Last month we noted that US foreclosure filings jumped 17% in Q3 of 2025 vs. Q3 2024, with Florida, Nevada, South Carolina, Illinois and Delaware leading the pack, based on research by ATTOM.

Now, ATTOM is reporting a 20% monthly spike in October vs. 2024 – marking the eighth straight month of YoY increases.

Breaking it down:

- There were 36,766 US properties with some type of foreclosure filing in October, which include notices of default, scheudled auctions, or bank repossessions – a 3% rise over September of this year, and a 19% jump vs. Oct. 2024.

- Foreclosure starts – the initial phase of the process, were up 6% vs. September and were 20% higher than October 2024.

- Completed foreclosures – the final phase, jumped 32% YoY for October.

That said, Attom CEO Rober Barber doesn’t think it’s a big deal.

“Even with these increases, activity remains well below historic highs. The current trend appears to reflect a gradual normalization in foreclosure volumes as market conditions adjust and some homeowners continue to navigate higher housing and borrowing costs,” said Barber.

Similar to last month’s report, Florida, South Carolina and Illinois led the nation in state foreclosure filings. City-wise, the following metro areas led the pack:

- Tampa, FL

- Jacksonville, FL

- Orlando, FL

- Riverside, CA

- Cleveland, OH

When it comes to completed foreclosures, Texas, California and Florida had the most – suggesting that those states will see more inventory available for sale at distressed prices. As CNBC notes, there’s strong demand for houses in these price ranges, so it’s likely that those foreclosed properties won’t last long on the market.

Putting things in perspective

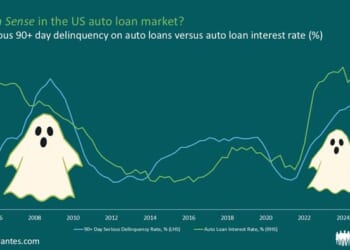

All of the above translates to less than 0.5% of mortgages in foreclosure. At the peak of the Great Recession, over 4% of mortgages were in foreclosure – so we have a ways to go, and are currently well below the historic average of between 1% and 1.5%.

Also right now, 4% of mortgages are delinquent, which as 12% at the peak of the financial crisis.

What is concerning are FHA loans:

“So, no foreclosure tsunami to worry about,” said Rick Sharga, CEO of CJ Patrick Co., a real estate market intelligence firm. “That said, there are a few areas of concern. [Federal Housing Administration] delinquencies are over 11%, and account for 52% of all seriously delinquent loans; we’re likely to see more FHA loans in foreclosure in 2026.”

Sharga also pointed out that states which are experiencing falling home prices with rising insurance premiums are seeing an uptick in defaults.

At the end of the day, in most major metros – anyone looking to buy a home is still better off renting that same home for a fraction of the mortgage, property tax, and maintenance – with the wildcard of course being the potential for capital appreciation.

Let’s Compare

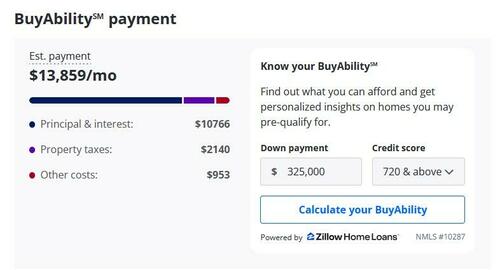

Take a $2.2 million home in San Diego, for example… Someone with excellent credit will pay $13,859 per month when you include taxes, HOA, and home insurance, and cough up $439,000 for the 20% down payment.

If interest rates drop to 4%, you’re still paying $11,480 per month…

Meanwhile, this almost identically sized house around the corner (literally) rents for $6,200 / month – which is $7,659 less per month than the mortgage (or $91,908 less per year) and includes a landlord to pay for that broken washing machine or whatever, plus you can bail when the neighbor kid drops a 2000W stereo in his Acura you can hear from 3 blocks away coming home from his Drakkar Noir-drenched attempt to get laid in the Gaslamp (did not get laid).

Either way you’re paying for a McMansion on a postage stamp.

Loading recommendations…