After yesterday’s mediocre, tailing 10Y auction, and with yields pushing higher today, prospects for the week’s final coupon auction, today’s $25BN in 30Y bonds, were not too exciting. Which is a good thing because the just concluded final refunding auction was quite disappointing.

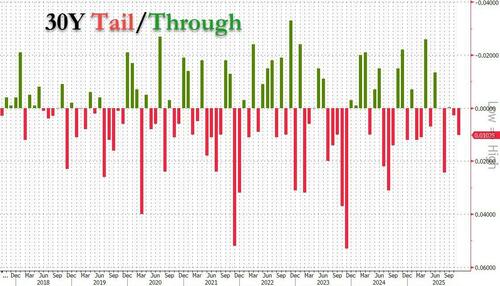

The auction stopped at high yield of 4.694%, down from last month’s 4.734%, but it also tailed the When Issued 4.684% by 1.00 basis point. This was the second tail in a row, and the biggest since August when the auction tailed by 2.1bps.

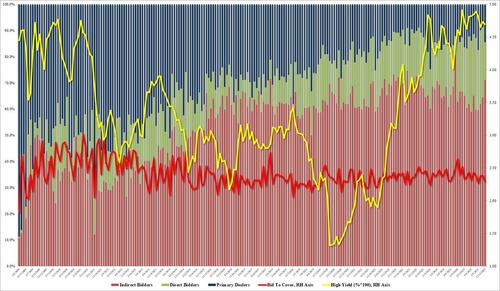

The bid to cover was 2.295, down from 2.382 and the lowest since August, when it was 2.266. Take that auction out and today’s BtC would have been the lowest since 2023.

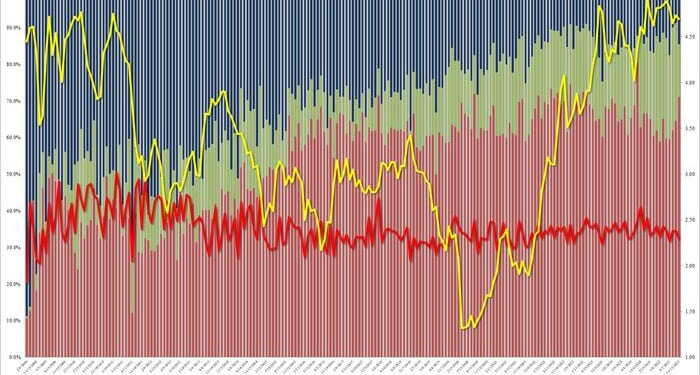

The internals were more solid, with Indirects taking down 71.0%, up from 64.5% and the highest since Oct 2024. Yet this was more than offset by the slide in Directs which took only 14.5%, down sharply from 26.9% in October and the lowest since October 2024. Finally, Dealers were left holding 14.5%, the most since August.

Overall, this was another subpar, tailing auction, and the only saving grace was the rebound in foreign buyers. Yet judging by the move higher in yields across the curve, the market was clearly disappointed with today’s auction.

Loading recommendations…