After a torrid meltup last week to end the month of November on a euphoria, if extremely illiquid note, futures are once again sinking as we start the final month of the year, in a swoon that was again catalyzed by a plunge in bitcoin which appears to have been spooked by hawkish overnight comments by the BOJ which continues to bluster that it may hike rates one day… soon… for real this time. As of 8:00am S&P futures were 0.7% lower while Nasdaq 100 contracts were -1.0%. Bond yields are 1-4bp higher. Bitcoin slid below $86,000, dragging the entire space and pulling crypto-linked stocks into the red. The Magnificent Seven also declined in premarket trading, with Tesla, Meta and Nvidia each falling more than 1%. Global bond yields are all higher this morning: Japan yields are 3-7bp higher led by the 7yr amid hawkish hint from the BoJ. OPEC+ countries agreed to maintain group-wide oil output quotas (i.e., pausing oil output hike) for 2026 yesterday, given the YTD decline in oil; Oil +1.7% since last Friday’s close. Trump said on Sunday that he has decided on his pick for the next Federal Reserve chair after making clear he expects his nominee to deliver interest-rate cuts. The US economic calendar includes November final S&P Global US manufacturing PMI (9:45am) and November ISM manufacturing (10am).

In premarket trading, Mag 7 stocks are all lower (Tesla -1.2%, Meta -1.4%, Nvidia -1.9%, Microsoft -0.6%, Amazon -0.4%, Alphabet -0.9%, Apple -0.6%).

- Crypto-exposed stocks slip following a drop in Bitcoin prices. Shares of Coinbase (COIN) are down 4%.

- Silver miners including Coeur Mining (CDE) rise as the precious metal extends Friday’s rally on tight supply. Coeur is up 3%.

- Vaccine makers are falling in early trading Monday as William Blair flags reports of a memo from a top FDA official,

- Vinay Prasad, that links Covid-19 vaccines in younger people to deaths associated with myocarditis. Shares of Moderna (MRNA) are down 4%.

- Barrick Mining (B) rises 4% after saying it is exploring an initial public offering of its North American gold assets as the Canadian mining company grapples with operational issues and cost blowouts.

- Canadian Solar (CSIQ) rallies 13% on news that the solar panel manufacturer is transferring the assets of its Chinese unit to Canadian ownership to safeguard sales into the US as Washington steps up scrutiny of imports from the Asian nation.

- Coupang (CPNG) falls 5% as the e-commerce firm faces an investigation by South Korean authorities over a data breach that affected about 33.7 million customer accounts.

- Leggett & Platt (LEG) shares are up 8% after Somnigroup International proposed an all-stock buyout.

Thanks to a powerful ramp on Friday, November marked the seventh straight month of gains for the S&P 500, the longest streak since 2021 as the monthly closed just barely in the green, rising 0.17%. It wasn’t enough for the Nasdaq 100 however, which was hampered by concerns about stretched AI valuations, and fell 1.6% in the month.

But so much for November, and December has seen a stark shift in sentiment with Monday’s risk-off mood most evident in crypto, with Bitcoin tumbling below $86,000 before paring the drop.

Sentiment was hammered early after Japan’s two-year bond yield rose to its highest level since 2008 when Governor Kazuo Ueda offered his clearest hint yet that the BOJ may be nearing an interest-rate hike (of course he has been doing this for months and every time the market falls for it). Traders raised the odds of a BOJ rate hike in December to about 80% after Ueda told business leaders that the central bank “will consider the pros and cons of raising the policy interest rate and make decisions as appropriate.” Any hike would be an adjustment in the degree of easing, with the real interest rate still at a very low level, he said. The move weighed on global bonds, lifting the rate on 10-year US Treasuries by three basis points to 4.04%. The yen led gains among major currencies against the dollar.

“The market is still hesitating a bit ahead of the upcoming macro data, and before the Christmas rally people typically expect,” said Andrea Tueni, head of sales trading at Saxo Banque France. “The drop in Bitcoin is weighing on sentiment and so are the comments from the BOJ.”

Given Japan’s role as a major source of global liquidity, any shift toward policy normalization will have implications for carry trades.

“It’s a structural change in global markets that investors need to adapt to,” said Alexandre Baradez, chief market analyst at IG in Paris.

The month opened with traders focused on a slate of economic indicators due before the Federal Reserve’s next policy meeting, following the S&P 500’s seventh consecutive monthly advance in November. Meanwhile, gold continued its advance, and copper rose to a new record high on fears the global market is heading for a supply crunch. Attention is also turning to the central bank’s leadership, after President Trump said he has decided on a successor to Chair Jerome Powell.

This week’s data include ISM Manufacturing for November, due today, and a much-delayed inflation number for September, set to be released on Friday. A preliminary reading of consumer confidence in December is also due that day. That datapoint will be key given it’s a post-government shutdown reading on the health of the economy.

Markets are now signaling a December rate cut in December is nailed on. And Trump said Sunday he has made his mind up about who will be Fed’s next chairman. Trump’s chief economic adviser Kevin Hassett is seen as the likely choice, people familiar said last week. Hassett signaled markets were ready for the announcement of a new Fed chair. People familiar with the matter last week said that Hassett was seen as the likely choice to succeed Powell. Speaking on CBS’ Face the Nation on Sunday, he declined to address whether he considers himself the front-runner.

“December could prove more challenging than many expected, especially for those who thought last month’s 5% dip was the long-awaited correction,” said Ipek Ozkardeskaya, a senior analyst at Swissquote. “With Fed funds futures pricing nearly a 90% chance of a 25bp cut, there isn’t much room left for additional dovish fuel.”

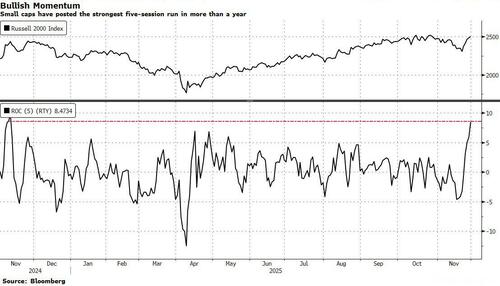

It’s not all gloom: traders are placing bullish bets on small-cap stocks in anticipation of lower rates. The Russell 2000 Index jumped 8.5% in the five trading days through Friday, making up the bulk of its gains this year.

In strategy, RBC’s Lori Calvasina said the S&P 500 should reach 7,750 over the next 12 months, based on sentiment, valuation, the economic outlook and monetary policy. Calvasina’s forecast, which implies a 14% rally for the benchmark, joins a chorus of strategists with bullish calls for 2026.

In Europe, the Stoxx 600 falls 0.4%, led by industrial, real estate and financial services. A drop for shares of Airbus also drags on the gauge after weekend news of a software glitch for its A320 jets. Industrial goods and services and real estate are the biggest fallers while the mining sector is rising as copper advanced to a record high. Here are some of the biggest movers on Monday:

- Airbus shares fall as much as 3.1% after the company had to attend to a solftware glitch.

- ASML shares rise as much as 3.1% after the company was added to JPMorgan’s Analyst Focus list and is its top pick in the wider semis sector, in which semiconductor capital equipment is viewed as the most attractive segment.

- European mining shares are among the best-performing sectors in the Stoxx 600 benchmark as copper advanced to a record high on the London Metal Exchange on fears the global market is heading for a supply crunch. Silver traded near a record.

- Reckitt Benckiser shares rise as much as 2.1%, the most in over a month, after Barclays upgraded the consumer goods company to overweight from equal-weight.

- European defense stocks fall after reports of progress in Ukraine-Russia talks over the weekend.

- Melrose Industries shares fall as much as 4.2% after news that CFO Matthew Gregory will retire from his position in 2026.

Earlier in the session, Asian stocks traded in a narrow range on December’s first trading day as investors braced for a data-heavy week, while gains in China helped offset regional weakness. The MSCI Asia Pacific Index was down 0.3% as of 4:50 p.m. Hong Kong time, led lower by tech shares, after earlier oscillating between gains and losses. Advances in Hong Kong and mainland China’s markets briefly lifted the region’s benchmark before losses in Japan, Taiwan and Australia pulled it lower. In Japan, Bank of Japan Governor Kazuo Ueda hinted that the central bank might lift interest rates at its next meeting this month, sending the Topix 1.2% lower. Meanwhile, market gains in China defied weaker-than-expected factory and manufacturing data, highlighting ongoing strains in the nation’s economic recovery.

In FX, the yen is leading gains against the greenback, rising 1% and taking USD/JPY below the 155-handle. The hint of a December interest-rate hike by Bank of Japan Governor Ueda played a role and also helped push Japanese 2-year yields to the highest since 2008. The yen is also likely benefiting from haven demand as broader risk sentiment struggles to recover after an abrupt turn lower during Asian trading hours.

In rates, treasuries fall, pushing US 10-year yields up 3 bps to 4.04%. European government bonds also decline.

In commodities, WTI crude futures rise 1.8% to near $59.60 a barrel as a key pipeline linking Kazakh fields to Russia’s Black Sea coast halted loading. Spot gold climbs $20 to $4257. Bitcoin also tumbled 6%, back below $86,000 after momentum ignition also sparked a rout and Korean momentum kamikazes joined in during Asian hours.

The US economic calendar includes November final S&P Global US manufacturing PMI (9:45am) and November ISM manufacturing (10am). While the Fed enters its pre-meeting blackout period, Powell and Governor Michelle Bowman are scheduled to speak, though they are barred from commenting on the economic outlook or policy. Fed officials will also receive a dated print of their preferred inflation gauge this week ahead of their final policy meeting of the year. Other data due include ADP private employment figures for November.

Market Snapshot

- S&P 500 mini -0.5%

- Nasdaq 100 mini -0.6%

- Russell 2000 mini -0.7%

- Stoxx Europe 600 -0.3%

- DAX -0.9%

- CAC 40 -0.4%

- 10-year Treasury yield +3 basis points at 4.04%

- VIX +1.6 points at 17.95

- Bloomberg Dollar Index -0.1% at 1216.62

- euro +0.2% at $1.1623

- WTI crude +1.8% at $59.62/barrel

Top Overnight News

- President Trump said Sunday he’s decided who he’ll nominate to be the next Federal Reserve chair, but he wouldn’t be drawn on whether the pick is National Economic Council director Kevin Hassett. White House Economic Adviser Hassett said he will be happy to serve if US President Trump picks him as Fed chair.

- Trump said on Friday he is cancelling all executive orders signed by former President Biden using autopen and stated that any document signed by Biden with autopen, which was approximately 92% of them, is hereby terminated and of no further force or effect. Furthermore, Trump stated that Biden was not involved in the autopen process and if he says he was, he will be brought up on charges of perjury.

- US and Ukrainian negotiators said they held productive talks on a potential peace framework but have yet to reach a breakthrough. Steve Witkoff is due to meet Vladimir Putin in Russia tomorrow. BBG

- Black Friday sales climbed 4.1%, Mastercard said, surpassing last year’s growth, a sign US consumers are continuing to spend despite persistent economic concerns. But Adobe Analytics expects growth in Cyber Monday sales to ease from last year. BBG

- The State Department announced a pause on visa issuances for Afghan passport holders, and the US immigration service said it will halt all asylum decisions, while the US Citizenship and Immigration Services Director said USCIS halted all asylum decisions until they can ensure that every migrant is vetted and screened to the maximum degree.

- For years it has seemed no sticker price was too high for American car buyers. Even as average new car prices approached $50,000 this year, dealers fretted more over depleted inventories than losing customers to sticker shock. Those days may be ending as increasingly stretched consumers are starting to draw the line on what they will pay for a new car, according to dealers, analysts and industry data. WSJ

- Trump downplayed his social media post saying Venezuelan airspace should be considered closed. The president confirmed he recently held a phone call with his counterpart Nicolas Maduro, but declined to say how it went. BBG

- Swiss voters overwhelmingly rejected the proposal for a 50% inheritance tax for the super-rich: FT.

- A private gauge of China’s manufacturing sector showed Chinese factories cut back on activity in November, reflecting weaker growth momentum. China RatingDog manufacturing PMI for Nov came in below expectations at 49.9 (vs. the Street 50.5 and down from 50.6 in Oct). WSJ

- Micron will invest $9.6 billion to build a plant in western Japan to make memory chips for AI applications. Nikkei

- The BoJ will thoroughly discuss the possibility of an interest-rate increase at its coming meeting, Gov. Kazuo Ueda said, stoking hopes that it will resume monetary tightening this year. Now that Tokyo’s trade agreement with the Trump administration has reduced external risks, the BOJ governor said the central bank will pay special attention to the outlook for wage increases in Japan next year. WSJ

- Copper rallied to a new record on fears the global market is heading for a supply crunch. Silver extended gains. BBG

- South African President Ramaphosa dismissed US President Trump’s threat to exclude the country from next year’s G20 summit and reaffirmed South Africa’s status as a founding member of the group: Reuters.

Macro

- China’s manufacturing activity contracted in November, according to official and private surveys, as stronger demand overseas after a trade truce with the US failed to reverse a deepening slowdown in the economy.

- Trump said Sunday that people shouldn’t read much into a social media post where he said Venezuelan airspace should be considered closed.

- Russian President Putin signed an order to allow visa-free entry into the country for Chinese citizens as ties between the two nations continue to deepen.

Trade/Tariffs

- China was reported on Friday to have banned imports of pigs, wild boars and related products from Spain’s Barcelona province, according to a China Customs document. In relevant news, Mexico’s Agriculture Ministry also suspended pork product imports from Spain due to a swine fever outbreak.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the new month mixed, with participants cautious as they digested the weak Chinese PMI data. ASX 200 was dragged lower by weakness in healthcare, telecoms, financials and tech, while sentiment was also not helped by disappointing Chinese PMI data and weaker-than-expected Australian Gross Company Profits and Business Inventories. Nikkei 225 slipped beneath the 50k level amid a firmer currency and risks of a BoJ rate hike in December, while there were hawkish-leaning comments from BoJ Governor Ueda, who said that they will consider the pros and cons of raising rates at the December meeting. Hang Seng and Shanghai Comp were kept afloat despite the discouraging Chinese PMI data, in which the headline official Manufacturing PMI continued to show a decline in factory activity at 49.2 (exp. 49.2) and Non-Manufacturing disappointed with a surprise contraction at 49.5 (exp. 50.0), while RatingDog Manufacturing PMI missed estimates at 49.9 (Exp. 50.5).

Top Asian News

- BoJ Governor Ueda is to deliver a speech at the Japan Business Federation on December 25th, according to the central bank.

- BoJ Governor Ueda said if their projection of economic activity and prices materialise, the BoJ will continue to raise the policy interest rate in accordance with improvements in economy and prices, while he added that even if the policy interest rate is raised, accommodative financial conditions will be maintained and the likelihood of their baseline scenario for economic activity and prices being realised is gradually increasing. Ueda also commented that at the December meeting, the BoJ will examine and discuss economic activity and prices at home and abroad, as well as market developments, based on various data, and consider the pros and cons of raising rates. Furthermore, he said it is important for FX to move stably reflecting fundamentals and that a weak yen works to push up consumer inflation, while they must be mindful that FX moves affect inflation expectations and underlying inflation in guiding policy.

- Japanese Finance Minister Katayama said it is “clear” that volatile swings in the FX market and the rapid weakening of the yen aren’t based on fundamentals.

- China’s financial regulator guides banks and insurers to fully provide financial support services related to the Hong Kong fire and said insurance institutions should promptly handle claims and other procedures for disaster-affected customers, while it added that banks should strengthen financial credit support and actively assist in disaster reconstruction.

- Indonesia said at least 303 people died in three provinces after severe rains caused floods and landslides.

- Vanke has reportedly requested 12-months to pay its bonds under the extension plan, Bloomberg reports.

European bourses (STOXX 600 -0.3%) are on the backfoot, following a cautious mood seen in APAC trade. The AEX (U/C) bucks the trend, with ASML (+1%) keeping the index afloat after positive analyst commentary. European sectors are mixed. Basic Resources leads, given the strength in underlying metals prices whilst Industrials sits at the foot of the pile, with Airbus (-3.5%) pressured after rolling out urgent fixes across its A320 fleet over the weekend. US equity futures are softer across the board (ES -0.5% NQ -0.7% RTY -0.8%), following the pressure seen in Europe. Focus later will be on US ISM Manufacturing figures, which will give further insight into the health of the US economy ahead of the FOMC meeting next week. Softbank (9984 JT) CEO said he did not want to sell a single NVIDIA (NVDA) share, but needed funds to invest in OpenAI and other opportunities.

Top European News

- Swiss voters overwhelmingly rejected the proposal for a 50% inheritance tax for the super-rich, according to FT.

- UK PM Starmer and Chancellor Reeves have been accused of misleading the Cabinet by using claims that there was a black hole in the public finances to justify tax rises during the run-up to the Budget, according to The Times’s Swinford, while it was separately reported by Bloomberg that Reeves denied lying about UK finances pre-Budget.

- UK PM Starmer is to defend the Budget after Reeves was accused of misleading the public, and will outline the growth mission after the Budget tax rises during a speech on Monday.

- S&P affirmed Latvia at A; Outlook Stable and affirmed Lithuania at A; Outlook Stable.

- ECB’s de Guindos said the current level of interest rates is appropriate and, in terms of future moves, this is data dependent.

FX

- DXY is subdued in the presence of JPY strength and in the absence of any pertinent catalysts and with the Fed in a blackout period, while US President Trump said he knows who he will pick for the Fed chair role, but didn’t give any further details. DXY resides towards the bottom of a 99.26-99.51 range (vs Friday’s 99.38-99.82 parameter), with the next downside level the 17th November low at 99.25.

- JPY is the marked outperformer this morning, given the risk tone and commentary from BoJ Governor Ueda, who ultimately hinted at a possible December rate rise, although market pricing has been little changed since last week, with a 67% chance of a hold at the 19th December announcement. USD/JPY currently resides towards the bottom of a 155.24-156.15 parameter, the next support level is seen at 155.21 (19th November low).

- EUR and GBP diverge, the former underpinned by the USD, whilst the latter is subdued ahead of UK PM Starmer’s speech at 10:30GMT, where he will reportedly outline the growth mission and will defend the Budget after Chancellor Reeves was forced to deny lying to the public about UK finances pre-Budget. No moves were seen in EUR or GBP on the Final Manufacturing PMI data. EUR/GBP reached a 0.8794 peak vs a 0.8754 intraday trough.

- Non-US dollars, CAD, AUD, NZD, are relatively flat with the broader market tone tentative and macro updates light. Upside capped in the antipodeans following overall disappointing Chinese PMIs, where the headline official Manufacturing PMI continued to show a decline in factory activity at 49.2 (exp. 49.2) and Non-Manufacturing disappointed with a surprise contraction at 49.5 (exp. 50.0), while RatingDog Manufacturing PMI missed estimates at 49.9 (Exp. 50.5).

Fixed Income

- USTs Mar’26 down to 113-06, lower by five ticks at worst. Downside echoes peers, but offset by dovish Fed expectations as markets near-enough price a December cut, and we look to updates on the next Fed Chair after President Trump said he knows who he will pick. Polymarket ascribes a 58% chance that Hassett will be appointed. Treasury Secretary Bessent recently said Trump could make an announcement pre-Christmas.

- Bund Dec’25 at a 128.50 low, posting downside of 37 ticks. Support comes into play at 128.37 from the 20th of November. Thereafter, the figure before 127.88 from the last week of September. JGBs and Gilts (see below) driving much of the bearishness, alongside upside in numerous Commodity prices, and particularly crude post-OPEC.

- Gilts Mar’26 opened lower by 12 ticks before falling further to a 91.16 low with downside of 42 ticks at most. Underperformance driven by the Budget and Chancellor Reeves coming under scrutiny over the weekend, with particular reference to the timing of OBR briefings and her pitch-rolling on Income Tax. PM Starmer to speak at 10:30GMT on growth.

- JGBs Dec’25 hit overnight and were lower by c. 50 ticks at worst. Pressure on the back of hawkish BoJ commentary, where Ueda, among other points, said that delaying a rate hike too long could cause sharp inflation and force a rapid policy adjustment. Remarks that lifted BoJ pricing to over a 70% chance of a hike in December vs sub-60% on Friday.

Commodities

- WTI and Brent are currently trading higher by c. 2%, as markets digest the OPEC+ and supply-related concerns following Ukraine’s attack on Russian refineries. WTI and Brent currently reside at the upper end of a USD 58.83/bbl to USD 59.97/bbl and USD 62.29/bbl to 63.35/bbl range respectively. Price action since the European cash open has been exceptionally lacklustre, and generally sideways around highs; some modest downticks have been seen in recent trade.

- Spot gold is firmer today and trades towards the upper end of a USD 4,205.63/oz to USD 4,262/oz range. XAU now at levels not seen since late October 2025; there is now a bit of clear air to the high of 21st October at USD 4,375.62/oz. Perhaps some focus on continued Ukrainian attacks on Russia, as traders now focus on the coming meeting between US Special Envoy Witkoff and Russian President Putin on Tuesday. Elsewhere, marked pressure in the crypto space perhaps sent flows to the more-traditional haven in APAC trade.

- Base metals held a strong positive bias throughout overnight trade, but then gave up some of the upside as the risk tone dipped a touch, with traders focusing on the disappointing Chinese PMI metrics. Focus has also been on the surge in 3M LME Copper, which saw the red-metal surge above USD 11.2k/t to print a fresh ATH at USD 11,297/t, before scaling back down to a current USD 11,189/t. ING opines that the latest bout of demand for the metal is thanks to “an upbeat CESCO Week event in Shanghai” – suggesting that it echoed the markets’ view of tight supply.

- OPEC+ agreed to keep group-wide oil output unchanged for Q1 2026, while it stated that participating countries approved the mechanism developed by the secretariat to assess participating countries’ maximum sustainable production capacity. Furthermore, it announced that the 41st OPEC and Non-OPEC ministerial meeting will be held on 7th June 2026.

- OPEC Secretariat receives update compensation plans from Iraq, the UAE, Kazakhstan, and Oman, according to a statement.

- Saudi Energy Minister said OPEC+ latest decision is the most important and transparent in deciding production level via State TV.

Geopolitics: Middle East

- Israeli PM Netanyahu submitted a letter to President Herzog, while Netanyahu said in a video statement addressing the pardon request that his personal interest was to complete the legal process until the end, while he added that the military and national reality, and national interest, demand otherwise, and that ending the trial immediately would advance much-needed national reconciliation.

- Israeli helicopters fired in the eastern areas of Khan Yunis inside the Yellow Line, according to Al Jazeera.

- Israeli security estimates that Iran may take the initiative and carry out retaliatory operations instead of Hezbollah and estimates preparations for a Houthi response in retaliation for the killing of Hezbollah Top Commander Al-Tabatabai, according to Al Arabiya.

- Hezbollah’s leader said on Friday in response to Israel’s killing of its military chief that the group has a right to respond and will set a time for it, while he added that Lebanon’s government should prepare a plan to confront Israel.

- Iran’s Foreign Minister Araghchi held talks with Turkey regarding the nuclear issue and Israel, while he also held a meeting with the Saudi Deputy Foreign Minister for Political Affairs in Tehran.

Geopolitics: Ukraine

- Russia’s Kremlin said that Russian President Putin is due to meet US envoy Witkoff on Tuesday. On the Russia-Ukraine peace development, the Kremlin adds that they are not going to engage in megaphone diplomacy.

- Ukrainian President Zelensky said a delegation headed by the security council chief travelled to the US for talks, while it was also reported that Zelensky is to visit French President Macron in Paris on Monday.

- US and Ukraine negotiations on Sunday focused on where the de facto border with Russia would be drawn under a peace deal, while the five-hour meeting was said to be difficult and intense, but productive, according to two Ukrainian officials cited by Axios.

- US Secretary of State Rubio said the meeting with Ukrainians was very productive but noted there is more work to be done, while he added that they have been in touch to varying degrees with the Russian side.

- Ukraine’s First Deputy Foreign Minister said there was a good start to US peace talks with a warm atmosphere conducive to a potential progressive outcome.

- Ukraine’s military hit Russia’s Afipsky oil refinery, while it was also reported that Ukrainian sea drones struck two Gambia-flagged tankers off the Turkish coast on Friday, which were said to be part of a Russian shadow fleet used to bypass Western sanctions.

- Russian forces carried out a massive strike on Ukrainian military-industrial and energy facilities.

- Russia’s Foreign Minister said following a Ukrainian drone attack on the CPC Black Sea terminal, that the civilian energy infrastructure that was attacked plays an important role in ensuring global energy security and has never been subject to any restrictions or limitations, while they strongly condemned the ‘terrorist attacks’ on CPC and oil tankers.

- NATO is considering being “more aggressive” in responding to Russia’s cyber-attacks, sabotage and airspace violations, according to its most senior military officer, Admiral Giuseppe Cavo Dragone, cited by FT.

- NATO is reportedly preparing for the scenario of confronting Russia with limited US support, according to a report by Bloomberg citing a wargame in Transylvania that showed European soldiers defending the continent largely without US support as President Trump reduces US deployments in Europe.

OTHER

- US President Trump declared on Truth Social that the airspace above Venezuela is closed. It was separately reported that President Trump held a call with Venezuelan President Maduro, while Trump also commented that Defence Secretary Hegseth told him that he did not order a second boat strike.

- US bipartisan lawmakers raised alarms on Sunday that Defence Secretary Hegseth may have committed a war crime following a report that he ordered a follow-on attack to kill survivors of a boat strike in September, according to POLITICO.

- Venezuela said it rejects US President Trump’s “hostile, unilateral and arbitrary” post about Venezuela’s airspace and noted that the statement shows “colonial pretentions” towards Latin America, while it added that Venezuela demands respect for airspace and will not accept foreign orders or threats.

- China’s Coast Guard carried out law enforcement inspections around the Scarborough Shoal, while the report noted that the Chinese military’s Southern Theatre Command organised combat readiness patrols in the ‘territorial’ waters and airspace of the Scarborough Shoal and surrounding areas on November 29th, according to Xinhua.

US Event Calendar

- 9:45 am: Nov F S&P Global U.S. Manufacturing PMI, est. 51.9, prior 51.9

- 10:00 am: Nov ISM Manufacturing, est. 49, prior 48.7

- 10:00 am: Nov ISM Prices Paid, est. 57.5, prior 58

Central Bank Speakers

- 8:00 pm: Fed’s Powell Speaks at Memorial Event

- Fed’s External Communications Blackout (November 29 – December 11)

DB’s Jim Reid concludes the overnight wrap

Good news from home as we start the month: over the weekend we found out that my daughter Maisie has made the South East England Artistic Swimming Squad. Considering I’m one of the worst swimmers imaginable—and would make an awful gymnast—I’m pretty impressed that she’s managed to stay on the right side of the gene pool lottery. To be fair, when she had Perthes Disease for three years and spent over a year in a wheelchair, swimming was the one thing that kept her going, so this is a fantastic achievement. I won’t book tickets for the 2036 or 2040 Olympics just yet, but you never know!

As it’s the start of the month, Henry will shortly release our usual performance review. November was very much a month of two halves: risk assets initially sold off, before a sharp recovery meant the S&P 500 just about posted a seventh consecutive monthly gain. The main driver was the Fed, as investors first priced out and then back in a December rate cut. Elsewhere, fears of an AI bubble remained prominent, with the Magnificent 7 losing ground for the first time since March. European assets also performed well as expectations rose about a potential peace deal in Ukraine. However, not every asset managed to recover—Bitcoin saw its worst month since February.

ChatGPT was three years old yesterday and that date could be a landmark moment in history in years to come. As we said in the World Outlook, the ultimate destination for AI will be hotly debated in 2026 and will unlikely reach a conclusion. As such there is plenty of opportunity for both sides of the boom-and-bust narrative to win for periods of time. So expect a volatile ride.

Asia has actually kick started December in a weak mood with Bitcoin down another -6% this morning and Nasdaq (-1.05%) and S&P 500 (-0.80%) futures both notably lower. 10yr US Treasuries are +3bps and 10yr JGBs are +6.7bps as Ueda has said at a speech this morning “At the Monetary Policy Meeting (MPM), the Bank will examine and discuss economic activity and prices at home and abroad as well as developments in financial and capital markets, including the point I just mentioned, based on various data and information, and will consider the pros and cons of raising the policy interest rate and make decisions as appropriate.”

Our Japanese economist believes this strongly suggests an interest rate hike at the December meeting and has pushed forward his view of a hike from January to the meeting later this month, the Friday before Christmas (see here for more of his views on this). Market pricing has increased from a probability of just under 60% to 83% as I type. This story brings shades of the 2022 meeting just before Xmas when the BoJ lifted its cap on 10yr JGBs from 0.25% to 0.5%. That saw the market spooked a little. The Yen has risen by +0.39% and the Nikkei is -2.04% lower this morning with 2yr yields +5bps, surpassing the 1% threshold and reaching their highest point since June 2008. More on Asia later.

This coming week will allow forecasters to fine-tune their Fed views ahead of that. There is plenty of data to get through, both shutdown-delayed and routine. Globally, we have European CPI tomorrow and PPI on Wednesday, following German and French CPI prints today. Various global PMIs are also out today, and we also have Cyber Monday, which follows what seems to have been a decent Black Friday weekend. As an example, Mastercard’s SpendingPulse index was up +4.1% on Friday, up from 3.4% last year. Newsflow continues to bubble up around peace negotiations for the war in Ukraine, so that’s one to watch as well.

Focusing in on the US, the Federal Reserve is firmly in its pre-meeting communications blackout ahead of the 10 December FOMC decision, leaving economic releases to do the talking. Markets have already priced an 80% chance of a 25bp cut next week, and this week’s data will help shape that view as well as expectations for 2026.

The US calendar begins today with the ISM Manufacturing Index, expected to hold near recent averages at 48.5, signalling continued softness in factory activity. Tomorrow brings unit motor vehicle sales, forecast at 15.8 million units, a modest improvement from October. Wednesday is the busiest day, featuring the ADP employment report, expected to show a gain of 50,000 jobs versus 42,000 previously. This report will take on added significance as it will be the most up-to-date labour market data available to Fed officials before they meet. Also due Wednesday are industrial production, likely to rise 0.1% after a slight decline last month, and the ISM Services Index, projected at 51.8, close to its two-year trend. On Thursday, factory orders should show a 0.5% increase, pointing to resilient capital spending.

Friday rounds out the week with the delayed September personal income and consumption report, and within it, the more important core PCE. This is expected to hold at 0.23% month-on-month, keeping the annual rate near 2.9%, a tenth above what the Fed was tracking when they only had CPI to use. The preliminary University of Michigan consumer sentiment survey is also anticipated to edge up to 54.0 from 51.0. While sentiment remains depressed—its 24-month average is comparable to Great Recession levels according to our economists—real GDP growth of 2.6% annualised over the past eight quarters and inflation-adjusted consumer spending growth of 2.8% underscore the economy’s resilience. Note that the combined September and October JOLTS report has been rescheduled for 9 December, while October and November payrolls and unemployment data will not arrive until 16 December, well after the FOMC meeting.

Across Europe, inflation will dominate the agenda. Country-level CPI prints for Germany and France set the tone today, followed by the Eurozone flash CPI for November tomorrow. Switzerland reports inflation figures on Wednesday, and Sweden follows on Thursday. These data points will be closely watched for confirmation that disinflation trends remain intact across the continent.

In Asia, the focus turns to manufacturing and policy signals. Most of China’s PMI data came out yesterday and this morning, but we still have the private-sector services PMI on Wednesday.

Geopolitical developments will also feature prominently. US and Ukrainian delegates met in Florida yesterday without any incremental headlines of note. The US’s main negotiator Witkoff is expected to travel to Moscow today and likely meet Putin tomorrow. EU defence ministers meet today on the same topic, followed by NATO foreign affairs ministers on Wednesday for further strategic discussions. French President Macron undertakes a state visit to China from Wednesday to Friday, underscoring diplomatic engagement in Asia.

Yesterday, China’s official manufacturing PMI came in a couple of tenths below expectations at 49.2, marking the eighth successive month below 50. The non-manufacturing equivalent surprisingly fell from 50.1 to 49.5, the first reading below 50 for nearly three years. Consensus was at 50.0. This morning, the RatingDog general manufacturing PMI, conducted by S&P Global, fell to 49.9 in November (compared to the expected 50.5).

Chinese equities are bucking the risk off elsewhere this morning, possibly on stimulus hopes given the data. The Hang Seng (+0.27%) and Shanghai Composite (+0.33%) are higher.

Recapping last week now and markets rebounded from their recent pullback, buoyed by new hopes of Fed rate cuts, as well as improved tech optimism and accelerating talks on a peace deal between Ukraine and Russia. This saw the S&P 500 advance by +3.73% (+0.54% Friday), its biggest weekly gain since mid-May, when US and China reversed their post-Liberation Day tariff escalation. The NASDAQ rose by +4.91% (+0.65% Friday) and the Magnificent 7 by +5.40% (+0.62% Friday). The Mag-7 rally came despite Nvidia falling -1.05% (-1.81% Friday) following reports that Meta (+9.04%, +2.26% Friday) was in talks with Alphabet (+6.85%, +0.07% Friday) to purchase Google’s AI TPU chips. The VIX volatility index declined by -7.08pts to a four-week low of 16.35. And credit spreads tightened amid the risk-on mood, with US IG (-5bps) and HY (-32bps) spreads seeing the biggest weekly tightening since August and May respectively.

Over in Europe, the peace narrative helped the STOXX 600 gain +2.55% (+0.25% Friday), with similar advances for the DAX (+3.23%) and the CAC 40 (+1.75%). By contrast, the STOXX Aerospace & Defence index (+0.27% on the week) and Rheinmetall (-2.57%) underperformed.

US Treasuries rallied following more dovish commentary from Fed officials as well as reports that Kevin Hassett is viewed as the frontrunner for the Fed Chair post. The pricing of a December rate cut rose from 63% to 83%. It was as low as 24.5% 10 days ago. Those moves came amid mixed US data, most notably with November consumer confidence (88.7 vs 93.3 expected) slumping to a 7-month low but the latest jobless claims suggesting a still resilient labour market as initial jobless claims fell back to 216k in the week ending November 22 (vs. 225k expected). The 2yr Treasury yield was -1.9bps lower at 3.49% (+1.4bps Friday), with 10yr yields down -5.0bps to 4.01%. In continental Europe, yields on 10yr bunds (-1.4bps), OATs (-6.3bps), and BTPs (-5.9bps) saw similar declines as Treasuries.

In the UK, markets welcomed the increase in fiscal headroom to £22bn as the budget revealed mostly back-loaded tightening. The main measures include £26bn of tax rises by 2029-2030 via frozen income tax thresholds, new National Insurance on salary-sacrifice pensions, and higher taxes on dividends, property, and savings. Coupled with lower-than-expected gilt issuance, this left 10yr gilt yields -10.6bps lower on the week, and the FTSE 100 advancing +1.90% (+0.27% Friday). The UK deficit is forecast to fall from 4.5% of GDP to 3.5% next year, and under 2% by the decade’s end, but markets still question long-term fiscal sustainability.

In commodities, Brent crude was +1.02% higher to $63.20/bbl (-0.22% Friday), with oil traders remaining cautious on the prospects of possible peace deal in Ukraine. Meanwhile, gold (+4.29% on the week) and Bitcoin (+6.80%) joined the broader rally after their earlier declines.

Loading recommendations…