Has the once prominent Women’s March Inc lost its tax-exempt status? The IRS website indicates this may have occurred.

Women’s March Inc and March On were two major groups that formed following the Women’s March on Washington Protests on January 21, 2017. Both groups sought to organize further protests across the country, but with differing agendas. It was reported that Women’s March Inc was formed by those who organized the original Washington D.C. event on January 21, while March On was formed by a collection of smaller groups that had organized related events outside of the nation’s capital.

Women’s March Inc aligns with left-wing causes. The vision statement on their website advocates for “feminist economies,” ending white supremacy, and the establishment of “feminist budgets” wherein resources are justly distributed according to feminist values.

The original Women’s March on Washington in 2017 drew crowds of more than a million people, but since then Women’s March Inc has been embroiled in controversy.

After the original protest, ten organizers of major Canadian marches planned to form a national organization to coordinate future protests in Canada. When they moved to form a board, Women’s March Inc’s leadership told them they would need to apply for positions within the group they had already built. Days later, two Women’s March Inc employees registered the name Women’s March Canada and appointed themselves directors. The original Canadian organizers were locked out of their social media accounts and received no response to their appeal for recognition.

The conflict mirrored wider tensions between local and national branches of the Women’s March movement, leading many regional groups to incorporate independently or join March On to continue organizing on their own terms.

These internal divisions, early allegations of antisemitism due to Women’s March Inc’s close association with Louis Farrakhan, and accusations of financial mismanagement set the stage for the group’s decline. More recently, the Women’s March movement, and by extension Women’s March Inc have steadily lost political relevance.

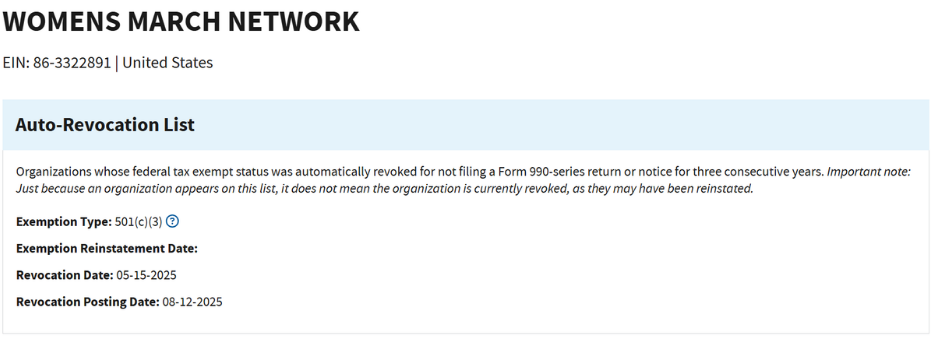

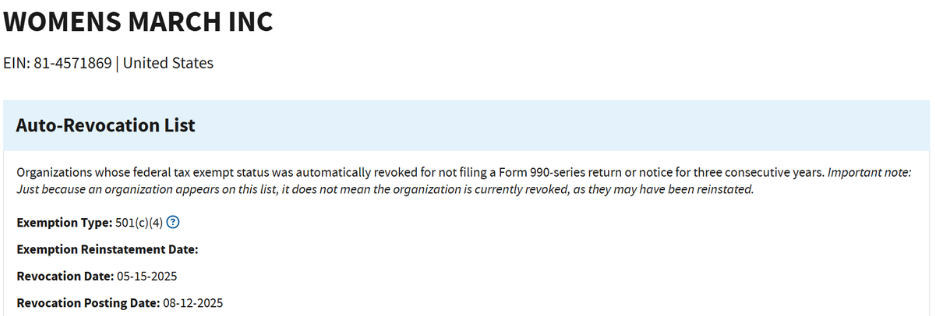

And then in May Women’s March Inc and its associated 501(c)(3) arm, Women’s March Network, made an appearance on the IRS’ auto-revocation list. The IRS posted the auto-revocation notice in August. According to the IRS, tax-exempt groups automatically have their tax-exempt status revoked for not filing their required form-990 tax documents for three consecutive years.

An IRS web page covering auto-revocation explains the impact of losing tax-exempt status for the nonprofit and its potential donors:

If an organization’s tax-exempt status is automatically revoked, it is no longer exempt from federal income tax. [ . . .] An automatically revoked organization is not eligible to receive tax-deductible contributions and will be removed from the cumulative list of tax-exempt organizations, Publication 78. The IRS will also send a letter informing the organizations of the revocation.

Donors can deduct contributions made before an organization’s name appears on the Automatic Revocation List. State and local laws may affect an organization that loses its tax-exempt status as well.

To that last point, in 2024 Women’s March Network received $150,500 from the Jewish Communal Fund, $75,000 from Planned Parenthood, and $25,000 from the Solidaire Network.

Women’s March Network and Women’s March are permitted to apply for reinstatement and may have already done so (despite the IRS assertion that they have not filed tax forms for three straight years). The difficulty of doing so is also spelled out on the IRS’s website covering auto-revocation:

The law prohibits the IRS from undoing a proper automatic revocation and does not provide for an appeal process. An automatically revoked organization must apply to have its status reinstated, even if the organization was not originally required to file an application for exemption.

Though the IRS website shows that Women’s March Inc and Women’s March Network may no longer have their tax-exempt status, both are still active. According to Women’s March Inc’s website, the group has many protests and events planned in the coming months. Many of their current protests center around SNAP benefits, abortion policy, or #NoKings demonstrations.

And on its web page the Women’s March Network still claims that donations to its cause are “100% tax deductible.”

***

Editorial note: these are the screenshots of the auto-revocations, as shown on the IRS website.