Authored by Allan Stein via The Epoch Times,

For years, Jakob stacked silver coins and bullion, building his treasure and waiting for the perfect moment to let it go, if that moment ever came.

With prices in late 2025 rapidly rising, money running low, and the holidays approaching, he decided to sell them on Nov. 18 at the spot market price of $50.13 per ounce.

He received more than $1,400 from a coin dealer in Phoenix. Enough to cover this year’s gifts.

“I wasn’t really wanting to sell, but everything is expensive,” Jakob, who didn’t want his last name used, told The Epoch Times.

“Christmas kind of made the decision for me,” he said. “I’ve got little kids. They’ve been wanting to go to Disneyland.”

As economic conditions worsen for many Americans, more precious metals investors are selling assets to take advantage of higher prices and bolster their finances, according to several coin and bullion dealers and customers who spoke with The Epoch Times.

For many, the need for cash is immediate, with essentials like groceries and electricity bills taking priority over holding onto their investments.

A coin and bullion dealer in Navajo County, Arizona, said that three out of every four transactions were people selling their silver and gold.

Many of these sellers were having a hard time making ends meet, he said, and asked not to use his company’s name.

The dealer said one woman, who looked in pain, needed money for dental care. Another woman, a single mother, needed cash to buy food.

At least two married couples sold their gold wedding rings for quick money to buy basic items.

Southwest Coin & Bullion, a gold and silver buyer in Phoenix, on Nov. 18, 2025. Allan Stein/The Epoch Times

“It’s a hard time,” the dealer told The Epoch Times.

“One customer flat out said, ‘I don’t want to sell right now, but I have to.’ He had a car repair, and [needed] Christmas money.”

The man received $2,200 for his collection of 1-ounce silver rounds.

“They aren’t all desperate,” the dealer noted. “The thing is, for the last two years, I’ve had more sellers than buyers, significantly more sellers than buyers, especially the last year,” due to rising prices.

“October was my best month. A lot of that was larger purchases, people who were on the fence or were thinking about it. It’s the price. People buy on the fear of missing out.”

The dealer explained that selling gold and silver when prices are rising quickly seems “counterintuitive” because it often makes more sense to buy and hold as prices climb.

He added that, as the saying goes, the goal in precious metals trading is to buy low and sell high.

A worker polishes gold bullion bars at the ABC Refinery in Sydney, Australia, on Aug. 5, 2020. David Gray/AFP via Getty Images

But that stable high is nowhere in sight, he said.

“Seriously, maybe one in 10 are taking a profit; the vast majority are selling out of need,” he said. “Most people who buy gold and silver buy it to sit on it as savings or insurance.”

“And with that being said, the majority of people are selling out of need, not out of wanting to take a profit.”

Gold and Silver

On Nov. 28, gold’s per-ounce value closed at $4,220.40 in U.S. dollars, and by 1 p.m. Eastern Time, silver hit a record high of $56.38 per troy ounce, precious metals analyst kitco.com reported.

Patrick McKeever, a precious metals dealer at Southwest Coin & Bullion in Phoenix, said the gold and silver markets remain highly volatile and unpredictable, as prices continue to rise with no clear end in sight.

He said that as the dollar drops in value and inflation goes up, more people are choosing to buy for the long term or sell to take advantage of higher prices in the short term.

“I think it’s just high demand,” McKeever told The Epoch Times.

“There’s several different entities buying up precious metals. You have the world governments, China, Russia, and the big banks aren’t hiding the fact that they’re buying as much as they can get,” he said.

McKeever pointed out that although precious metals are sometimes dismissed as outdated or poor investments, history shows their remarkable ability to retain value amid the rise and fall of currencies.

“Finding that top right now, I don’t think anybody knows,“ he said. ”All we see is the price continuing to go up, demand continuing to stay solid.”

At current prices, McKeever said he’s more “bullish” on gold than silver, the latter being an industrial metal.

Regardless, he sees both as valuable hedges against inflation and financial hardship, and uncertainty.

The United States Gold Bullion Depository, also known as Fort Knox in Kentucky in 2009. Michael Vadon/CC BY-SA 2.0

“They’re just a good safety net, so if you have the ability to hold them—yep,” McKeever said.

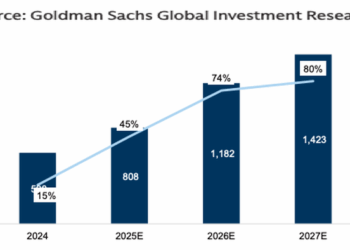

According to a 2023 Gallup study, the proportion of people who viewed gold as one of the best long-term investments rose from 15 percent in 2022 to 26 percent a year later.

Cash Shortfall

In the meantime, a 2025 survey by the online gold buyer Cash for Gold USA found that seven out of 10 Americans are selling jewelry to pay for basic needs.

“Despite gold prices increasing by nearly 45 percent over the past year, significantly more Americans have been selling gold to serve as a household lifeline rather than the precious metal’s record high prices,” the company revealed.

More than half of the people surveyed in June said that they sold gold for quick cash to cover money problems.

The survey included 1,002 people who had sold items such as gold, diamonds, jewelry, coins, and watches to Cash for Gold USA.

Although 50.5 percent sold items to get money, 68.4 percent said the cash was used for household essentials. Most of it went toward paying bills (52.6 percent) and buying groceries (15.9 percent).

The survey found that besides helping with money problems, people sold their metals because they had items they did not use, or had forgotten about (45.4 percent), or because they got them from someone else (13.8 percent).

Nearly 70 percent of people in the survey used the money to make their finances better now or in the future, including paying off debts (13.4 percent) or purchasing a home (3.2 percent).

“We were shocked by the responses,” said Barry Schneider, co-founder of Cash for Gold USA, in a statement.

Mikah Snowden, a sales representative at Galina Fine Jewelers in Cottonwood, Ariz., works behind the showcase on March 20, 2023. Allan Stein/The Epoch Times

“We expected more people to tell us it was the record-high prices of gold driving their decision to sell, which have increased by around $1,000 per ounce over the past year. Gold has been selling for more than $3,300 an ounce.”

The study reported other reasons for selling. About 10.8 percent sold because of divorce or separation, 5.4 percent due to job loss or reduced hours, and 3.6 percent because of medical bills.

Most sellers spent their money on basic needs. Only 9 percent used the money for a vacation, 4 percent for new jewelry, and just 2 percent for electronics. Fewer than one in six used their money on luxury items.

“This is not the gold rush of 1849, but this survey suggests to us that those employed in America face financial hardships, despite holding down jobs,” Schneider said.

Gabe Wright, co-owner of Coin Heaven in Cottonwood, Ariz., holds gold and silver coins, two of the hottest-selling items on March 20, 2023. Allan Stein/The Epoch Times

The Epoch Times contacted major bullion dealers, such as SD Bullion and Battalion Metals, but did not get a response to its request for comment.

On Nov. 18, Levi from Phoenix visited a busy downtown bullion shop with 124 quarters from around 1964, the last year American coins were made with 90 percent silver.

Levi told The Epoch Times he spent years collecting coins, saving them as an investment since he was young.

He decided to sell because he needed the money and ended up making more than $1,000.

“I’ve just been collecting them over time. I’ve been finding them at gas stations, things like that. I still have more,” Levi said.

Loading recommendations…