment strategy. On the other hand, Cisco shares are jumping premarket after AI demand fueled an upbeat earnings forecast.

“There’s a rotation going at the moment from stocks and indexes which outperformed this year, in favor of laggards,” said David Kruk, head of trading at La Financiere de l’Echiquier. “It’s both healthy for the market and absolutely not negative in terms of the direction of travel.”

In Europe, Stoxx 600 pares earlier gains to trade up 0.1%, with financial services and energy offsetting tech sector gains. ALK-Abello lead gains after the allergy solutions firm beat estimates and boosted its outlook for the year. Tech shares outperform, while the retail sector lags on a busy day for corporate earnings. Here are some of the biggest movers on Thursday:

- ALK-Abello shares jump as much as 14% to a record high after the Danish allergy solutions company boosted its outlook for the year following better-than-expected revenue in the third quarter.

- Bilfinger shares surge almost 11%, the most in more than seven months, as the industrial services company significantly raised its free cash flow outlook.

- Wizz Air shares jump as much as 17%, the most since February, after the budget airline reported earnings ahead of expectations.

- Burberry shares gain as much as 7.4% after the UK trench coat maker reported retail comparable sales for its second quarter that beat analyst estimates, turning positive for the first time in two years.

- Delivery Hero shares rise as much as 9.6% after the food delivery firm said growth of gross merchandise value is set to accelerate in 4Q.

- Convatec gains as much as 7.9% after delivering results in-line with expectations and tightening its organic revenue guidance for the full year.

- Azimut shares drop as much as 16%, the steepest fall since March 2020, after the Bank of Italy said it found significant governance and organizational issues in the firm’s Azimut Capital Management SGR unit.

- 3i Group shares tumble as much as 12%, the most in three-and-a-half-years, after reporting a slowdown in growth during October at discount retailer Action, the largest investment within its portfolio.

- Siemens shares fall as much as 5.2% after the German industrial firm’s results were hurt by currency headwinds.

- Aviva fell as much as 5.3% after the UK insurer reported third-quarter results and new financial targets which analysts said were mixed.

- Banco Sabadell shares dropped as much as 4.8% after the Spanish lender reported net income for the third quarter that missed the average analyst estimate.

Earlier in the session, Asian equities advanced for the fourth consecutive session, supported by gains in China and Japan. Stocks fell in Australia after unemployment figures. The MSCI Asia Pacific Index climbed as much as 0.5%, with Alibaba and Advantest among key gainers. Stocks also rose in Hong Kong and South Korea. Japan’s Topix index advanced for a fourth day, its longest winning streak in more than a month, amid a weakening of the yen. Meanwhile, Australia’s equity benchmark S&P/ASX 200 index fell to its lowest in more than three months, as upbeat jobs data dented expectations for central bank easing next year. The Australian unemployment numbers “effectively wiped out the prospects of rate cuts and sent equities lower,” said Matthew Haupt, a portfolio manager at Wilson Asset Management. The numbers suggest that the economy is “more resilient and maybe policy is not that restrictive.”

In FX, the Bloomberg Dollar Spot Index down by 0.2% and weaker against all G-10 currencies, with the Aussie dollar and Swedish krona outperforming.

In rates, Treasury yields trade near session highs into the early US session, with losses led by the front-end where 2-year yields are cheaper by 2bp on the day, after the longest government shutdown in US history ended. New 10-year yield near 4.10% is about 2bp higher than Wednesday’s auction result amid similar price action in bunds and gilts. Focal points of US session include 30-year bond auction and four scheduled Fed speakers. This week’s Treasury auctions conclude with $25 billion 30-year new issue at 1pm; Wednesday’s 10-year note auction tailed by 0.6bp. WI 30-year yield near 4.675% is ~6bp richer than last month’s, which tailed by 0.4bp

In commodities, gold climbs by $42 to $4,237/oz while silver gains 1.6% to ~$54, nearing its record high. Oil prices steady after the drop seen Wednesday, with the IEA once again raising its surplus estimate. Brent climbs 0.2% to $62.84/barrel.

The US economic calendar that was scheduled to include October CPI and weekly jobless claims is expected to continue to face delays as government reopens. Fed speaker slate includes Daly (8am), Kashkari (10:30am), Musalem (12:15pm) and Hammack (12:20pm)

Market Snapshot

- S&P 500 mini little changed

- Nasdaq 100 mini little changed

- Russell 2000 mini -0.1%

- Stoxx Europe 600 +0.1%

- DAX -0.4%

- CAC 40 +0.7%

- 10-year Treasury yield +1 basis point at 4.08%

- VIX +0.2 points at 17.66

- Bloomberg Dollar Index -0.2% at 1215.78

- euro +0.2% at $1.1618

- WTI crude +0.5% at $58.76/barrel

Top Overnight News

- The government shutdown officially ended and furloughed federal employees were set to return to work. Donald Trump signed a temporary funding bill into law, but it may take days to weeks to backpay workers and reinstate food aid, among other functions. BBG

- US President Trump’s administration froze flight cuts at 6% rather than hiking to 8% on Thursday, according to the US Department of Transportation.

- As the US shutdown ends, that it is now up to Johnson and Thune to determine how/if the Republican’s will address health care costs. Surmising that “the next few months are strewn with political landmines for the GOP”: Punchbowl

- White House Economic Adviser Hassett said the government shutdown will impact this quarter’s GDP and anticipates it to be between 1.5-2%, as well as noted that GDP for the year will be roughly 2% and that supply-side policies will allow growth without inflation. Hassett said he agreed with the last two Fed meetings that it was time to cut rates and noted the Fed is unlikely to cut 50bps, with the Fed more likely to do 25bps, while he added that he will do it if asked to be the Fed Chair.

- US data center developers are flooding utilities with inflated growth plans, muddying efforts to plan for future power needs with projects that may never materialize. Developers are approaching multiple utilities with the same project in a quest to find the lowest-priced power, leading to so-called phantom data centers. FT

- Volodymyr Zelenskiy implored EU allies to overcome their divisions on the use of frozen Russian assets, telling Bloomberg Television that fresh funding is critical for Ukraine to stay in the fight against Moscow. BBG

- Boston Fed President Susan Collins said Wednesday there should be a “high bar” for further easing by the Federal Reserve in the months ahead, projecting that the Fed should likely “keep policy rates at the current level for some time.” Also, NY Fed’s Perli said it won’t be long before the Fed is purchasing assets to grow the balance sheet as reserves are no longer abundant. WSJ, BBG

- China’s credit expansion slowed more than expected in October from a year ago, dragged down by weaker government bond sales and sluggish borrowing demand across the economy. BBG

- UK economic data for the month of Sept falls short across the board (GDP, industrial production, and manufacturing production all came in below the consensus). FT

- Alibaba is overhauling its main AI app to resemble OpenAI’s ChatGPT, adding shopping-focused features as it works to develop a full AI agent and build a user base. BBG

- BoJ Governor Kazuo Ueda said the central bank is aiming for moderate inflation accompanied by wage rises and economic improvement, signaling that its goal aligns with Prime Minister Sanae Takaichi’s focus on reviving growth. Moreover, giving voice to the Takaichi administration’s view that it was premature for the central bank to raise interest rates, Finance Minister Satsuki Katayama said inflation has yet to sustainably hit the BOJ’s 2% target. RTRS

- Australian employment surged in October as firms took on more full-time workers, pulling the jobless rate down from a four-year high and bolstering a growing view that the current easing cycle may have run its course. RTRS

- Investors are turning bullish on small-cap stocks, as earnings growth outpaces their larger counterparts and cheap valuations are seen sparking an M&A wave. BBG

Trade/Tariffs

- US officials flagged they will reduce tariffs on popular groceries, as pressure mounts to address the cost-of-living crisis, according to FT.

- EU is set to propose a plan to the US that would implement the next phase of the trade agreement reached in the summer, according to Bloomberg citing people familiar with the matter.

- EU seeks to accelerate crackdown on cheap Chinese parcels, according to FT.

- India announced anti-dumping duties on some steel products from Vietnam.

- China’s Foreign Ministry said G7 countries should also stop manipulating trade issues with China.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks followed suit to the mixed performance in the US, with little fresh catalysts as the government shutdown ended. ASX 200 was pressured amid underperformance in the tech, real estate and energy sectors, while stronger-than-expected jobs data from Australia did little to inspire a turnaround. Nikkei 225 was choppy as participants reflected on recent earnings releases and firmer-than-expected PPI data.

Hang Seng and Shanghai Comp were mixed with strength in pharmaceuticals offset by weakness in energy and tech, while Chinese press noted that brokerage firms expect China’s A-share market to continue to gain in 2026, with earnings growth anticipated to be around 4.7% next year.

Top Asian News

- BoJ Governor Ueda said they are aiming for stable inflation with a rise in wages and the BoJ is striving to achieve moderate inflation backed by wage growth by helping improve the economy, while he added the BoJ aims to achieve sustained economic growth that benefits the public. Ueda also said if long-term rates rise sharply in a way out of step with usual market moves, the BoJ is ready to respond flexibly, such as by increasing bond buying.

- South Korean Foreign Minister Cho asked US Secretary of State Rubio for a swift release of a joint fact sheet on last month’s South Korea-US summit, while Rubio assured South Korea’s Foreign Minister Cho that he would work with related US agencies for the release of a joint fact sheet on the summit, according to Yonhap.

- Alibaba (9988 HK / BABA) is preparing to overhaul the main mobile AI app in the coming months, in order to more closely resemble ChatGPT, via Bloomberg citing sources.

- China’s Foreign Ministry on Japanese PM Takaichi’s remarks, said despite strong protest from China, the PM has stubbornly refused to take that back. If Japan dares to intervene, that will constitute aggression. Japan must stop interfering in Chinese internals affairs.

European stocks opened mixed and traded choppily since, with pressure led by the DAX and FTSE 100. Softer UK Q3 GDP and weak manufacturing output hit UK sentiment and coupled with political uncertainty around PM Starmer weighs on the FTSE. Macro drivers were otherwise limited, though the morning brought a heavy earnings slate from names such as Deutsche Telekom, Siemens, Flutter, and Rolls-Royce. Sectors are mixed, with outperformance from Technology (+0.8%), Chemicals (+0.7%), and Insurance (+0.7%). Prosus (+3.0%) outperformed after Tencent’s earnings, lifting Tech, while Insurance and Chemicals gained amid light sector-specific news. Laggards include Financial Services (-1.5%), Energy (-0.5%), and Autos & Parts (-0.5%). Energy weakened as crude softened on constructive Russia–Ukraine headlines and mixed private inventories, with BP (-1.6%) and Shell (-1.1%) trading ex-div. Financial Services were dragged lower by a -11.5% slump in 3i post-interims, while Autos eased after strong gains in the prior session.

Top European News

- Officials working for the UK Chancellor have asked the OBR to take into account measures on energy bills, rail fares and other forms of regulated prices in the upcoming budget forecasts, via Bloomberg citing sources; intended to provide extra fiscal space via lower inflation.

- EU’s von der Leyen said the EU is working with Belgium on options to deliver on commitment to cover Ukraine’s financing needs.

- The European Commission will reportedly encourage member nations finance officials to apply pressure on Belgium to back the EUR 140bln reparations loan for Ukraine, via Politico citing officials.

- German Economy Ministry, in its monthly report, said the recent threat of semiconductor supply bottlenecks and Chinese export restrictions on rare earths do not appear to pose an acute threat to the supply situation for German industry in short term.

- ECB’s Buch said the markets are under-pricing geopolitical risk; adds new regulatory frameworks are not needed and needs commitment from legislators to not weaken current frameworks.

FX

- The DXY drifted lower in early Europe after holding steady overnight, with little reaction to the passage and signing of the US funding bill that formally ends the shutdown. Markets remain wary that the deal only delays the issue, with another funding standoff possible at end-January. Data uncertainty persists after the White House signalled that October CPI and jobs reports are unlikely to be released, while the BLS has given no timing confirmation; only September data is assured, with no date set. White House adviser Hassett warned the shutdown will drag Q4 GDP to 1.5–2.0%, with full-year growth near 2%, though he said supply-side policies should support growth without boosting inflation. The DXY trades near fresh weekly lows at the bottom of a 99.15–99.59 range, with support at 99.00 and the 98.91 low from October 30th.

- EUR/USD firmed as the pair followed the dollar’s slide, breaking above 1.1600 after an indecisive overnight session, driven by broad USD weakness rather than fresh Eurozone catalysts. EUR/USD holds within a 1.1579–1.1635 band, just shy of the 1.1637 October 30th high, with the 50DMA (1.1662) and 100DMA (1.1663) closely aligned overhead.

- GBP/USD posted modest gains after an initial dip on slightly softer UK GDP (-0.1% M/M vs Exp. 0.0%), before recovering on broader USD weakness. BoE pricing turned marginally more dovish (≈1bp) post-data, while focus remains on the fiscal challenges facing Chancellor Reeves ahead of the Nov 26 Budget, where she must balance discipline with avoiding growth or inflation risks. Political uncertainty around PM Starmer persists, though tensions eased after the Health Secretary dismissed reports of an attempted ouster. GBP/USD trades in a 1.3101–1.3171 band, with resistance at 1.3184 (Tuesday high) and 1.3191 (Monday peak).

- USD/JPY traded without clear direction overnight, easing after meeting resistance near 155.00. The pair extended lower into Europe as the dollar softened and risk sentiment faded. USD/JPY now sits toward the lower end of a 154.32–155.01 band, holding comfortably within yesterday’s 154.04–155.04 range.

- The Antipodeans diverged, with AUD/USD outperforming after stronger labour data and a drop in unemployment. The upbeat release briefly pushed AUD/NZD to 1.1637 before slipping back below 1.1600 (vs earlier 1.1534 low). As a result, NZD/USD lagged, unable to fully benefit from broader USD softness given AUD-driven cross dynamics.

Fixed Income

- USTs opened softer as risk appetite improved overnight following the House vote to end the shutdown and President Trump signing the legislation. Futures dipped to 112-27, around five ticks lower, matching Wednesday’s base and holding above the 112-20/112-15 lows from earlier in the week. The move later retraced as risk sentiment faded, lifting fixed income, JPY, and gold, while the USD came under pressure. With markets now awaiting delayed US data, the near-term bias appears dovish. Today’s lineup features Daly, Hammock, Kashkari, and Musalem, ahead of a 30yr auction. Data vendors are expected to update release schedules shortly, with some prints potentially arriving next week. Officials have suggested October BLS data may not be published, though confirmation is still awaited. Any forthcoming data will shape expectations for December, with markets pricing a ~55% chance of a 25bps cut, leaving the short end sensitive to the timing and tone of releases.

- Bunds traded directionally in line with USTs, slipping to an early 129.19 low before rebounding as the broader risk tone deteriorated, lifting the benchmark to a fresh 129.40 WTD high. German-specific news was limited, with focus instead on France and ongoing discussions around Ukraine funding.

- OATS welcomed positive developments for PM Lecornu as the National Assembly adjourned with 200+ amendments still pending, but crucially advanced the Social Security Financing Bill to the Lower House. Politico cited PS representative Guedj describing Lecornu as “fair” and “trustworthy,” a welcome endorsement ahead of renewed focus on the separate revenue bill. The vote on the revenue section is slated for November 17th, before lawmakers return to the Social component, with targeted passage by November 24th. While several contentious points remain, the momentum is favourable for both Lecornu and France’s fiscal trajectory. In response, the OAT–Bund 10yr spread has continued to tighten, narrowing to 72bps.

- Gilts opened firmer by five ticks on the dovish read from the morning’s soft growth data and strength in peers, before quickly reversing to a 93.60 trough (down ~10 ticks). The initial dovish impulse (Gilt-positive, yield-negative) was partly offset by the implied fiscal strain ahead of November’s Budget, which proved briefly Gilt-bearish. The move was short-lived, and Gilts later rebounded to a 93.83 peak, posting gains of up to 18 ticks and briefly outperforming as December cut odds ticked up by ~1bp to ~21bps. Focus now turns to upcoming October and November inflation prints, which will be pivotal given the MPC split and Governor Bailey’s likely tie-breaking role ahead of the December decision.

Commodities

- Crude benchmarks are steady after Wednesday’s ~USD 2.60/bbl slide, which followed OPEC’s modest upward revision to its 2025 supply outlook, reinforcing oversupply concerns. WTI trades USD 58.12–58.56/bbl and Brent USD 62.34–62.81/bbl through European hours. The IEA’s monthly report — raising 2025–26 demand and supply forecasts broadly in line with the EIA and OPEC (which kept its demand growth view unchanged) — drew little market reaction. Elsewhere, Reuters reported Russia’s Orsk refinery will remain offline until Sunday after Tuesday’s Ukrainian drone strike.

- Spot gold consolidated overnight within a USD 4180–4219/oz band after Wednesday’s sharp rally, before extending gains into Europe as the softer dollar provided support. XAU now trades near session highs around USD 4235/oz. With the US government reopened, markets await delayed data: the White House confirmed the September BLS report will be released but warned that October CPI and jobs data may never be published. In a quiet catalyst environment, this uncertainty has likely contributed to renewed dollar weakness.

- Base metals extended Wednesday’s gains after President Trump confirmed the end of the US government shutdown. 3M LME Copper briefly dipped to USD 10.87k/t in early APAC trade before reversing higher as the House passed the reopening bill, peaking at USD 10.98k/t before easing to USD 10.95k/t into Europe.

- US Private Inventory Data (bbls): Crude +1.3mln (exp. +2.0mln), Distillate +0.9mln (exp. -2.0mln), Gasoline -1.4mln (exp. -1.9mln), Cushing -0.0mln

- US DoE announced that contracts were awarded for the acquisition of approximately 1mln barrels of crude for the SPR.

Geopolitics

- Israel reportedly conducted artillery raids and shelling on the eastern areas of Gaza and Khan Younis, according to Al Jazeera.

- Israel is reportedly seeking a new 20-year security agreement with the US, doubling the usual term and adding “America First” provisions to win the Trump administration’s support, according to Axios sources.

- White House said when asked about a report on the US mulling a base on the Gaza border, that this is not something the US is interested in.

- US Secretary of State Rubio said there’s some concern of events in the West Bank spilling over and creating an effect that could undermine what they are doing in Gaza, but added they don’t expect it to and will do everything they can to make sure it doesn’t happen.

- US Secretary of State Rubio said as of now, the assessment the US has to make is that Russia does not really want peace.

- Russia’s Kremlin said Ukraine must negotiate with Russia “sooner or later” and that its negotiation position is worsening by the day. Believes that Russia and Europe will resume dialogue sooner or later. Remans open to reaching a settle on Ukraine through political and diplomatic means. Wants peace settlement but will keep fighting in the absence of one to ensure its own security.

- G7 Foreign Ministers said they are raising economic costs to Russia and exploring measures against countries and entities that are helping finance its war efforts.

US Event Calendar

- 8:00 am: Fed’s Daly Speaks on Balance Sheet Management

- 10:30 am: Fed’s Kashkari Delivers Opening Remarks

- 12:15 pm: Fed’s Musalem Speaks at a Fireside Chat on Monetary Policy

- 12:20 pm: Fed’s Hammack in Moderated Discussion

DB’s Jim Reid concludes the overnight wrap

At last! A record-long US government shutdown came to an end overnight after 43 days with President Trump signing the funding legislation that was passed in a 222-209 vote by the House on Wednesday evening. The package passed by Congress includes three bills of full-year funding for specific departments including agriculture and veteran affairs, but with most government agencies being funded through January 30. So, we could be on the verge of another shutdown in just over 10 weeks’ time, not least if tensions over healthcare subsidies that Democrats had pushed for escalate between now and then. But for now, the end of the shutdown has boosted the market mood, with S&P 500 futures +0.19% higher this morning, having already rebounded by more than 3% from their intra-day lows on Friday.

Ahead of the vote, yesterday saw European risk assets outperform their US counterparts for a second consecutive session, as lingering AI and tech worries held back the US on a relative basis. The S&P 500 (+0.06%) managed to turn positive after Europe closed and the Dow Jones (+0.68%) even posted a new all-time high, but the Mag-7 (-1.19%) fell behind. Yields on 10yr treasuries slid by -4.7bps, catching up a bit after Tuesday’s holiday and dragged down by falling oil prices. Across the Atlantic, the Stoxx 600 rose +0.71% to a fresh high, while other indices like the CAC 40 (+1.04%), DAX (+1.22%) and IBEX 35 (+1.39%) also made sizable advances.

The softer US session came despite some positive comments from Treasury Secretary Scott Bessent early in the day. In an interview with Fox News, Bessent said that the US will announce tariff relief for certain commodities like coffee and bananas over the coming days. This is the latest development in a series of trade-positive news this week, after the US said it was close to deals with Switzerland and India to lower their tariff rates. Bessent also talked up the recent rally in Treasuries, noting that the Treasury has “additional time and flexibility” before deciding on any future issuance changes. Those comments added to a supportive backdrop for Treasuries, with the 10yr yield down -4.7bps to 4.07%, while the 2yr fell -2.2bps to 3.57%. Overnight, Treasuries are half, to a basis point higher across the curve.

The front-end rally yesterday was limited by hawkish comments from Boston Fed President Collins, who said that it “will likely be appropriate to keep policy rates at the current level for some time”. With Collins a voter this year, that marks all four of the voting regional Fed presidents that have expressed some skepticism on the need for a rate cut in December. So even as rates rallied along most of the curve, Collins’ comments saw pricing of a December rate cut decline from 67% to 59% on the day, the lowest this has been since the Fed resumed rate cuts in September. Of course, data will play a key part in the FOMC decision in four weeks’ time, but the risk is that the outlook may remain hazy in aftermath of the shutdown. Indeed, yesterday the White House suggested that October CPI and jobs reports were likely to be skipped altogether. The CPI has been published every month since 1919 and the monthly employment report since 1948 in their current format. Given what the world has been through over this period, it’s remarkable that October 2025 might be the only historical blank we’ll ever have!

In other Fed news, Atlanta Fed President Bostic said that he will retire once his term ends on February 28. His announcement was unexpected given his mandatory retirement wasn’t until 2031, and while whoever succeeds him will be appointed by the Atlanta Fed’s own board of governors, the nomination will still need approval from the overall Fed Board. The Atlanta Fed don’t vote next until 2027, so this story isn’t of immediate consequence but it’s interesting in the bigger scheme of things nonetheless.

Turning back to equities, while the S&P 500 (+0.06%) eked out a gain, both the NASDAQ (-0.26%) and the Russell 2000 (-0.30%) lost ground. Airlines (+4.84%) were the biggest winners within the S&P amid the impending shutdown end but it was a defensive session overall, with the healthcare sector (+1.36%) also outperforming. By contrast, the Mag-7 (-1.19%) were weighed down by losses for Meta (-2.88%), Tesla (-2.05%) and Amazon (-1.97%). And energy (-1.42%) was the worst performing sector within the S&P 500, with Brent crude falling -3.76% to $62.71/bbl amid growing supply glut concerns as OPEC acknowledged that the oil market moved into surplus sooner than expected.

Turning to Europe, equities continued to outperform US peers for another day, with the STOXX 600 (+0.71%) advancing to new records. As mentioned at the top, most continental indices saw gains of above 1% but the FTSE 100 (+0.12%) underperformed here in the UK. This came as political speculation swirled around allegations that the UK’s Health Secretary Wes Streeting planned to challenge the leadership of PM Keir Starmer. Despite Streeting later denying the reports yesterday, the political uncertainty still had a small negative impact in other UK assets. For instance, the 10yr gilt yield rose +1.1bps, while sterling fell -0.13% against the dollar. The spotlight on the UK will continue today, when we’ll get the UK’s September GDP just after we go to press.

In terms of yesterday’s data, we received Germany’s final HICP inflation for October, which confirmed the flash reading of +2.3% y/y that had come in a tenth above expectations. The upside was driven by strong services inflation (+3.6% y/y in Oct from +3.5% y/y in Sept), although details suggest this was mostly due to volatile travel items. Lingering inflation risks were brought up by ECB’s Schnabel, who stressed that while inflation is currently “in a good place” at 2%, risks were tilted “a little bit to the upside”. She noted “stickiness” in services inflation and mentioned geopolitical fragmentation and supply chain impact in areas such as rare earths as inflationary drivers. The hawkish messaging, although unsurprising from her, supported yield curve flattening, with 2yr bund yields down a marginal -0.3bps while 10yr yields were -1.5bps amid the global bond rally.

The more notable bond moves came in France, where 10yr OAT yields fell -4.7bps bringing the OAT-bund spread to 73bps, its lowest since August. This came as France’s National Assembly voted to keep the suspension of the country’s unpopular pension reform in its budget. The postponement of the pension age increase until after the 2027 presidential election had been offered by PM Lecornu to keep the Socialists on board in budget talks. While the near-term cost would be modest – at less than €2bn by 2027 – it will inevitably increase the country’s long-term deficit issues if the reform is not re-introduced later on. For now, markets have taken a positive view of the first major budget hurdle being comfortably cleared, but our economists see the real test on the social security budget coming in the Senate (November 19-25) and the joint committee a few days after (see their note on the budget process here).

Asian equity markets are mostly higher this morning with a couple of exceptions. The S&P/ASX 200 (-0.52%) stands out after stronger-than-anticipated employment data diminished expectations for further interest rate reductions by the RBA (details below). The Hang Seng (-0.45%) is declining partly due to tech stocks, but with the KOSPI (+0.62%), Nikkei (+0.30%), Shanghai Comp (+0.55%) and CSI (+1.03%) comfortably higher.

Australian net employment increased by 42,200 in October compared to September, which saw an increase of 12,700, significantly surpassing market predictions of a 20,000 gain, bolstered by a 55,300 rise in full-time positions. The participation rate remained stable at 67%, and most importantly, the unemployment rate decreased to 4.3% from 4.5%, which had been the highest level since November 2021. This robust report propelled the Australian dollar up by as much as +0.3% to a ten-day high of $0.6560, while yields on the policy-sensitive 3-year government bonds rose by +10.4bps, to trade at 3.80%, the highest level in over seven months. This puts some doubts to the house view of a February cut but the key swing factor will likely be Q4 inflation.

Elsewhere, Japanese producer inflation increased by +2.7% year-on-year in October, slightly exceeding expectations for the month, thereby keeping markets alert to hawkish signals from the Bank of Japan.

To the day ahead now, we’ll get the UK’s October RICS house price balance, September monthly GDP, Eurozone September industrial production. We’ll also hear from the Fed’s Musalem, the ECB’s Villeroy and Elderson, and the BOE’s Greene, plus we’ll receive the ECB’s economic bulletin. Earnings today include Walt Disney and Applied Materials. The US is also hosting an auction for 30-yr bonds ($25bn).

Loading recommendations…