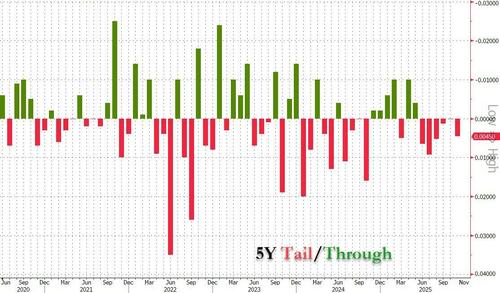

After yesterday’s sale of $69BN in 2Y notes, which came smack in the middle of market expectations with metrics that were just about average, moments ago the US Treasury sold $70BN in 5Y notes at a high yield of 3.562%, down from 3.625% last month and the lowest since last September when the Fed launched its current rate cut cycle; the auction tailed the When Issued 3.557% by 0.5bps, and was the 5th tailing 5Y auction of the past 6.

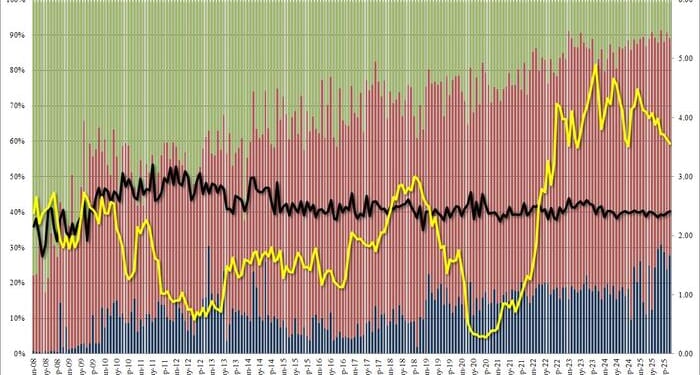

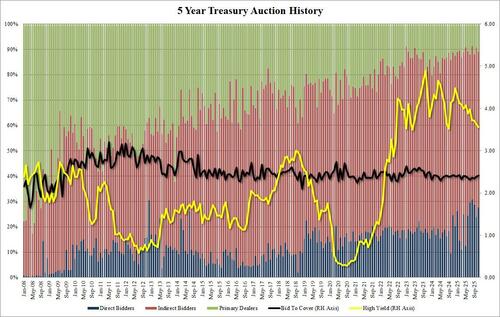

The bid to cover was 2.41, better than last month’s 2.38 and the highest since April, although for a metric that has a 5bps range this is hardly a huge achievement: as shown in the chart below, the BtC has moved in a 3bps range around 2.40 for the past 3 years!

The internals were less impressive, with Indirects (i.e. foreign buyers) sliding to 61.35% from 66.84% and below the recent average of 64.7%. And with Directs rising to 27.6% from 23.9%, Dealers were left with 11.0% of the allocation, up from 9.3% last month but below the 10.4% recent average.

In summary, it was another mediocre auction although with yields sliding across the curve after the Hassett report (which may or may not be a trial balloon), it appears that nobody noticed as the dovish euphoria swept across markets to contain the early selling and boost buying across all asset classes.

Loading recommendations…